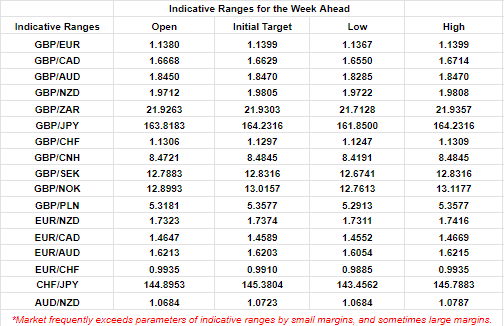

GBP/USD Week Ahead Forecast: Eyeing 2023 Highs Around 1.25 Amid Fresh Oil Rally

- GBP/USD eyeing 2023 highs around 1.25 amid fresh oil rally

- Inflationary oil gains keeping BoE Bank Rate risk tilted higher

- As Fed sees credit tightening carrying water for interest rates

- GBP/USD supported near 1.2279, 1.2188 & 1.2148 on charts

- BoE speeches, U.S. ISM PMIs & monthly payrolls data eyed

Image © Adobe Images

The Pound to Dollar exchange rate rose strongly in March but could climb further to retest the year's highs near 1.25 this week as a fresh rally in oil prices keeps the immediate interest rate risks tilting higher at the Bank of England (BoE) and more so than for the Federal Reserve (Fed).

Sterling entered the new month carrying a hat-trick of weekly gains over the Dollar on Monday but potentially has scope to extend its March recovery further as a rally in oil prices fuels UK inflation rates that were already moving in the wrong direction for the BoE at the last reading.

Oil prices rose by a high single-digit percentage after the Organization for Petroleum Exporting Countries (OPEC) announced a significant cut to planned oil production levels at the weekend, which potentially keeps alive the ongoing risk of another increase in Bank Rate for next month.

"The “precautionary measure” will take a collective 1.16m bpd out of the market. It looks like OPEC is getting a bit panicky about demand this year and is trying to create a psychological floor at $80," says Neil Wilson, chief market analyst at Finalto Trading.

"It suggests OPEC thinks the Fed is heading for a hard landing – the banking ‘crisis’ is the catalyst for this move and OPEC wants to get ahead of it," he adds.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of March rally indicating possible areas of technical support for Sterling, and shown alongside Brent Crude Oil future.To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of March rally indicating possible areas of technical support for Sterling, and shown alongside Brent Crude Oil future.To optimise the timing of international payments you could consider setting a free FX rate alert here.

The production cut is important for Sterling because the BoE assumed in its latest forecasts that inflation would halve this year and it actually rose from 10.1% to 10.4% in February, while Monday's increase in the oil price might be likely to impede any decline of inflation up ahead.

BoE policymakers have also more recently warned that if interest rates are to be lifted further then this would likely only be in response to signs of inflation becoming more stubborn or persistent at too high levels, and this is exactly the risk thrown up by the production cut.

Hence why the Pound is now likely to pay even more close attention on Tuesday when BoE chief economist Huw Pill speaks about "Inflation, Persistence, and Monetary Policy" at the International Center for Monetary and Banking Studies in Geneva.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

"Despite overnight losses in Cable to the 1.2275 area, the pound remains in a solid, short-term uptrend. Broader technical signals remain positive and underlying trend signals are aligned positively for the GBP," says Shaun Osbourne, chief FX strategist at Scotiabank.

"This implies limited downside for the GBP for the moment and ongoing pressure for a retest—at least—of key, medium-term resistance at 1.2445/50," Osbourne writes in a Monday market commentary.

Tuesday's speech is followed on Wednesday by an appearance from the Monetary Policy Committee's Sylvana Tenreryo at the Royal Economic Society Annual Conference, although these UK calendar highlights are bookended by important U.S. data that could have implications for the Dollar.

Institute for Supply Management PMI surveys of the U.S. manufacturing and services sectors are set to provide some of the earliest insights into the performance of the U.S. economy amid and after last month's series of small bank failures this Monday and Wednesday.

