GBP/EUR Rate Forecast for the Week Ahead: Potential Targets

- GBPEUR technical setup has broken down

- Key support level gives way, exposing sub-1.14

- UK Autumn Statement, PMIs in focus for GBP

- Eurozone PMIs, German IfO key events for EUR

Above: File image of Jeremy Hunt by Simon Dawson / No 10 Downing Street.

The British Pound reached a fresh six-month low last week, and a technical deterioration on the charts suggests the coming days risk further downside unless UK PMI numbers can outshine those of the Eurozone.

But ahead of Thursday's data will come the UK Autumn Statement, which could offer the Pound some support if the government takes some decisive steps to boost business investment and productivity despite the limited fiscal headroom available.

Whatever the case, the Pound is under pressure relative to its continental neighbour, and it is therefore questionable as to whether events this week can arrest the decline.

GBP/EUR hit a fresh 6-month low just shy of €1.14 last week, largely thanks to a below-consensus inflation print that pushed the market into raising bets for the amount of interest rate cuts that will fall in 2024.

"The recent UK inflation data has had – and is continuing to have – a deleterious impact on sterling, in relation to a variety of currencies," says Bill McNamara, chief analyst at The Technical Trader.

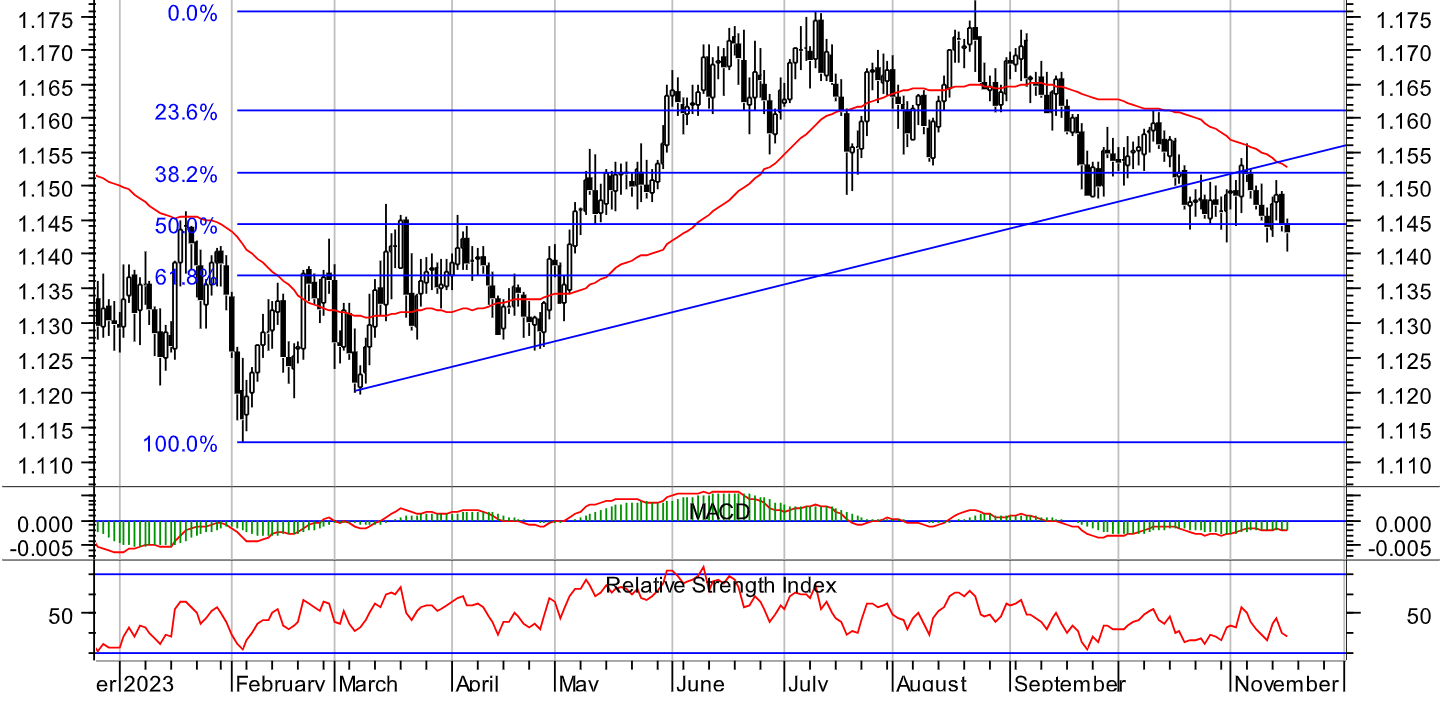

"With regard to the euro, the UK currency has lost ground over recent sessions, to the extent that it has dropped through the bottom of its range (where a degree of support had taken shape at around the 1.145 level) and to its lowest reading since early May," says McNamara.

Image courtesy of The Technical Trader. Track GBPUSD with your own custom rate alerts. Set Up Here.

