Pound-Dollar Week Ahead Forecast: Upside Risks Persist as U.S. Data Eyed

- GBP/USD could benefit if global markets recover further

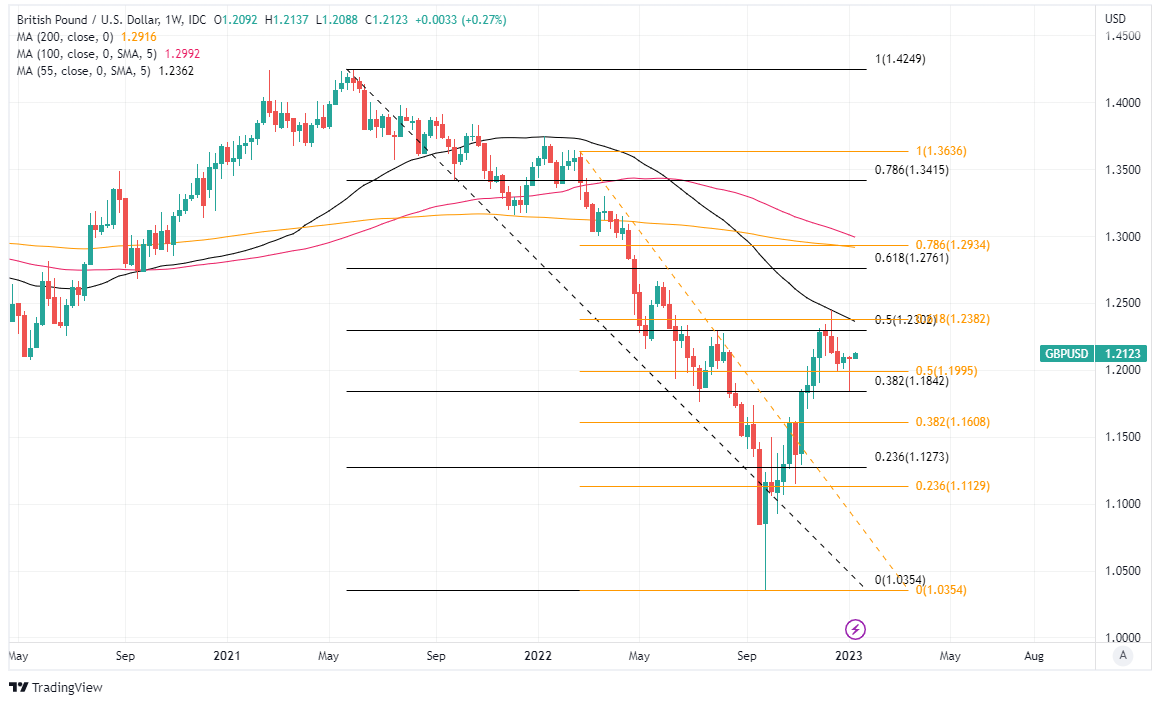

- But technical impediments lurking above 1.23 on charts

- Moving averages at 1.1929 & 1.2012 may offer support

- Fed speeches & U.S. CPI data set to determine outlook

- UK GDP to confirm recession; BoE speeches up ahead

Image © Adobe Images

The Pound to Dollar exchange rate has sharply reversed its New Year losses and could rise further this week if global markets build on last Friday's gains but public remarks from Federal Reserve (Fed) officials and the latest U.S. inflation figures are potential risks to the recovery.

Dollars were sold heavily on Friday to the benefit of Sterling and other currencies after a volley of data provided what may have been a tentative indication of Federal Reserve policy beginning to have the desired effects of softening the labour market and dampening the U.S. economy.

Wage growth surprised notably on the low side of expectations in Friday's non-farm payrolls report while the Institute for Supply Management (ISM) Services PMI tumbled for the month of December to join its S&P Global counterpart in warning of a recession in the largest U.S. economic sector.

Subsequent falls in U.S. government bond yields and losses for the greenback lifted riskier assets including stocks and the Pound.

"All told, today's data deluge takes shine off the USD's bounce from this week," says Mazen Issa, a senior FX strategist at TD Securities.

