Euro Extends Losses After ECB Speakers Point To April Rate Cut

`

`

Image © Adobe Images

Euro exchange rates were lower at the start of the new week amidst an ongoing rise in bets that the European Central Bank (ECB) would cut rates as soon as April.

Slovak central bank chief Peter Kazimir and Governing Council member Mário Centeno directly addressed the prospect of an April cut on Monday.

"The next move will be a cut, and it is within our reach," said Kazimir. "I am confident that the exact timing, whether in April or June, is secondary to the decision's impact."

"There is a lot more information, and (being) data-dependent is not (being) wage-data dependent... we don't need to wait for May wage data to get an idea about the inflation trajectory," said Centeno.

The comments extend the repricing in ECB rate expectations in favour of an earlier cut that followed the central bank's January policy decision and guidance.

The Euro to Pound exchange rate is now down by a third of a per cent at 0.8516 on the day; "EUR/GBP falls to 0.8517 as dovish guidance from ECB policymakers hurts euro," says a note Robert Howard, an analyst at Reuters. "Centeno says ECB interest rate cuts should start sooner rather than later."

The Euro to Dollar exchange rate was lower by a similar amount at 1.0820.

Centeno, a member of the rate-setting Governing Council, said he prefers a first-rate cut in April.

"There is a lot more information, and (being) data-dependent is not (being) wage-data dependent...we don't need to wait for May wage data to get an idea about the inflation trajectory," he said in an interview.

He saw "a lot of evidence that inflation is falling in a sustained way" towards the medium-term objective of 2%, with surprisingly strong declines lately after the dissipation of "almost all" shocks that had propelled prices, such as energy costs and supply restrictions.

"We can react later and more strongly, or sooner and more gradually. I am completely in favour of gradualism scenarios because we have to give economic agents time to adapt to our decisions," he said, hoping for a continuous, sustainable trimming and seeing 25 basis-point steps as "a good metric".

The Euro fell after the ECB kept interest rates and guidance unchanged at last Thursday's policy update, but President Christine Lagarde did not discount a rate cut happening as soon as April, which the market interpreted as signalling April is 'live' to a cut.

Image courtesy of Lloyds Bank.

"It was particularly interesting that Lagarde, while not endorsing an April cut, did not appear to push back strongly against that possibility," says Hann-Ju Ho, Senior Economist at Lloyds Bank.

Lagarde nevertheless maintained the first move would more likely fall in June.

Kazimir also says a June hike seems "more probable, but I will not jump to premature conclusions about the timing."

"The risks of a premature cut, in my view, are much greater than those of acting a bit later," he explains. "We are not behind the curve; it's more the case that the market has gotten ahead of events since December."

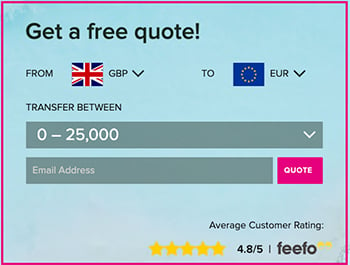

Track GBP/EUR with your own custom rate alerts. Set Up Here