Pound-Euro Rate Week Ahead Forecast: Risks Being Trapped Below 1.13

- GBP/EUR back at Feb lows with limited scope for recovery

- Supported near 1.1263 but resistance stymies beyond 1.13

- Soft wage & CPI data risks trapping GBP/EUR below 1.13

Image © Adobe Stock

The Pound to Euro exchange rate was pushed back to early February lows last week and while it could yet recover a footing in the days ahead, the risk is that a receding UK inflation tide leads Pound Sterling to remain under pressure around the 1.13 level from midweek on.

Sterling slipped several places lower in the major currency rankings for the year last week when underperforming in what was otherwise a buoyant market for European currencies and even after official figures continued to cast the UK economy in a resilient light for the new year period.

Losses were without obvious catalysts but enough to push Sterling below its 50 and 100-day moving averages against the Euro and to leave it facing an uphill battle to void the appearance of vulnerability now creeping into the technical picture on the charts.

"The MPC’s May decision will depend importantly on this week’s labour market (18th April), CPI (19th April) and flash PMI reports (21st April)," says James Moberly, an economist at Goldman Sachs.

"Our baseline remains a hold in May in light of easing wage pressures and policy tightening already in the pipeline, but we see a low hurdle for another 25bp hike with firmer data this week," Moberly writes in a Monday research briefing.

Above: Pound to Euro rate shown at 4-hour intervals with Fibonacci retracements of February rally indicating possible areas of short-term technical support. Click image for closer inspection.

Any attempted recovery by the Pound to Euro rate would be complicated on Tuesday if the Office for National Statistics confirms a fourth moderation of UK wage growth for the month of February, as this could have implications for next month's Bank of England (BoE) interest rate decision.

The consensus among economists suggests pay packets grew at a slower pace of 6.2% in February, down from 6.5% previously, once bonuses are excluded from the measurement and at a further reduced pace of 5.1% if bonuses are accounted for.

"The BoE has regularly cited the strength in private sector pay growth as a key risk that threatens to keep inflation persistently above target," writes Andrew Goodwin, chief UK economist at Oxford Economics, in a research briefing last week.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

"We expect that falling inflation expectations, a looser jobs market, and waning momentum in earnings growth will weigh on pay growth in 2023. Our modelling suggests that private sector total wage growth will slow to 3.8% by the end of this year, from its current rate of 5.4%," he adds.

Softer pay growth could be taken to mean that members of the BoE Monetary Policy Committee are able to breathe easier about the risk of a self-perpetuating wage-price spiral fueling persistently high inflation in the UK economy over the coming quarters.

Inflation figures out on Wednesday will be equally as important, however, and would also make another increase in interest rates less likely if it turns out that the consensus is right to be looking for an earlier easing of price pressures to have reasserted itself last month.

"A miss here could give the Bank some confidence to pause. A beat would likely cement another hike. What to expect? We see headline CPI slowing to 9.74% y-o-y. Core CPI should slow to 5.85% y-o-y," says Sanjay Raja, an economist at Deutsche Bank.

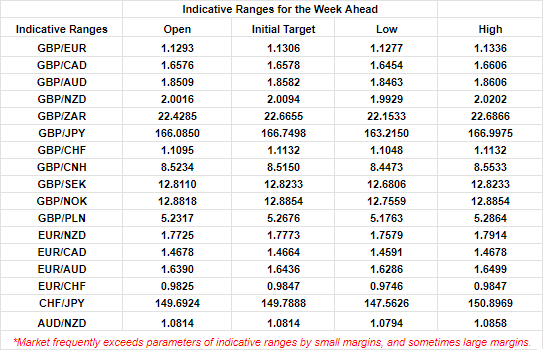

Above: Quantitative model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

The consensus suggests inflation fell to 9.8% in March and that core inflation came in at a reduced 6%, and any outcomes lower than these numbers could lead financial markets to rethink the widely held assumption that Bank Rate is likely to rise again next month.

Any downward revision to expectations for interest rates could lead the market to shy away from Sterling in the latter half of this week and would risk seeing the Pound to Euro rate remaining suppressed below its 50 day moving average around 1.1331 this week.

"Either way, evidence is building that the UK perhaps will not have too much of an inflation concern in the months ahead. This is why we expect a dovish turn from the BoE over the next few months," says Jordan Rochester, a strategist at Nomura.

"We have avoided trading EUR/GBP for quite some time and will continue to do so until the BoE – perhaps at the next meeting – makes it clear it is done hiking vs the ECB, which still has a couple more to go," Rochester and colleagues write in a note to clients last week.