Those are followed on Friday by the non-farm payrolls report for March and the Dollar could be especially sensitive to any strong readings after Fed policymakers suggested strongly that last month's turbulence in the banking sector might preclude interest rates from rising much further in the U.S.

The idea is that more stringent lending standards will reduce the availability of credit in a "credit tightening" episode that hampers growth and dampens inflation without lifting borrowing costs, bond yields and investor returns in the same way as further increases in the Fed Funds rate.

"Tightening from what has transpired so far does not appearto be large enough to provide the amount of restraint the market is pricing. The federal funds rate path through the rest of the year is more than 100bp lower than before the bank failures," says Michael Cahill, a G10 FX strategist at Goldman Sachs.

"We think we are approaching the limit on the amount of Dollar weakness that can be priced on the back of policy divergence without clear evidence that the economy is evolving towards the more cautious path that policymakers laid out," he adds.

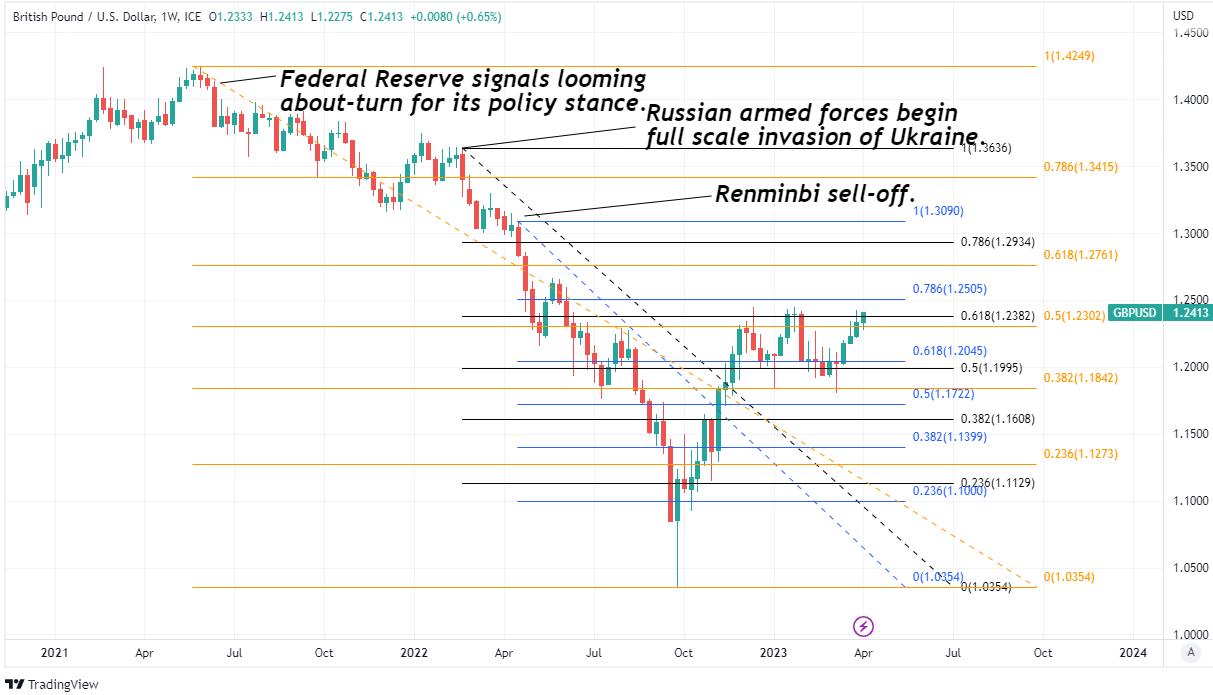

Above: GBP/USD at weekly intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for Sterling, and including selected moving averages. Click image for closer inspection.

Above: GBP/USD at weekly intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for Sterling, and including selected moving averages. Click image for closer inspection.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||