GBP/EUR Rate Still Tipped to Strike Fresh Highs

Image © Adobe Images

The Pound to Euro conversion has fallen from its 2024 highs, but analysts at Barclays and Julius Baer are not dropping their predictions that Pound Sterling rally to fresh highs.

GBP/EUR has retreated from highs just above 1.17 to the 1.1650 area following two successive weeks of declines, driven in part by a softer-than-forecast UK inflation release and the March Bank of England policy meeting.

"Pound Sterling weakened after the Bank of England's voting pattern showed that the last remaining hawks, who were still in favour of another rate hike last month, have now also moved to a hold," says David Alexander Meier, an analyst at Julius Baer.

Market odds of a June interest rate cut from the Bank rose after Mann and Haskel dropped their votes for further rate hikes, while the Bank said it could cut rates from current levels without the risk of boosting inflation.

"This was seen by markets as a shift that allows for an earlier BoE policy easing. We argue that it could be premature to expect earlier BoE cuts," says Meier. "A rebounding economy and positive real wage growth still argue for caution."

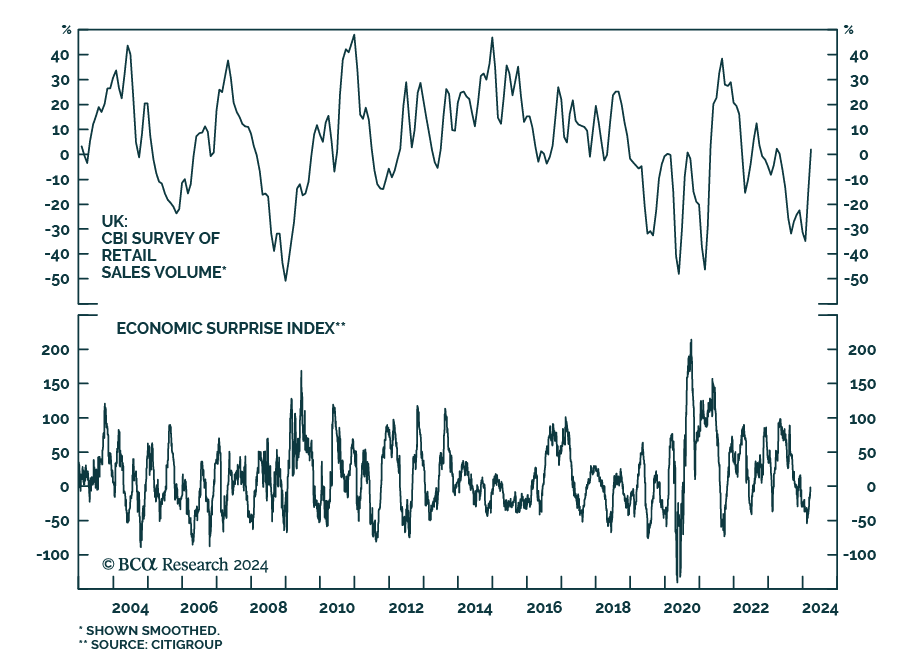

Economists at BCA Research say they also anticipate the Bank of England cutting interest rates in the second half of the year owing to a spate of upside economic data surprises that hint at an improving economy.

"The latest batch of economic data out of the UK suggests that economic conditions have recently stabilised," says Roukaya Ibrahim, an economist at BCA Research. "Easing inflation is providing a tailwind for consumer spending."

Should market bets for a June rate cut recede in response to incoming data, the Pound can recover its post-BoE losses.

Track GBP/EUR with your own custom rate alerts. Set Up Here

"We continue to expect the first cut in August and believe that the pound can remain robust once the policy divergence to the ECB becomes clearer this year. We thus stick to our three-month target of EUR/GBP 0.85," says Meier.

(EUR/GBP at 0.85 gives a GBP/EUR rate of 1.1765, which forms the top of a long-running range for the pair).

Above: The UK data pulse is picking up. Image: BCA Research.

Currency strategists at Barclays say the perceived dovishness of the Bank of England does not alter the Pound's constructive outlook.

"Last week's dovish pivot by the MPC may have weighed on the pound temporarily but does not change our constructive outlook. The latter is based on demand resilience (evidenced in the notable outperformance versus the eurozone) and still-considerable wage growth and domestic inflation, which require relatively high rates for longer," say analysts.

Also underpinning a constructive stance on the Pound at Barclays are expectations for a closer relationship with the EU (and associated partial unwind of the pound's Brexit premium) following the UK's next general election.

Barclays forecasts EUR/GBP grinding towards 0.82 by Q1-25 and look for opportunities to re-engage into GBP longs at better levels.

EUR/GBP at 0.82 equates to GBP/EUR at 1.22.