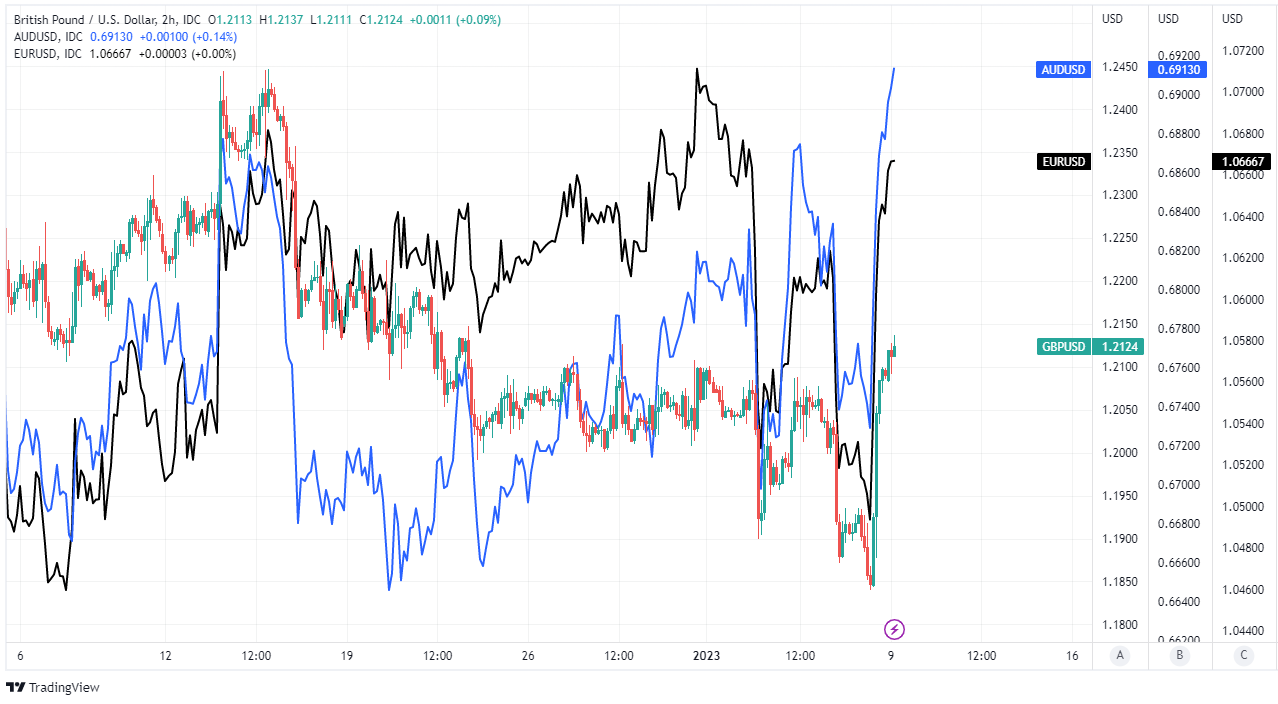

Above: Pound to Dollar rate at 2-hour intervals alongside AUD/USD and EUR/USD. Click image for closer inspection.

"For the USD, we think it will be difficult to push renewed weakness ahead of US CPI next week," Issa writes in review of Friday's data.

