GBP/USD Week Ahead Forecast: Buoyant with Upside Risk

- GBP/USD could have scope to rise ahead of Fed decision

- If global markets welcome interventions in banking sector

- GBP/USD support around 1.2140 & 1.2054 on the charts

- Resistance leaning against recovery at 1.2205 & 1.2313

Image © Adobe Images

The Pound to Dollar exchange rate has remained buoyant near to six-week highs in recent sessions but could edge higher still this week if global markets stabilise ahead of eagerly awaited interest rate decisions from the Federal Reserve (Fed) and Bank of England (BoE).

Heavy losses for U.S. and European financial stocks did nothing to help the underperforming Dollar last week and the risk is now that any renewed sense of calm on Monday will also see the greenback remain a laggard due to a coordinated central bank action announced at the weekend.

"The US$ is caught between opposing forces - a materially downgraded Fed tightening cycle and system stability concerns that would ordinarily give it a safe haven boost," says Richard Franulovich, head of FX strategy at Westpac.

"Our best guess is that liquidity backstops, including US$ Fed swap lines and the “resolution” of Swiss banking concerns will undercut the US$ safe haven upside potential," Franulovich writes in Monday comments.

Above: GBP/USD at 2-hour intervals alongside JPY/USD, EUR/USD, CHF/USD and AUD/USD.

Above: GBP/USD at 2-hour intervals alongside JPY/USD, EUR/USD, CHF/USD and AUD/USD.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

Central banks including the Bank of Canada, Bank of England, Bank of Japan, European Central Bank, Federal Reserve, and Swiss National Bank said they will coordinate to boost the availability of U.S. Dollars in the global financial system from Sunday onward.

This came hard on the heels of a Sunday announcement detailing the state-brokered takeover of Credit Suisse by UBS after recent bank failures in the U.S. led to market speculation about the loss-making lender's viability and a bonfire of European banking stocks last week.

"The banking crisis is a significant financial upset but not (yet) a major economic event. The turmoil lowers the likely peak in central bank rates on both sides of the Atlantic more than it hurts the outlook for economic growth," says Holger Schmieding, chief economist at Berenberg.

"For the US, we have cut our call for the peak in Fed rates by 50bp while nudging our GDP forecasts down slightly. For the Eurozone and the UK, we have adjusted the balance of risks to our calls," Schmieding adds.

