GBP/EUR Week Ahead Forecast: Rally Curbed as Inflation Data Eyed

- GBP/EUR facing UK economy, BoE headwinds

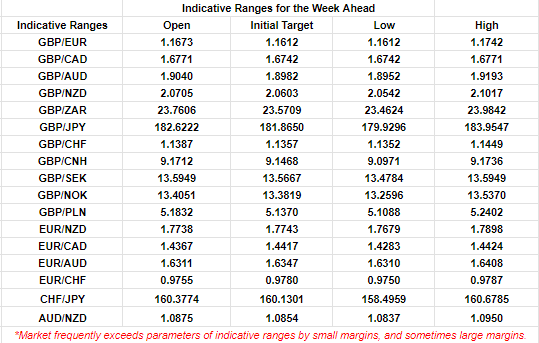

- Scope for rough 1.1612 to 1.1742 range ahead

- Central bankers eyed ahead of Europe inflation

- Inflation trajectory & market response uncertain

Image © Adobe Images

The Pound to Euro exchange rate receded from some of its best levels since August 2022 last week and could now be likely to consolidate within a rough 1.1612 to 1.1742 range ahead of midweek remarks from central bankers on both sides of the channel and Friday's reading of the European inflation pulse.

Sterling remained one of the top-performing major currencies of the month and year on Monday but featured as an underperformer for the recent week when a stronger-than-expected set of UK inflation numbers and larger-than-usual increase in the Bank of England (BoE) Bank Rate were not enough to lift it back to earlier highs against the Euro.

The GBP reaction "to the surprisingly large rate hike should be a lesson to those who are overly bullish on the EUR," says Ulrich Leuchtmann, head of FX research at Commerzbank, in a Friday research briefing.

"Positive rate surprises are not always positive for the currency," he adds.

It's not clear if Sterling's damp performance resulted from investor disappointment with the size of the BoE's interest rate step on Thursday, which is a possibility, or market concerns about the outlook for the UK economy in the face of what is already the third most significant 'tightening' cycle since the establishment of the BoE in 1694.

But what is clear is that the UK's core inflation rate now appears to be on the cusp of leading the overall inflation rate higher once again when it normally follows the latter, indicating homegrown inflation pressures, and that this has led financial markets to anticipate Bank Rate rising to 6.25% by year-end.

Above: GBP/EUR shown at daily intervals with selected moving averages.

"Whether the aggressive BoE market pricing will subside or inflation continues to surprise, we see it as a headwind for GBP. We still like our short GBP/CHF trade recommendation," says Kirstine Kundby-Nielsen, an analyst at Danske Bank.

"We continue to expect a 25bp at the August meeting although it is a close call between 25bp and 50bp. In order for BoE to opt for 50bp instead of 25bp we believe that we would have to see data releases prove considerably stronger," she adds.

The expected peak for Bank Rate would make for the BoE's second most aggressive tightening cycle on record having been surpassed only by the 10% or so increase to 17% seen between 1978 and 1979, and is also suggestive of significant risks ahead for an economy that is now much more indebted than back then.

The latter is an automatic headwind for Sterling but so too is the risk of a fresh upturn in UK inflation if the author's valuation model is anything to go by, as this would diminish the 'fair' or fundamental value of GBP/EUR if the rebound in inflation is not matched in Europe: Here, 'fair value' is currently estimated to sit between 1.1552 and 1.1791.

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

"I keep hearing that call from economists around the street, that base effects are going to cause a big drop in July and finally take the pressure off of the BoE. If that doesn't happen then watch out as we could be in for another round of Liz Truss style pain," says Brad Bechtel, global head of FX at Jefferies.

Many analysts say the interest rate implications of rising inflation should make the latter a supportive influence for a currency but financial market responses to inflation numbers have been mixed and inflation itself is a corrosive influence on the theoretical value of currencies wherever not offset by rising interest rates.

And with Bank Rate still lagging far behind inflation while price pressures show signs of accelerating again, the inflation risk to the 'fair value' of GBP/EUR is likely to remain tilted to the downside unless the market consensus is right to expect Europe's inflation data for June to follow a similar pattern to the UK's on Friday.

Friday's release of Euro Area inflation figures is the highlight of the economic calendar for GBP/EUR in what is quiet week for UK data but it will be preceded by the national numbers of Germany, Italy and Spain, as well as the annual Policy Panel discussion at the European Central Bank Forum on Central Banking.

The Policy Panel features ECB President Christine Lagarde, BoE Governor Andrew Bailey, Federal Reserve Chairman Jerome Powell and Bank of Japan Governor Kazuo Ueda but will be watched most closely for clues on how the world's major central banks would be likely to respond to a prolonged period of elevated core inflation.

Above: Pound to Euro rate shown at weekly intervals with selected moving averages denote possible support and/or resistance for Sterling.