GBP/USD Week Ahead Forecast: Formative Period for Outlook

- GBP/USD recedes from 1.25 as UK data deluge looms

- April inflation likely key arbiter of medium-term outlook

- Salvation from inflation invites rebound to 1.30 & above

- But stagflation prolongation sees 1.20 & below beckon

- Fed's policy patience also offering support short-term

Image © Adobe Images

The Pound to Dollar exchange rate rallied ahead of the weekend and could attempt to rise further ahead of Wednesday’s release of UK inflation figures, which could ultimately be the difference between whether Sterling climbs toward 1.30 over the coming months, or unravels back toward 1.20 and below.

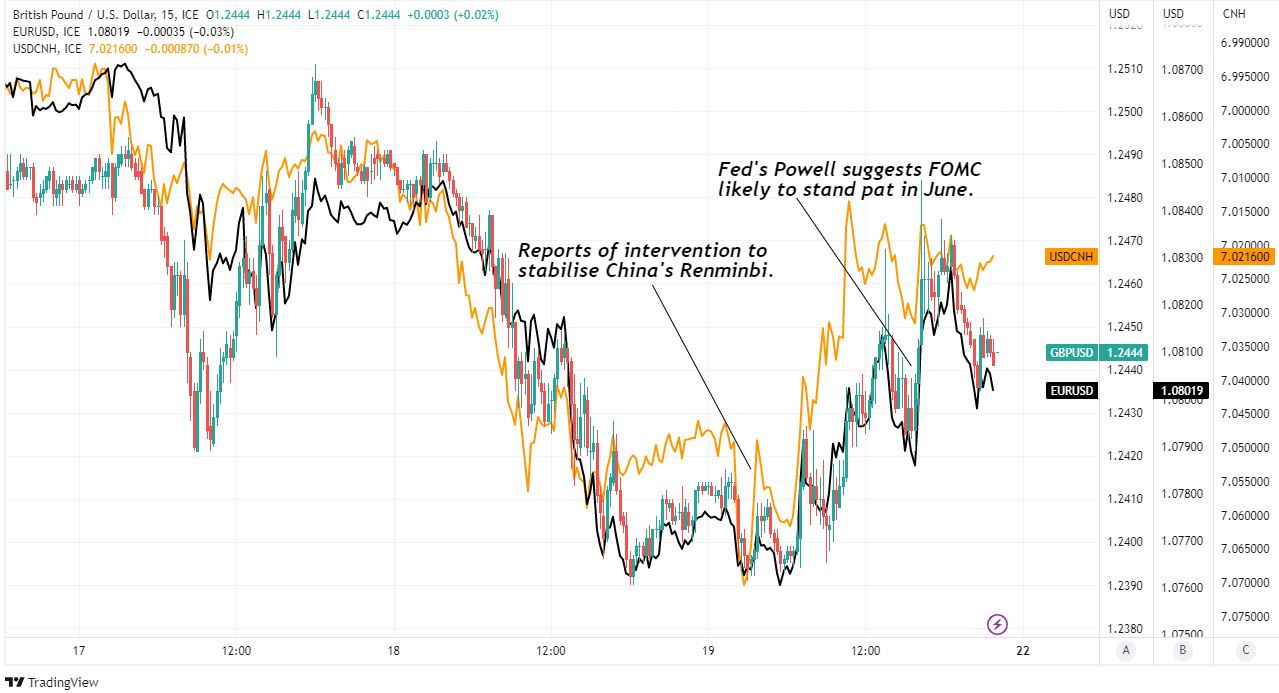

Sterling rallied alongside other currencies late in the European session on Friday when Dollars were sold widely after Federal Reserve Chairman Jerome Powell suggested interest rates could be left unchanged next month for the first time since January last year.

“Until very recently it's been clear that further policy firming would be required. As policy has become more restrictive, the risks of doing too much versus doing too little are becoming more balanced, and our policy has adjusted to reflect that,” he told the Thomas Laubach Research Conference.

“So we haven't made any decisions about the extent to which additional policy firming will be appropriate but given how far we've come, as I noted, we can afford to look at the data and the evolving outlook and make careful assessments,” he said in a panel discussion going into the European close.

Friday’s remarks undermined market pricing that had implied a small probability of a June increase in interest rates, and appeared to be seconded by Neel Kashkari, President of the Minneapolis Fed, this weekend.

Above: Pound to Dollar rate shown at 15-minute intervals alongside other selected pairs. Click image for closer inspection.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

Kashkari told the Wall Street Journal that he too favours holding the Fed Funds rate at 5.25% in June to better gauge how recent turbulence in the banking sector, and the 5% increase since last March, is impacting the economy.

As far as the prospect of a more patient Fed continues to dampen U.S. bond yields, it could act as a headwind for the Dollar and a tailwind for Sterling, although the debt ceiling saga in Washington is a significant source of uncertainty about the likely direction of the greenback this week.

“The 2yr yield is up over 30bps this week and we suspect a deal on the debt ceiling next week is nearly fully priced,” says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

“With economic data unlikely to be a catalyst for further moves higher in short-term yields, we are sceptical of short-term rates moving much higher and hence the positive momentum for the dollar may start to fade,” he adds in a Friday research briefing.

For GBP/USD and Sterling more broadly, much about the short and medium-term outlook hinges on Wednesday’s inflation data for April, and whether it confirms the decisive turn lower that is widely anticipated among economists.

