GBP/EUR to be Frustrated Near and Above 1.14 in the Coming Week

- GBP/EUR risking frustration between 1.1387 & 1.1420

- But remains supported near & around 1.13 short-term

- Market's more hawkish BoE outlook aiding GBP/EUR

- But upside risk to ECB expectations grow as limitation

- Central bankers in focus as UK & EU calendars quiten

Image © Adobe Images

The Pound to Euro exchange rate has remained buoyant in upper half of its year-to-date range in recent trade but could find technical resistance levels in the 1.1387 to 1.1420 area continuing to frustrate its recovery in the week ahead.

Sterling was a middle-of-the-road performer among major currencies last week but finished little-changed against the Euro for the period after repeated attempts to resume and extend a two-month recovery fell afoul of the 100-day moving average at 1.1387.

But GBP/EUR has also been quick to find a bid in bouts of losses while remaining well-supported above 1.13 in what some say is the result of interest rate markets betting that the Bank of England (BoE) is likely to raise Bank Rate further in the months ahead.

"We have been stressing how markets are rewarding currencies that can count on domestic tightening prospects despite financial turmoil, and the pound is indeed one of those," writes Francesco Pesole, an FX strategist at ING, in a Friday market commentary.

"While our more dovish view for the BoE compared to the ECB keeps us bullish on EUR/GBP for the remainder of the year (we still target 0.90 [GBP/EUR: 1.1111] in the second half of the year), there aren’t clear short-term drivers to buck the bullish GBP trend at the moment," he adds.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of December downtrend indicating possible areas of technical resistance, and selected moving averages denoting possible support and resistance.

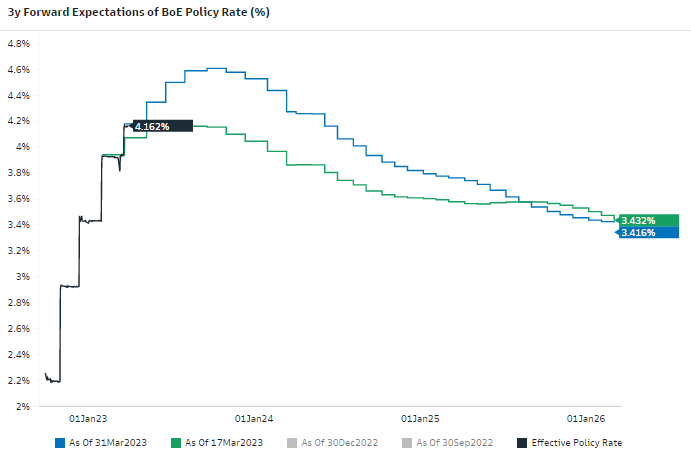

Prices in interest rate derivative markets have shifted to imply an expectation that Bank Rate will rise above 4.5% this year since late March when UK inflation surprised on the stronger side of expectations for February, and BoE policymakers have said little to discourage this.

Governor Andrew Bailey warned from the London School of Economics last week that already-announced increases in Bank Rate are yet to work their way through to the economy, and that their effects won't be fully felt by households until later this year and next.

However, he also said interest rates would still rise further this year if inflation turns out to be more stubborn than was assumed by the Monetary Policy Committee, which has done nothing to discourage the market's recently more hawkish assumptions about the outlook.

"Bailey seems confident that the UK will see inflation drop quite a bit in the coming months but the market remains skeptical on anyone's ability to predict inflation currently," says Brad Bechtel, global head of FX at Jefferies.

The rub for the Pound to Euro rate, however, is that some in and around the market see a risk of the European Central Bank (ECB) eventually outdoing the BoE when it comes to interest rates and Eurozone inflation data out on Friday might only have encouraged those expectations.

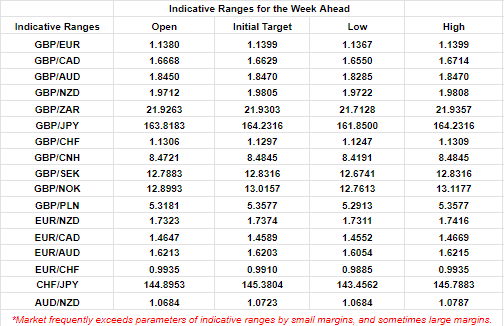

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

Europe's main inflation rate fell from 8.5% to 5.7% in March but the more important core inflation rate ticked higher from 5.6% to 5.7% and this has been flagged by numerous ECB policymakers as something that would likely ensure further increases in interest rates up ahead.

"Although the bar is now too high for the MPC to take a more hawkish position than the market, high and sticky domestic inflation along with strong wage growth make the BOE a relatively less dovish central bank versus G10 peers in the wake of the banking sector turmoil," says Sheryl Dong, an FX strategist at Barclays.

Above: Changes in market implied expectations for BoE Bank Rate between selected dates. Source: Goldman Sachs Marquee. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Changes in market implied expectations for BoE Bank Rate between selected dates. Source: Goldman Sachs Marquee. To optimise the timing of international payments you could consider setting a free FX rate alert here."This leaves sterling range-bound around current levels versus the euro, whose macro exposures and monetary policy outlook are somewhat similar," Dong writes in Monday market commentary.

Central bankers will be the main focus again in the UK and Europe this week where economic calendars are otherwise more sparsely populated and the BoE's chief economist Huw Pill is the highlight for Sterling on Tuesday.

He speaks about "Inflation, Persistence, and Monetary Policy" at the International Center for Monetary and Banking Studies ahead of a Wednesday appearance by Sylvana Tenreyro who address the Royal Economic Society Annual Conference.