GBP/EUR Week Ahead Forecast: European Data Could Limit Any Rebound

- GBP/EUR looking for a foothold around 1.13

- Indicative 1.1288 to 1.1377 range short-term

- German inflation & Euro Area GDP in focus

Image © Adobe Images

The Pound to Euro exchange rate steadied above its April low last week but whether it can recover by much this time out likely depends on how German inflation and economic growth numbers from Europe's major economies impact expectations for European Central Bank (ECB) interest rate policy.

Sterling rose against all counterparts in the G10 basket last week but gains over the European single currency were among the most limited after a widely anticipated decline in March retail sales came in larger than was expected on Friday, leading to a last-minute setback for the Pound.

Sales fell by almost one percentage point on the month while the earlier estimate of growth in February was revised down to 1.1% but the bigger picture is that sales volumes grew by 0.6% in the opening quarter, marking their first quarterly increase since the period ending in August 2021.

That and the latest S&P Global PMI surveys were all indicative of ongoing economic resilience and when combined with what has so far been only a slovenly decline in inflation, all of it means continued upside risks for the Bank of England (BoE) Bank Rate in the months ahead.

"The combination of strong labour market and inflation data earlier this week, the rebound in consumer confidence and upside surprise in the April services PMI, and the stronger-than-expected GDP data last week have prompted us to change our BoE call," says Abbas Khan, an economist at Barclays.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of February rebound indicating possible areas of technical support, and selected moving averages denoting possible support and resistance.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of February rebound indicating possible areas of technical support, and selected moving averages denoting possible support and resistance.

"Granted, headline inflation will have fallen by at least 2pp in the upcoming April print on the back of energy-related base effects, but we think there will be insufficient evidence that core inflation is decelerating by the time of the June meeting to prevent further tightening," he adds in a Friday research briefing.

Khan and the Barclays team raised their forecast for the 2023 peak in Bank Rate to 4.75% on Friday, implying two more increases over the coming meetings.

Meanwhile, market-implied expectations shifted to suggest that investors see risks of three more taking the benchmark to 5% by year-end.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

This has all helped to support Sterling in recent trading but with similar economic conditions also stoking risks of further increases in European Central Bank (ECB) interest rates up ahead, the single currency has limited gains in GBP/EUR so far and could do so again this week.

"The takeaways from the UK PMI were similar, although the services prices charged component actually ticked up again, which corroborates the signal from the price and wage data earlier this week," says Michael Cahill, a G10 FX strategist at Goldman Sachs.

"Despite the similar releases (and if anything more concerning price news in the UK), EUR/GBP moved higher on the net through the releases, which probably reflects that there is still debate over 25bp/50bp for the ECB in May while a 50bp BoE hike seems like a tall order," Cahill and colleagues said on Friday.

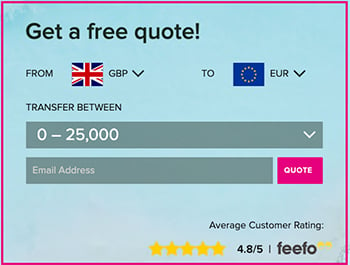

Above: Quantitative model estimates of trading ranges for selected pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

This week, however, Germany's March inflation figures are bookended by first-quarter GDP data from all of Europe's major economies on Friday and each will have scope to impact the market and policymakers' views of the outlook for European Central Bank interest rates with possible implications for GBP/EUR.

"This week Lane, Schnabel, Knot, de Guindos, and Lagarde all stressed the May decision as being data dependent. Lane described himself as in a “wait and see mode”. Knot specifically said the April inflation data would determine the size of the May hike," says Peter Sidorov, CFA and an economist at Deutsche Bank.

"Next Friday will see the euro area flash Q1 GDP release, with the Big 4 euro area economies seeing their prints earlier the same day. Our latest Nowcast (Figure 6) combining regular survey and hard data points to growth of as much +0.4% qoq," Sidorov and colleagues write in a Friday research briefing.

The consensus among economists is that Europe's overall economy likely expanded by 0.2% last quarter following an unchanged or zero growth reading in the final months of last year, implying downside risks for the Pound if Deutsche Bank is on the money with its forecast.

Meanwhile, Germany's annual inflation rate is seen edging lower from 7.4% to 7.3% while its EU harmonised rate is seen dipping from 7.8% to 7.7%.