Pound Boosted by Another Services Inflation Surprise

Image © Pound Sterling Live

Pound Sterling defended its recent gains after UK inflation hit the target in June and left markets none the wiser as to whether the Bank of England would proceed with an interest rate cut in August.

Market-implied expectations for a Bank of England rate cut on August 01 were at 50/50 heading into today's all-important inflation release, and we are none the wiser following these inflation data. This is because the three main components of headline CPI, core CPI and services CPI, all met expectations.

The ONS said headline UK CPI inflation remained at 2.0% for a second month in June, meeting expectations. Core inflation, which excludes energy and food, stayed at 3.5%, also meeting expectations.

Typically, we would expect strong moves in Sterling on inflation day. But, because the odds of an August rate cut are effectively unchanged, the Pound to Euro exchange rate is steady at 1.19. The Pound to Dollar rate was also unchanged at 1.2975.

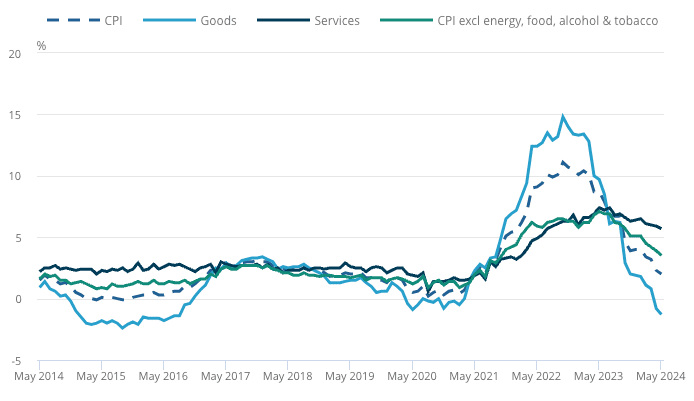

The annual rate of services inflation remained at 5.7%, as expected. This was the key release of the day. Services inflation is falling slower than other sectors in the inflation data set, and unless it comes down, headline inflation will start rising again into year-end.

"5.7% is simply too high," says Kyle Chapman, FX Markets Analyst at Ballinger Group. "I don't think this was enough to tip the balance towards a rate cut in August."

Restaurants and hotels, which are included in the services basket, made the largest upward contribution to the monthly change in inflation. The largest downward contribution came from clothing and footwear, which are part of the goods basket.

This reinforces a familiar theme: energy and goods have been the main contributors to inflation falling back to target, but consumer-facing services industries continue to see price rises.

This is because wages are the main cost burden on such businesses, and wage pressures remain elevated, running well above inflation.

With this in mind, attention now turns to Thursday's job and wage releases, where the Bank of England hopes for any clearer signs of change in the wage-inflation trend.

These inflation data support the Pound in that they give traders no incentive to sell and book profits on the recent strong run.

Pound Sterling is 2024's best-performing G10 currency, and there were risks that the rally would lose some steam if inflation figures undershot expectations. Because inflation met expectations, an extension of the trend remains possible.

The National Institute of Economic and Social Research (NIESR) says inflation will start to tick higher from here.

"Core inflation remains elevated at 3.5 per cent, as does services inflation at 5.7 per cent, possibly prompting the Bank of England to remain cautious with regards to interest rate cuts. We expect inflation to rise throughout the rest of the year due to base effects, before falling back towards target in early 2025," says Monica George Michail, NIESR Associate Economist.

Even if the Bank of England cuts interest rates in August, the prospect of rising inflation should keep them cautious.

Under such a scenario, we would expect the Pound to fall but then recoup losses. The long and short of it is that interest rates in the UK are relatively elevated compared with elsewhere, which makes Sterling-based assets attractive to foreign investors.

This can maintain demand for the Pound.