GBP/USD Week Ahead Forecast: U.S. Data and Fed Policy in Focus

- GBP/USD recovery disrupted by soft U.S. data

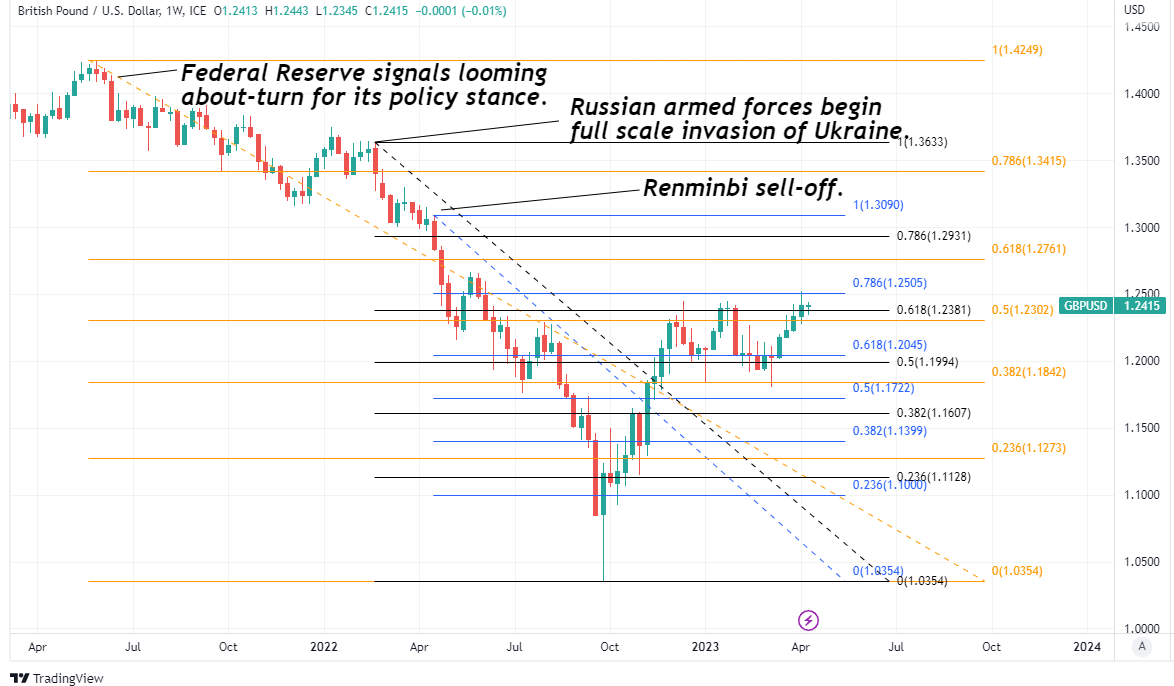

- As resistance stymies path above 1.25 on chart

- March inflation data could see setback deepen

- Supports located near 1.2355, 1.2250 & 1.2165

- BoE speeches, UK GDP data in focus for GBP

Image © Adobe Images

The Pound to Dollar exchange rate eased from nine-month highs over the long Easter weekend but would risk a deeper setback this week if U.S. inflation figures or other data cast doubt over the popular idea that the Federal Reserve (Fed) has all but reached the end of its interest rate cycle.

Dollars were bought widely during the latter half of last week, leading the Pound to retreat from nine-month highs above the 1.25 level including after non-farm payrolls data suggested on Friday that U.S. labour market conditions softened a touch during March.

Friday's report suggested some sectors of the U.S. economy shed workers last month as overall employment growth moderated in what was only one of several data points to indicate a softening of economic activity toward the end of the recent quarter.

"GBP/USD can fall towards downside support at 1.2155 (50 day moving average) if the US CPI is strong and the USD strengthens as we expect," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"UK GDP for February will likely be soft on Thursday, also weighing on GBP/USD," Capurso and colleagues write in a Tuesday research briefing.

Above: Pound to Dollar rate shown at daily intervals with other selected pairs. Click image for closer inspection.

The Dollar benefited when Institute for Supply Management surveys warned last week that manufacturing and services sector activity slowed in March but would potentially rise further this week without a clear continuation of the nine-month downtrend in U.S. inflation on Wednesday.

U.S. inflation fell to 6% during February in what was its ninth consecutive decline from a peak of 9.1% in June last year and the consensus among economists suggests that it fell further to 5.2% last month, although the risk is of it actually declining by less than that on Wednesday.

"This week's data and indicators were on the softer side, with markets continuing to infer that a 25bp FOMC rate hike in May is just as likely as a pause and that cuts may be implemented as early as June," says Marc Giannoni, chief U.S. economist at Barclays.

"We think that monthly core inflation slowed only slightly, from 0.45% (5.5% y/y) to 0.4% m/m (5.6% y/y)," he adds in a Friday research briefing.

Financial markets have bet heavily since the March failure of Silicon Valley Bank that there is a high chance of the Fed reducing its interest rate later this year but the markets would potentially be compelled to abandon that idea if inflation falls by less than is expected on Wednesday.

Above: Quantitative model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"Rate cuts being priced into the US curve and interest rate compression between the USD and other currencies drove a large portion of the March decline in the USD," says Stephen Gallo, a global FX strategist at BMO Capital Markets.

"There is a clear risk that this dynamic continues to weigh on the USD in the near-term. Tactically speaking, I think it makes more sense to sell into near-term USD rallies," Gallo adds.

March inflation data is the highlight of the U.S. calendar but will be followed by minutes from last month's Fed policy meeting late on Wednesday and by retail sales figures for the same month on Thursday.

The Pound''s retreat from above 1.25 would likely extend further if any U.S. data leads to a 'hawkish' repricing of the outlook for Federal Reserve policy but Sterling will also be sensitive to the details and implications of Thursday's February GDP figures from the UK.

Speeches from Bank of England (BoE) Governor Andrew Bailey and other members of the Monetary Policy Committee are also likely to garner attention on Wednesday, Thursday and Friday, and especially if the latest commentary begs to differ with market-implied expectations for Bank Rate.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for Sterling, and including selected moving averages. To optimise the timing of international payments you could consider setting a free FX rate alert here.