GBP/USD Week Ahead Forecast: Fed, USD and BoE Headwinds Constrain

- GBP/USD supported near & around 1.1950 short-term

- But upside limited by growing UK-U.S. rate headwinds

- Attempted recoveries could fade above 1.22 short-term

- PMI surveys, BoE speeches & U.S. PCE data in focus

Image © Adobe Stock

The Pound to Dollar exchange rate unravelled its new year gains last week and would be fortunate if able to avoid a further foray below 1.20 in the days ahead following a disadvantageous widening of the expected interest rate differential between the Federal Reserve (Fed) and Bank of England (BoE).

Dollars were bought widely at the expense of Sterling and most other G20 currencies after the U.S. consumer price index eased by less than was expected for January and producer prices data also suggested that cost pressures in supply chains remained stubbornly elevated in the new year.

"January's CPI report was disappointing as it revealed that inflation pressures remain elevated. In addition, the extent of previously reported easing was overstated. The Fed clearly still has some work to do in reining in inflation," says Tom Kenny, an economist at ANZ.

"The minutes to the 1 February FOMC meeting will be scrutinised for discussion on when the central bank might pause. The recent strength of jobs and inflation data are likely to make those insights less relevant though," Kenny and colleagues write in a Monday research briefing.

The inflation figures and other data emerging from the U.S. have helped drive expectations for the likely peak in the Federal Reserve interest rate to new highs, leaving derivative markets pricing on Friday a September 2023 peak in the 5.25% to 5.5% range.

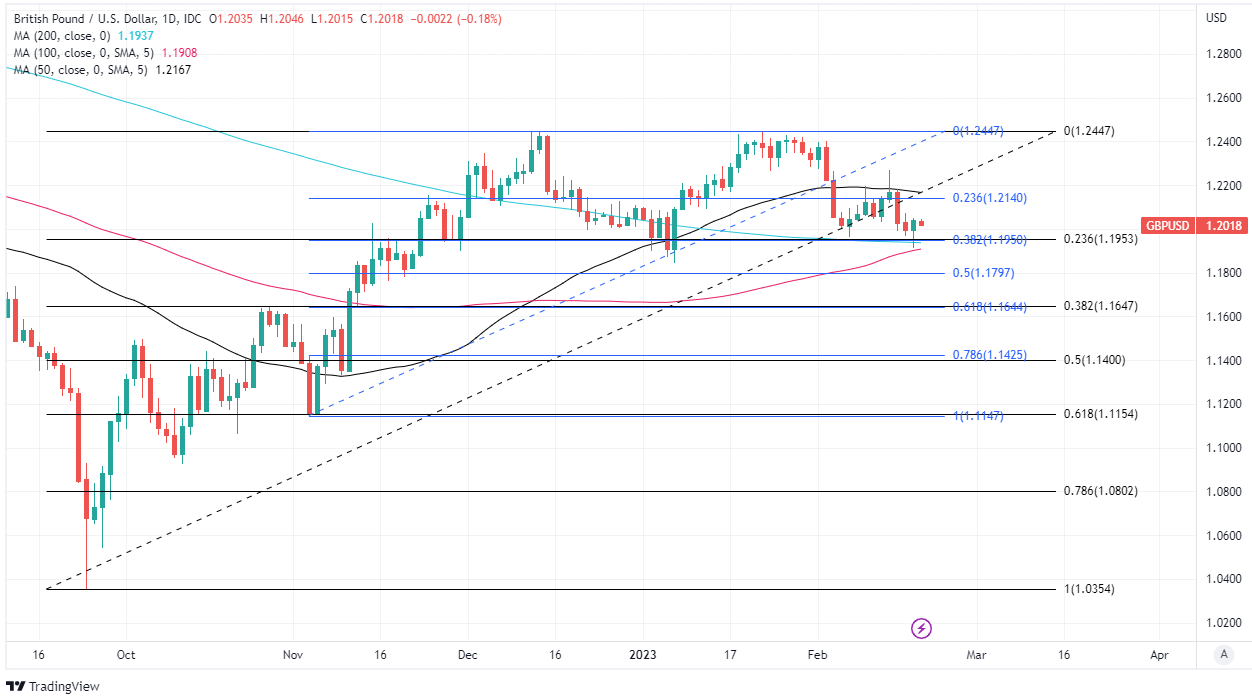

Above: Pound to Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of various microtrends indicating possible areas of technical support. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Shifting expectations risk driving the differential between expected interest rates at the Fed and Bank of England (BoE) back near to its widest level since before the 2008 financial crisis, which would be a weight around the ankles of the Pound-Dollar rate.

"GBP/USD can consolidate in the week ahead after stepping down last week. The UK flash PMIs for February are the local highlight in the week ahead (Tuesday)," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"We expect the PMIs to remain below 50 indicating the UK economy is contracting. However a weak UK economy is not new news and readings modestly below 50pts are unlikely to see a large reaction from GBP/USD," Capurso and colleagues write in a Monday research briefing.

UK retail sales came in better than was expected for January on Friday while other data out on Tuesday suggested employment picked up further going into year-end, although none of these data points have been able to offset headwinds stemming from a dampened BoE interest rate outlook.

This is after UK inflation rates fell further than was expected for the month of January last Wednesday and the BoE's chief economist suggested a March increase in Bank Rate can no longer be taken for granted; with a smaller 0.25% increase the most that should be expected.

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

The Dollar's widening interest rate advantage is a burden that could weigh heavier on the Pound if the BoE's most hawkish policymaker, Catherine Mann, also indicates an emerging preference for smaller interest rate steps in the months ahead when addressing the Resolution Foundation on Thursday.

"Investors no longer see a 25bp increase in Bank Rate at the MPC’s next meeting on March 23 as a done deal, in the wake of January’s CPI report, but still are attaching an 85% probability to the hike," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"This looks far too high to us, given that January’s data strongly support the MPC’s view—expressed clearly via its forecasts—that the headline rate of CPI inflation will fall back to the 2% target quickly without raising Bank Rate further," Tombs writes in a Thursday economics commentary last week.

Any softening of Catherine Mann's policy stance or equivalent remarks from other members of the Monetary Policy Committee would be a further dampener for the Pound, although it will also be sensitive to the outcome and implications of Tuesday's S&P Global PMI surveys for February.

With central bank speeches aside, the PMIs are the highlight of the week for the Pound to Dollar rate ahead of Friday's reading of the Core Personal Consumption Expenditures Price Index for January; the Federal Reserve's preferred and most closely watched measure of U.S. inflation.

Above: Pound to Dollar rate shown at weekly intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.