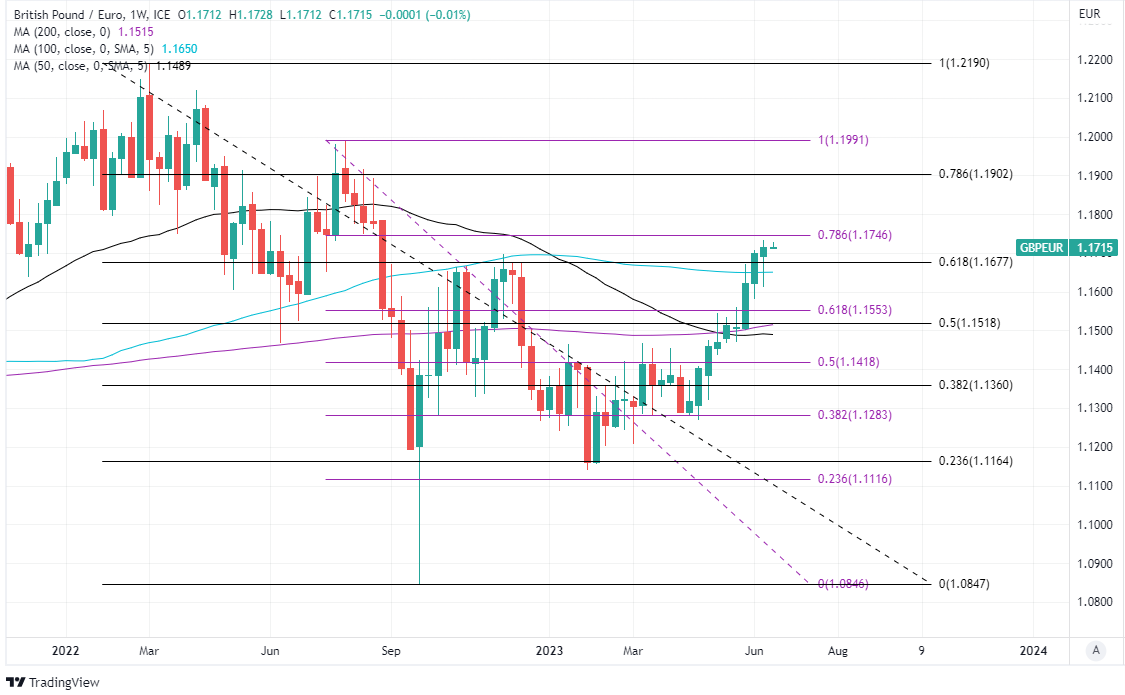

GBP/EUR Week Ahead Forecast: Topping on Charts amid Volatility in Fits and Starts

- GBP/EUR rally to meet further resistance near 1.1746 on charts

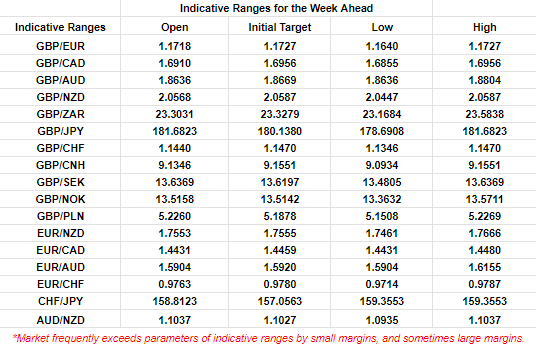

- Scope for 1.1640 to 1.1727 range in a big week for UK economy

- UK inflation & difficult BoE policy choices pose risk to GBP/EUR

Image © Adobe Stock

The Pound to Euro exchange rate has been carried to one-year highs in recent trade but inflation data and a difficult interest decision for the Bank of England (BoE) could lead to volatility in fits and starts with the risk of a top forming around a nearby resistance level on the charts in the days ahead.

Office for National Statistics (ONS) figures confirming an almost record increase in average wage growth for April have further lifted market expectations for the Bank of England Bank Rate and got some economists asking themselves whether a dreaded 'wage-price-inflation' spiral might be in the cards.

This followed an almost 10% increase in the national minimum wage, which is now in the process of rebuilding company profit margins and could lift prices for products and services, inflation and wage expectations among workers further down the line with knock-on implications for interest rates.

"Despite the sizable cumulative tightening already in the pipeline, we now think that taming inflation persistence will require a tighter monetary policy stance than previously forecast," says Abbas Khan, an economist at Barclays.

"As such, our baseline policy path projection now sees the MPC voting for four (two previously) additional 25bp hikes, bringing Bank Rate to a terminal 5.5% by the November Monetary Policy Report meeting," Khan writes in a Friday research briefing.

Above: Pound to Euro rate shown at daily intervals with spread or gap between 02-year UK and German government bond yields. Click for closer inspection.

The increase in wage growth as well as last month's divergence between a falling UK inflation rate and rising measure of core inflation - which reflects the inflation percolating in the domestic part of the economy - has led some economists and markets to expect Bank Rate to be lifted from 4.5% to 5.75% by year-end.

But the benchmark's increase from 0.1% in December 2021 to 4.5% currently has already added more than £9k in annual interest to the cost of buying an average-priced home with a 25% loan-to-value mortgage, which far exceeds the uplift in the £31,200 average wage over the same time.

"Mortgage borrowers between 2014 and 2022 were stress tested to see if they could maintain repayments if Bank Rate jumped by more than 300bp, but we already have had a 440bp increase to date," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"The proportion of large businesses with an interest cover ratio of less than 2.5—a level below which businesses are materially more likely to experience repayment difficulties—would return to the levels last seen in 2001, if Bank Rate increased by a total of 450bp over a 12 month period," he adds, citing the BoE's 2022 Financial Stability Report.

The already significant increase in Bank Rate is why some economists say the BoE is nearing the limit of what it can safely and reasonably do to bring inflation back to the 2% target but with financial stability aside, and any suggestion of this from the BoE on Thursday would very likely be followed by heavy selling of Sterling.

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

"The extent to which market expectations have moved presents a major communications challenge for the MPC. There is no press conference scheduled for the June meeting and so the messaging in the minutes will need to be clear on how the MPC interprets the recent data," says Andrew Goodwin, chief UK economist at Oxford Economics.

"One potential option would be to acknowledge market concerns and try to reassert its inflation-fighting credibility with a 50bps hike. We think this is unlikely but not implausible in the current climate, and expect the MPC to stick to a 25bps hike," Goodwin writes in a Friday research briefing.

Another more medium-term risk for the Pound and UK economy might be the emerging scope for increased mortgage costs to stoke additional pay growth and more inflation further down the line but higher up the income pyramid where there is the most mortgaged strata and what is sometimes referred to as the 'squeezed middle.'

To many this sort of scenario would appear to be an almost Erdognomic outcome if not for the low level of unemployment and tight labour market prevailing in the UK at present.

Thursday's BoE is the highlight of the week for Sterling but is preceded by a Wednesday release of inflation figures for May, which the consensus suggests will show annual price growth falling from 8.7% to 8.4% last month but with the more important core inflation rate remaining at 6.8% after rising from 6.2% in April.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of July and March 2022 falls indicating possible areas of technical resistance that could frustrate Sterling's rally in the near future. Click for closer inspection.