GBP/EUR Week Ahead Forecast: BoE Holds Key to Further Recovery

- Scope for GBP/EUR to rise above 1.15 if BoE received positively

- But setback likely if little change in February's outlook for inflation

- UK's March GDP data also eyed as European calendar quietens

Above: King Charles III coronation procession travels along The Mall, London. Image © John-Parnell-Flickr,

The Pound to Euro exchange rate entered the new week trading back above 1.14 and may attempt to rise further in the days ahead but Thursday's forecast update and interest rate decision from the Bank of England (BoE) are both wild card risks that could cut either way for Sterling.

Sterling benefited last week when a European Central Bank (ECB) interest rate stance and deteriorating German economic data led the single currency to fall widely ahead of the weekend while lifting the Pound to Euro rate to a new 2023 high of 1.1475 by the Friday close trade.

The ECB was hawkish in warning that interest rates could be raised until it becomes clear they are "sufficiently restrictive" for driving inflation back down to 2% but it also acknowledged that reduced lending resulting from recent turbulence in the financial sector could ultimately do some of the work for it.

"At this point, the odds of a monetary policy mistake will rise proportionally to the number of additional interest rate hikes the ECB delivers," says Mathieu Savary, chief European strategist at BCA Research.

"Inflation has passed its peak and will decline steadily in the next twelve months. Focusing on wages is misplaced. Wages are a highly lagging indicator and inflation expectations point toward a sharp deceleration later in 2023," Savary writes in a Monday research briefing.

Above: Pound to Euro rate shown at daily intervals with selected moving averages and Fibonacci retracements of 2022 fall indicating possible areas of technical resistance for Sterling.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

The Pound was a beneficiary of the single currency's misfortune but its prospects now hinge substantially on whether the BoE remains confident in its February forecasts suggesting that a sharp second-quarter decline would lead inflation to fall back to around 4% by year-end.

"We think the MPC will keep options open in a balanced manner, reiterating that evidence of persistent inflationary pressures could require further tightening, while signaling that it might pause if data comes in in-line with MPR projections," writes Abbas Khan, an economist at Barclays, in a Friday research note.

"The MPC is likely to mention that it continues to closely monitor developments in the US banking sector for potential effects on credit conditions faced by UK households and businesses, but that there have been only limited negative spillovers into the UK banking system," he adds.

Inflation held stubbornly in the double digits during the opening quarter while much of the other data emerging over the recent months has continued to cast the UK economy in a resilient light, and at a point when demand stands to be supported further by sharply reduced energy prices.

Wise words of wisdom;

"...But it is not the new inventions which are the difficulty. The trouble is caused by unthinking people who carelessly throw away ageless ideals as if they were old and outworn machinery.

They would have religion thrown aside, morality in personal and public life made meaningless, honesty counted as foolishness and self-interest set up in place of self-restraint.

At this critical moment in our history we will certainly lose the trust and respect of the world if we just abandon those fundamental principles which guided the men and women who built the greatness of this country and Commonwealth

Today we need a special kind of courage, not the kind needed in battle but a kind which makes us stand up for everything that we know is right, everything that is true and honest.

We need the kind of courage that can withstand the subtle corruption of the cynics so that we can show the world that we are not afraid of the future...,"

Queen Elizabeth II, Christmas Day Broadcast 1957

This is a big part of why economists and financial markets expect Bank Rate to be raised from 4.25% to 4.5% on Thursday and are also banking on as many as two further increases taking the benchmark as high as 5% later in the year.

What the BoE says or implies about these assumptions is likely to matter for how Sterling trades into the next weekend and although it's far from clear that either scenario would be all that good for the currency, some say that any further increase in Bank Rate could keep the GBP/EUR recovery going.

"The UK’s terms of trade have rebounded since August and, in turn, the magnitude of the likely real income squeeze has diminished meaningfully. At the same time, the housing market is showing tentative signs of stabilizing. This has not only created room for a shift in the BoE’s policy stance, but also eased the pressure on government finances," writes Michael Cahill, a G10 FX strategist at Goldman Sachs, in a Friday research briefing.

"In February, we recommended taking profits on Sterling shorts and then argued that GBP should no longer underperform on crosses—essentially upgrading our view from underweight to neutral. We are now taking an outright constructive stance. Essentially, we think that the same factors that acted as headwinds on Sterling in 2022—mostly natural gas prices and the relative stance of BoE policy—have turned to tailwinds," he adds.

Cahill and colleagues argued on Friday that a waning appetite for raising interest rates, among other central banks, could now enable the Pound to recover more of the losses sustained last year if the BoE raises Bank Rate this Thursday and keeps its options open in relation to subsequent decisions.

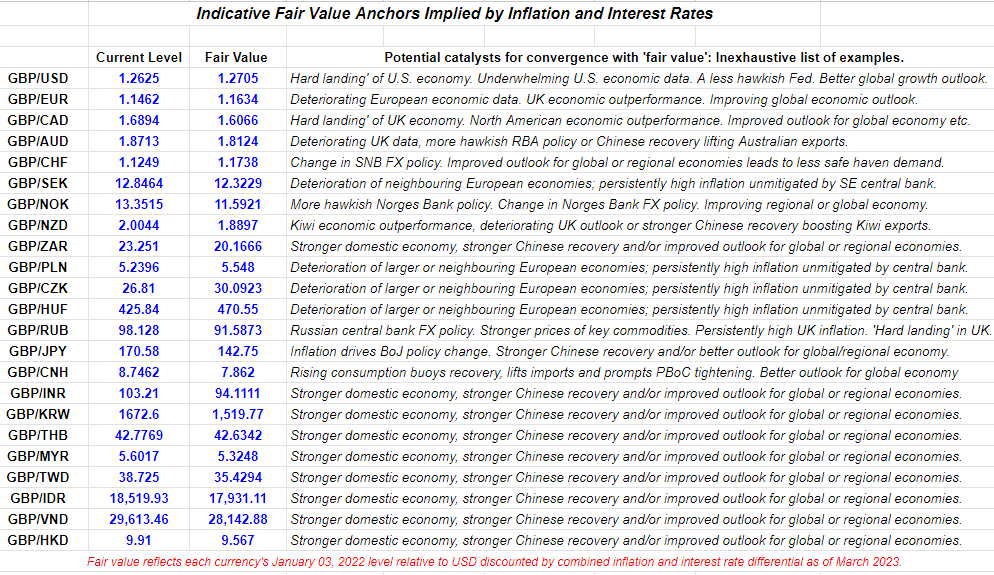

They tipped the Pound to Euro rate as a buy at the same time with a target equal to an upgraded three-month forecast of 1.1627, which is almost exactly where GBP/EUR would trade if discounted from its January 2022 level using the latest combined inflation and interest rate differential.

A large majority of currencies have and do still trade below their implied levels while the Pound has traded above them in relation to most counterparts but with the GBP/USD, GBP/EUR and GBP/CHF pairs being exceptions alongside Central and Eastern European currencies.

Thursday's BoE decision will be key to if this gap is likely to close any further anytime soon, although Friday's release of economic growth numbers for March will also provide input into how the Pound to Euro rate finishes up the week.

Economic output rose 0.4% in January while rebounding from a -0.5% contraction in December but came in unchanged with zero growth in February and the economist consensus suggests that Friday's data will confirm there was also no further growth in March either.

Above: Pound Sterling Live estimates of 'fair value.' Click the image for closer inspection.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |