Pound-Dollar: New Highs Tipped for Months Ahead

"We recommend staying long GBP vs USD & SEK" - Deutsche Bank.

Image © Adobe Images

The Pound to Dollar exchange rate eased from close to one-year highs in the final session of a holiday-shortened week for some markets but the trend on the charts has shifted in favour of further gains and many analysts are tipping new highs for the months ahead.

Sterling gave ground to a rebounding greenback on Thursday after surveys of key parts of the UK and U.S. economies appeared to encourage an earlier retreat from some of the Pound to Dollar rate's best levels since June last year.

Pounds were also sold against European and some Asia Pacific currencies after the S&P Global Construction PMI suggested that falling housebuilding activity likely took more wind from the sails of the UK's third largest economic sector in March.

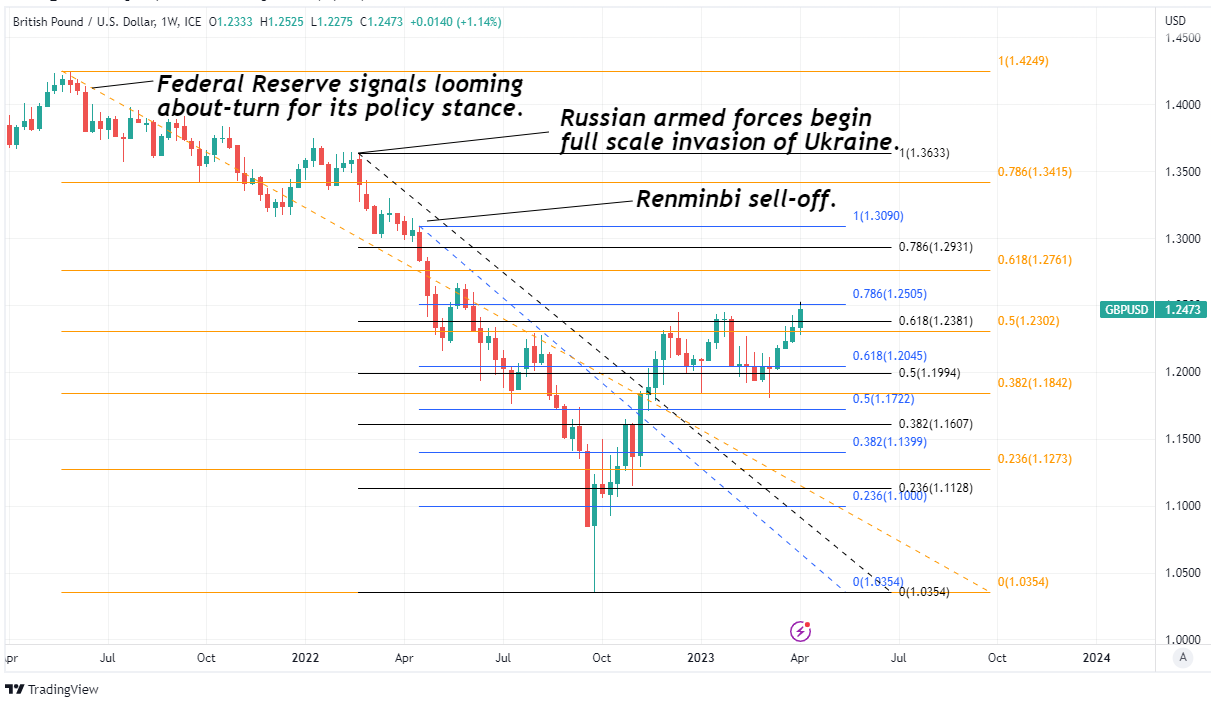

"Yesterday's close above the 61.8% retracement at 1.2446 nullified a potential double top pattern and has resolved the rectangular consolidation to the topside," says George Davis, chief technical strategist at RBC Capital Markets, who tips the Pound to reach 1.2667 over the next one-to-three months.

"The 1.2599 level serves as the next resistance target in this regard, followed by the May high at 1.2667," Davis adds in a Thursday review of the charts.

Above: Pound to Dollar rate shown at hourly intervals alongside EUR/USD. Click image for closer inspection. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

Suffocating construction activity echoed the findings of the Institute for Supply Management survey of the U.S. services sector on Wednesday, followed by a Dollar rebound that has further encouraged Sterling's earlier slippage back below 1.25.

The ongoing retreat by Sterling interrupts a rally dating back to the early days of March and the emergence of stability risks in the U.S. banking sector, which have since led financial markets to bet on an almost imminent reversal of the Federal Reserve (Fed) interest rate cycle.

"This is largely a US-centric issue. And that is a key point because it means not only that the US economy is squeezed to the detriment of the dollar but also that owing to limited contagion, growth in the rest of the world can remain fairly resilient (i.e., pointing to the middle of the dollar smile)," says Skylar Montgomery Koning, a macro strategist at TS Lombard.

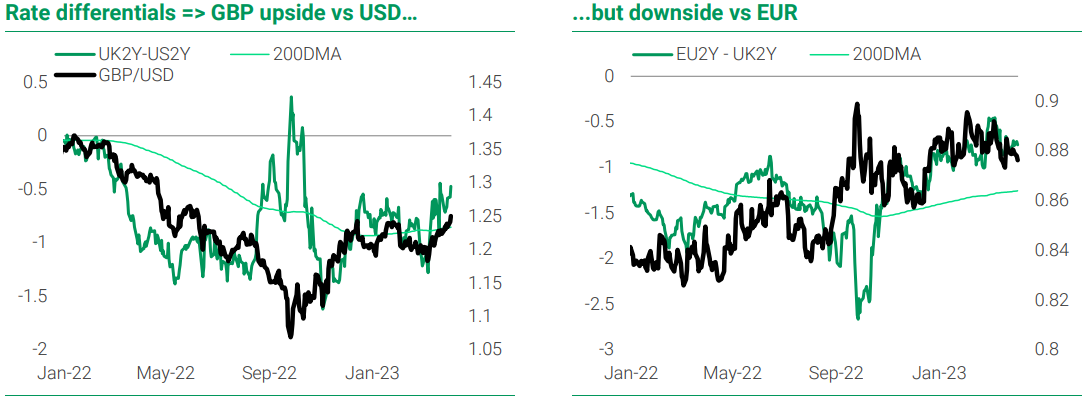

"Market attention has now shifted to looking for confirmation that the US economy is entering recession and to what extent the Fed will cut. We expect steep end-2023 cuts from the Fed on recession, which means rate differentials will continue to point to GBP/USD upside (see chart below left). Volatility will continue on incoming data, and there will no doubt be positive US surprises along the way, but the downward bias is clear," she adds in a Wednesday research briefing.

Source: TS Lombard. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

Fed officials remain insistent that interest rates are unlikely to be cut this year but that didn't keep the Dollar from being sold widely over the course of March, catalysing a rally by the Pound in turn, which has also since drawn encouragement from shifting sentiments about the UK economy.

"The market has converged to our view that UK growth expectations can be upgraded in line with other major economies for this year, though our house view is still more optimistic than the new consensus (Figure 1)," says Shreyas Gopal, an FX strategist at Deutsche Bank.

"In the micro, the move in the currency over the past month looks a little overdone versus relative rates performance, with the added kicker that the market is still mostly pricing another hike by the BoE at the May meeting but our base case is for a hold," Gopal adds.

Office for National Statistics figures suggested last week that the UK economy eked out a small expansion in the final quarter last year while other data has illustrated an economy that would appear to be faring better this year than professional forecasters had anticipated.

"The domestic good news may now be in the price, but given the external backdrop suggests the risks to our Cable forecasts (Q2: 1.25, Q4: 1.28) are still skewed to the upside. We recommend staying long GBP vs USD & SEK," Gopal writes in a Thursday research briefing.

Above: GBP/USD at weekly intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible technical resistance areas for Sterling, including selected moving averages. Click image for closer inspection.