Above: Pound to Dollar rate shown at 2-hour intervals alongside other selected exchange rates. Click image for closer inspection.

The consensus suggests a sharp fall from 10.1% to 8.3% is likely, although some economists forecast even steeper declines and if they’re right there may be risk of flash-in-a-pan-losses for the Pound to Dollar rate on Wednesday.

“Inflation will almost certainly have fallen sharply in April because of the large base effect caused by last April's 48% rise in energy prices. Further downward pressure will come from fuel prices,” says Andrew Goodwin, chief UK economist at Oxford Economics.

“With further large base effects caused by the VAT rate for hospitality being restored to 20% last April, we expect CPI inflation to have fallen to 7.9% in April 2023, from 10.1% in March,” Goodwin writes in a Friday research briefing.

Both the consensus and other forecasts suggest inflation will fall faster than the Bank of England (BoE) expects, suggesting downside risk to market expectations for Bank Rate to be lifted from its current 4.5% over the coming months, and a potential banana skin for the Pound.

But while Sterling could fall on Wednesday if expectations of future increases in Bank Rate are revised away, there is an argument for it to benefit once the dust settles should inflation decline in a meaningful way as this would portend an eventual recovery of lost purchasing power.

Above: Quantitative model estimates of ranges for selected pairs this week. Source Pound Sterling Live. Click the image for a more detailed inspection.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

“GBP has been the best performing G10 currency year to date, helped by an unwind of its cheap valuation. However, the pound is still cheap on most valuation measure, leaving scope for further gains,” says Thomas Flury, an FX strategist at UBS Global Wealth Management.

“We advise investors to stay long GBPUSD and target a move to 1.38. Dips toward the 1.20 level should be used to add to positions,” Flury writes in a Friday research briefing while tipping GBP/USD to reach 1.33 by December, 1.35 by March 2024 and 1.38 by June next year.

The Pound has fallen from 1.40 since inflation first rose above the BoE’s 2% target in June 2021 - also when the Fed began to shift its own policy in a hawkish direction - and from 1.35 since commodity prices lifted inflation from 5% to more than 10% following the invasion of Ukraine.

But if those exchange rates are discounted by the inflation and bank rate differential that would prevail for GBP/USD if inflation falls as economists expect on Wednesday, then the implied ‘fair value’ for Sterling would be somewhere between 1.30 and 1.35.

“If UK inflation metrics do not fall on a relative basis, the picture for sterling becomes more problematic,” writes Stephen Gallo, a global FX strategist at BMO Capital Markets, in an April research briefing.

Above: Pound to Dollar rate shown at daily intervals. Click image for closer inspection.

Above: Pound to Dollar rate shown at daily intervals. Click image for closer inspection.

The big risk for the Pound is that inflation does not fall enough this Wednesday or in the months ahead, leading to a continuing erosion of purchasing power and potentially necessitating a further aggressive interest rate response from the BoE.

“There was a time when FX investors would sell the currency of a country where inflation was consistently higher than that of its main trading partners. We haven't seen this dynamic in the FX market recently because the inflation dilemma as occurred synchronously across G10,” Gallo says.

Wednesday’s inflation data is the highlight of the week for Sterling but is followed by two public appearances by BoE Governor Andrew Bailey on the same day, while bookended by the release of S&P Global PMI surveys on Tuesday and April retail sales figures on Friday.

Each of these could impact sentiment about UK economic prospects and appetite for the Pound, however, other factors will also GBP/USD in the meantime including the degree to which the Dollar benefits from uncertainty about the debt ceiling and price action in China’s Renminbi.

“Comments on Friday evening suggested the Chinese authorities are concerned about the pace of depreciation,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Above: Pound to Dollar rate shown at daily intervals alongside EUR/USD and upside down Dollar-Renminbi rate. Click image for closer inspection.

Above: Pound to Dollar rate shown at daily intervals alongside EUR/USD and upside down Dollar-Renminbi rate. Click image for closer inspection.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

One momentary source of pressure on the Pound and support for the Dollar last week was the falling Renminbi, which gave ground to half its G20 counterparts following a volley of official statistics suggesting the Chinese economic recovery from last year's pandemic-related closures may be faltering.

“From a fundamental point of view, the foundation for the current macroeconomic recovery is not yet solid, especially the recovery pace of terminal demand represented by consumption is still slow,” says Wei Wei, chief strategist of Ping An Securities Research Institute.

“Based on the assumptions of the above economic background, the author predicts that the annual CPI in 2023 will be about 0.8% year-on-year, and the trend will first fall and then rise, with the low point in June-July,” Wei adds in a post for ChinaForex.

Last week's losses were notable because the Renminbi usually tends to trade in a countercyclical fashion as if it were an Asian equivalent of the U.S. Dollar, rising as its economy slows but falling as it grows, and particularly when measured in trade-weighted or overall terms.

While China's low inflation and high interest rate mark the Renminbi out as undervalued and one of the most attractive currencies on the market, the Pound has been known to share a high correlation with it and so any further losses would potentially be a downside risk for Sterling this week.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of 2021 downtrend indicating possible areas of technical resistance for Sterling. Selected moving averages denote possible support and resistance. Click image for closer inspection.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of 2021 downtrend indicating possible areas of technical resistance for Sterling. Selected moving averages denote possible support and resistance. Click image for closer inspection.