McNamara says Pound-Euro weakness now points towards the possibility of further near-term downside, and the next target looks like it might be at around 1.1360, a level that would equate to a 61.8% retracement of the rally that began in February and which culminated in the July closing high, at 1.1746.

"If that level fails to arrest the slide, the next area of possible support is the April low, at 1.128. In short, the path of least resistance remains to the downside," says McNamara.

The UK offers more interest with the Autumn Statement due Wednesday, which should see the government lay out updated tax and spending plans.

Such budget announcements can considerably impact the Pound's value, which fell to near-record lows just over a year ago when Liz Truss's government delivered its ill-fated mini-budget.

Both the Pound and Truss fell as markets fretted about the ability of the UK to pay for the hefty tax cuts and spending increases the new government proposed.

But, the era of Sunak and Hunt is a more considered one that places sustainable finance at its heart, and for this reason, we see very low odds of a major decline in the Pound following 2023's Autumn Statement.

Above: "UK still has only limited headroom" - Lloyds Bank.

The government will be tightly constrained by the UK's fiscal position, limiting the scope for tax cuts and spending increases. But there are signs that the thrust of the focus will be on helping boost businesses ahead of a consumer-focussed budget statement in the spring of 2024.

The Pound could benefit if the government convinces markets it has done enough to boost UK productivity.

"Speculation has built around a cut in inheritance tax. And extending corporation tax full expensing, which is currently due to end in 2026, looks likely, in conjunction with other measures to boost investment," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

Above: UK PMIs, image courtesy of Lloyds Bank.

Thursday sees the release of the PMI survey for October at 09:30 GMT, and we expect Pound exchange rates to move on any surprises.

The S&P Global/CIPS manufacturing November PMI is forecast at 45.0 in November, up from 44.8 in October. Services are expected at 49.6, largely unchanged on October's 49.5. The headline Composite PMI is expected at 48.8, also marginally unchanged on 48.7 previously.

"November's flash PMI is likely to signal an economy stuck in the doldrums. October's composite PMI was in contractionary, sub-50, territory for the third successive month, and the forward-looking balances of the S&P Global/CIPS surveys remained downbeat," says Goodwin.

If the data deviates to the upside, the Pound can benefit, particularly given market sentiment towards the UK economy is already poor.

Where Pound-Euro ends the week could rest with how the equivalent Eurozone PMI's for November land, due for release just half an hour ahead of those of the UK.

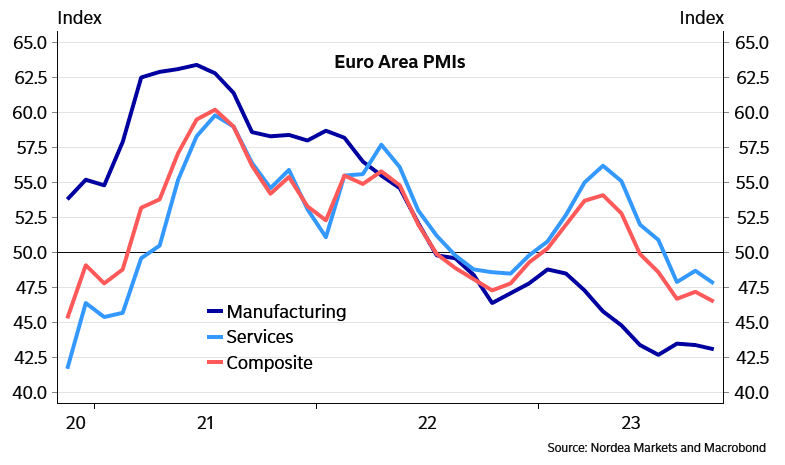

The Eurozone manufacturing PMI is expected at 43.5 in November, up from 43.1 in October, and services is seen at 48, up from 47.8. The composite reading is expected to land at 46.7, slightly higher than 46.5 previously.

Should the Eurozone's PMIs outshine the UK's, Pound-Euro could test deeper into the 1.13s.

"We think the flash Eurozone PMIs are unlikely to signal a rebound, even though lower oil prices might provide a little boost. The German ifo is also unlikely to show more positive momentum, as it usually reflects the equity market mood and the survey took place when stocks were weak," says Dominic Schnider, a strategist at UBS. "So, for now we believe consolidation is more likely than further gains for the EUR."

Image courtesy of Nordea Bank.

"The last PMIs were truly poor and showing both lower activity for manufacturing and services. The shape of the Euro economies is weakening but with a still too high inflation rate cuts are unlikely to come as fast as markets currently expect. There is a chorus of ECB speaker out next week with Lagarde scheduled to speak twice," says Dane Cekov, an analyst at Nordea Bank.

Regarding the ECB speakers, Chief Economist Philip Lane speaks on Monday at 05:00 GMT, President Christine Lagarde speaks at 16:00 on Tuesday. Isabel Schnabel is due later in the day at 17:15.

Frank Elderson speaks at 14:10 on Wednesday, Schnabel again at 19:30 on Thursday. Lagarde is due her second talk at 09:00 on Friday and De Guindos rounds the week off at 12:00.