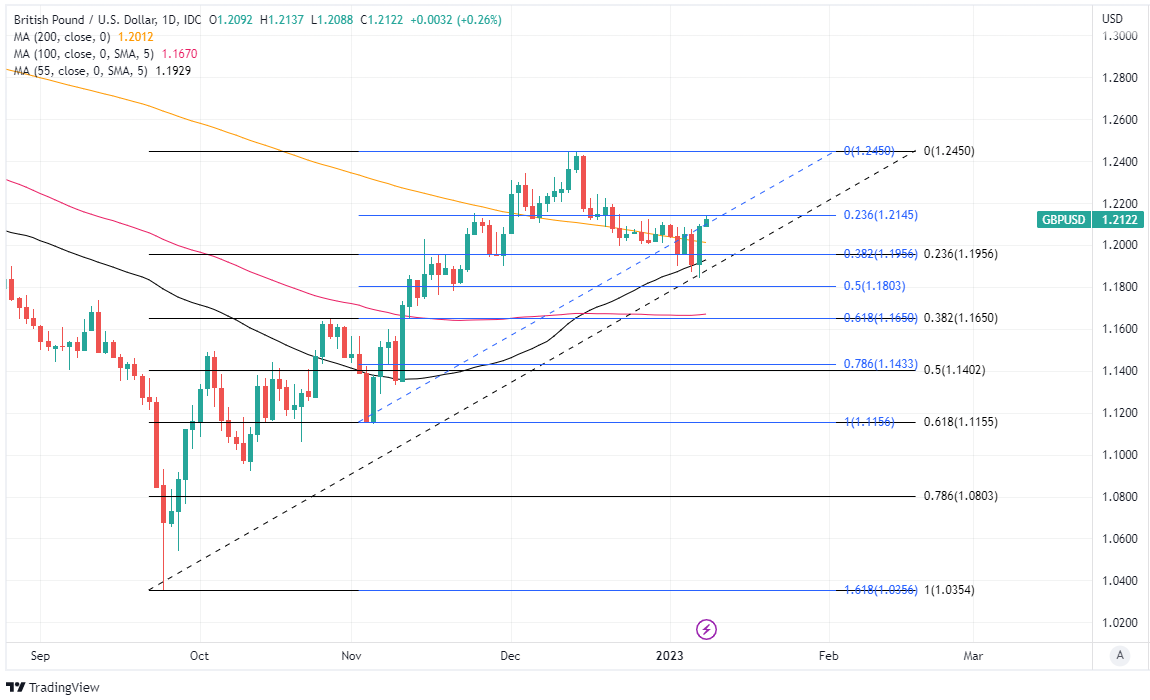

Sterling had been trading at multi-month lows close to 1.1850 earlier on Friday but later reclaimed its 200-day average at 1.2012 and appeared poised to take a run at its mid-December highs above 1.24 when entering the new week.

This might be possible if China's formal abandonment of coronavirus-related restrictions on international travel on Monday supports a continued rebound in global markets but a Tuesday speech from Fed Chairman Jerome Powell and Thursday's U.S. inflation data are both potential banana skins for Sterling.

"Minutes to the December FOMC meeting show most members believe the Fed needs to start balancing the risk of under versus over tightening, a notable shift over the past few months from a majority who weren’t concerned about overtightening," says Tom Kenny, an economist at ANZ.

"This opens the door to another step down in the pace of tightening at the upcoming FOMC meeting," Kenny adds in a Monday research briefing.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of late September recoveries indicating possible areas of technical support for Sterling. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Economists are looking on average for U.S. inflation to have fallen from 7.1% to 6.6% in December but investors have already reduced expectations for U.S. interest rates in recent weeks so the Pound and Dollar may be more exposed to any upside inflation surprise than anything else.

However, before then attention will be on Fed Chairman Jerome Powell Tuesday when he participates in a panel discussion at the Riksbank’s International Symposium on Central Bank Independence, as well as appearances from other Fed policymakers

"We expect year-over-year U.S. consumer price growth to slow significantly in December to 6.3% from 7.1% in November. That would be the lowest level of annual price growth since October 2021 and below the peak 9.1% rate in June 2022," says Nathan Janzen, assistant chief economist at RBC Capital Markets.

"We expect ‘core’ (excluding food & energy products) price growth to slow to 5.6% year-over-year in December from 6.0% in October. By our count, almost half of the year-over-year increase in ‘core’ price growth is coming from higher home rents," Janzen writes in a Friday research briefing.

While the Pound to Dollar rate will be heavily influenced by international developments, Friday's GDP report for November is expected to all but confirm a recession underway in the UK and Sterling could be sensitive to any positive or negative surprise on this note.

Above: Pound to Dollar rate shown at weekly intervals with selected moving averages and Fibonacci retracements of 2021 downtrend indicating possible areas of technical resistance for Sterling. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.To optimise the timing of international payments you could consider setting a free FX rate alert here.

"November's GDP data should leave little doubt that a recession has begun," writes Samuel Tombs, chief UK economist at Pantheon Macroeconomics, in a Monday research briefing.

"But with the MPC already anticipating a deep downturn and currently placing more weight on wage and price developments, this report likely won't lead to a decisive decline in interest rate expectations," he adds.

Tombs forecasts a 0.2% fall in GDP that would all but assure a second contraction for the final quarter and the UK's entry into recession but consensus favours an even steeper 0.3% decline on Friday.

While Friday's GDP data is the highlight of the week, the market will also likely pay close attention to remarks from the BoE's Governor Andrew Bailey, Huw Pill and Catherine Mann on Monday, Tuesday and Thursday.

Huw Pill and Catherine Mann are currently some of the most hawkish members of the Monetary Policy Committee and there is uncertainty over how much further Bank Rate is likely to be lifted in the months ahead.