GBP/USD Rebound Frustrated by Event Risk in the Week Ahead

- GBP/USD supported at 1.23 but struggling above 1.24

- Fed decision, ISM PMIs & payrolls could drive setback

- But hawkish bent in BoE guidance could aid GBP/USD

- As resilient economy, rising wages stoke inflation risks

Image © Adobe Images

The Pound to Dollar exchange rate has laid siege to six-month highs in recent trading but uncertainty about this week's interest rate decisions and U.S. economic data could prevent a further recovery over the coming days.

Subdued appetite for Dollars has kept Sterling on the front foot near mid-December highs but this week's Federal Reserve (Fed) decision and U.S. economic data could yet turn the tide in favour of the greenback.

The big question is whether the Fed will go out of its way to reverse the recent loosening of financial conditions but Wednesday's decision is bookended by economic data including Institute for Supply Management (ISM) PMI surveys and January's non-farm payrolls report.

"US payrolls is the most important economic release for financial markets (released Friday). Average hourly earnings that accompanies its release will give a read on wage costs," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia

"We slimly favour a 50bp increase of the Funds rate. However, we consider the FOMC’s decision will be finely balanced between a 25bp and 50bp increase," he adds in a Monday research briefing.

Above: Pound to Dollar rate shown at 2-hour intervals with Fibonacci retracements of January rally indicating possible short-term technical support for Sterling. Click image for closer inspection.

Recent public remarks of policymakers have led the market to expect a 0.25% increase in the Fed Funds rate this week but the Fed could attempt to surprise hawkishly if it wants to reverse recent declines in U.S. bond yields or to discourage speculation about interest rate cuts for later this year.

Falling yields have driven overall financial conditions looser since November, weighing on the Dollar and drawing protests from Federal Open Market Committee members in the process, hence why any successful attempt to turn the tide would likely undermine the Pound-Dollar rate this week.

But without a hawkish surprise, a softer Dollar could help to keep Sterling afloat ahead of Thursday's Bank of England (BoE) interest rate decision.

"We suspect GBP will rally on dips and will challenge and break resistance against the USD at 1.25. A dovish BoE against a backdrop of economic frailties is the main argument offered against GBP upside," writes Dominic Bunning, European head of FX research at HSBC, in a Friday research briefing.

"For GBP-USD, it is important to recognize that this exchange rate is being driven by risk appetite rather than rates," he adds.

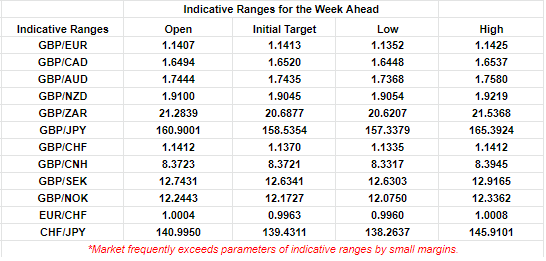

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Thursday's decision is widely expected to see Bank Rate raised from 3.5% to 4% while many economists also expect the BoE to confirm that the end of its interest rate cycle is just around the corner, although there are reasons for why the bank might choose to keep its future policy options open instead.

These reasons include recent data showing core inflation remaining stubbornly elevated in December and wage growth accelerating again in November, as well as other figures indicating that the UK economy has not slowed as fast as anticipated by the BoE in its latest forecasts.

If these factors lead the Monetary Policy Committee to favour hawkish guidance about the outlook on Thursday it would be supportive of the Pound to Dollar rate, although it will also be responsive on Thursday and Friday and to the release of January's ISM Services PMI in the U.S. and non-farm payrolls report.

The Dollar sometimes rises in response to poorer-than-expected economic data, meaning Sterling may be vulnerable to any negative surprises this week.

"Sterling looked wobbly earlier this week but rebounded strongly; this resilience and persistent pressure on 1.24+ levels suggest building upside drive for gains to extend. Key support is 1.2265," writes Shaun Osborne, chief FX strategist at Scotiabank, in a Friday market commentary.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of 2022 downtrend indicating possible areas of technical resistance while selected moving-averages denote potential support. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.