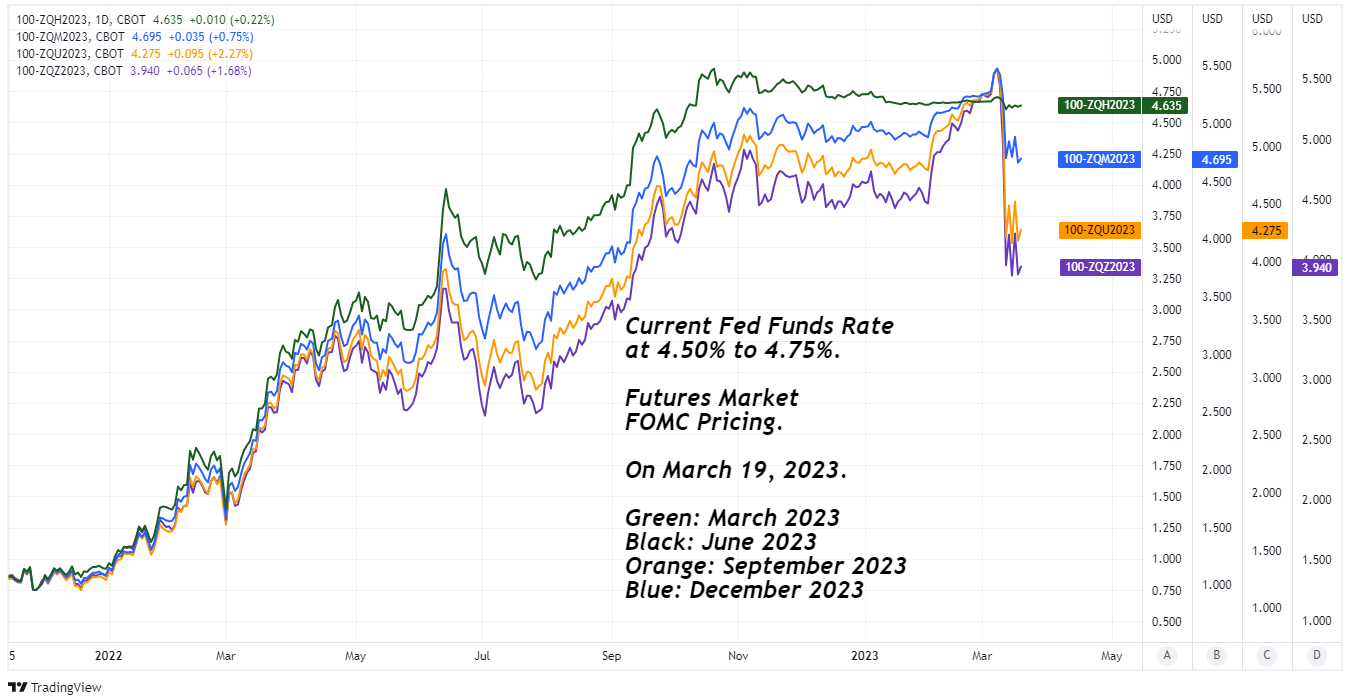

Above: Expected level of Fed Funds interest rate implied by Federal Funds rate futures. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Expected level of Fed Funds interest rate implied by Federal Funds rate futures. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Financial markets have had concerns about the stability of small and medium sized banks as well as some larger firms due to the cost of paying sharply increased interest rates on depositors' balances at a time when profits are still being earned from low interest rate loans advanced over the last decade or so.

"This, together with the most tangible signs yet that the rapid hikes have had an impact, should keep the Fed more cautious for a while," writes Michael Cahill, a G10 FX strategist at Goldman Sachs, in a Friday research briefing.

"In short, while we think the pure “dovish shock” scenario is probably not sustainable, the latest developments have also likely crimped the right tail of the Dollar distribution," Cahill and colleagues add while tipping the Federal Reserve to leave its interest rate unchanged on Wednesday.

All of this is since the failures of Silicon Valley Bank and others earlier in March, which led financial markets to sharply revise down their expectations for the Federal Reserve interest rates ahead of this Wednesday's decision, seemingly weighing on the Dollar in the process.

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

The Pound to Dollar rate would benefit early this week if Sunday's announcement of coordinated central bank action dampens market demand for the greenback but Sterling would find itself vulnerable and at risk of a sharp correction if the Federal Reserve raises its interest rate on Wednesday.

"The FOMC meeting matters because US inflation is too high, the labour market is too tight, and spending is growing solidly. We continue to expect the FOMC to increase the Funds rate by 25bp," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"GBP/USD can ease this week if the USD strengthens as we expect. There is downside support for GBP/USD at 1.1824 (50% Fibbo). There are a number of important UK data and the Bank of England’s (BoE) monetary policy meeting on Thursday that can cause some volatility," he adds in a Monday briefing.

The economist consensus still narrowly favours another increase in the Federal Reserve interest rate this week, which is no longer fully priced-in for the Dollar and could weigh especially heavily on Sterling if the Bank of England then follows up on Thursday by leaving Bank Rate unchanged.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages indicating prospective technical support and resistance for Sterling, while Fibonacci retracements of December correction lower indicate technical resistance. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages indicating prospective technical support and resistance for Sterling, while Fibonacci retracements of December correction lower indicate technical resistance. To optimise the timing of international payments you could consider setting a free FX rate alert here.

The BoE turned non-committal in its guidance on the outlook for interest rates last month and in the time since then not many policymakers have said anything to suggest they are likely to vote for another increase this week.

But a lot about Thursday's decision could yet be determined by inflation figures due out on Wednesday and by what Monetary Policy Committee members make of last week's budget, which is set to have a similar effect on government borrowing to that of the 'mini budget' last September.

"We’re sticking with our long-standing forecast that the MPC will keep Bank Rate at 4.0% at this week’s meeting. While about two-thirds of economists expect a 25bp hike, investors have come around to our view," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"February’s CPI report—released on Wednesday but seen by the MPC on Monday—might throw a spanner in the works, though our 9.9% forecast matches the MPC’s," Tombs writes in a Monday research briefing.