Pound Sold After UK Inflation Plummets

Image © Adobe Stock

The British Pound was softer across the board after UK inflation figures for October came in below analyst expectations and verified market expectations that the Bank of England would be in a position to cut interest rates by the middle part of 2024.

Headline CPI inflation plummeted from 6.7% year-on-year in September to 4.6% in October, said the ONS, undershooting the consensus expectation for a reading of 4.8%. Inflation flatlined at 0% month-on-month in October, which was markedly down on September's 0.5% and just below expectation for 0.1%.

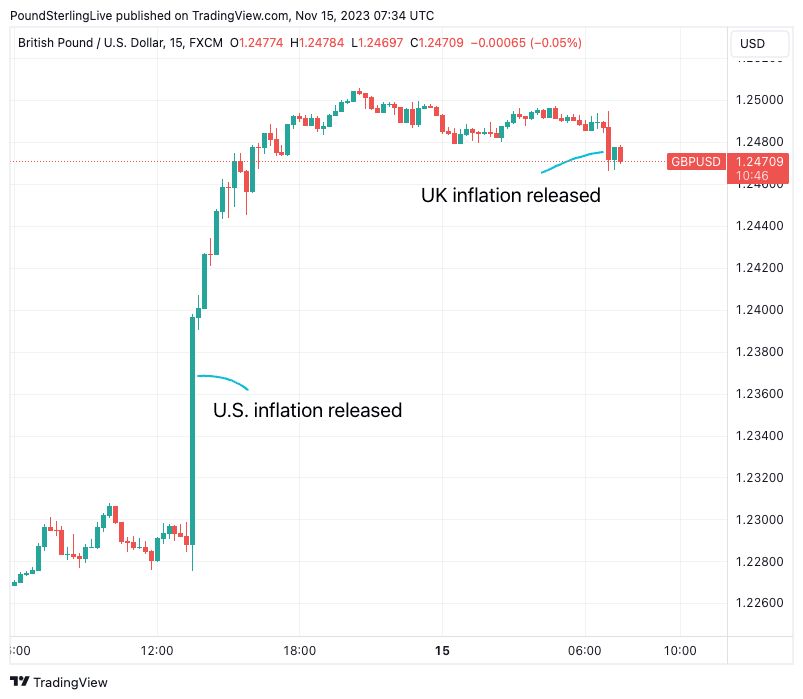

UK bond yields fell and, in turn, weighed on Pound Sterling, although the downside is relatively limited at the time of publication: the Pound to Euro exchange rate was seen lower at 1.1472 in the minutes after the release, the Pound to Dollar exchange rate was down 0.20% on the day at 1.2472.

"The pound weakened this morning following the release of softer than expected UK inflation data, with markets now anticipating Bank of England interest rates to remain on hold in the next few policy meetings with the first UK rate cut priced for around mid-2024," says Hann-Ju Ho, an economist at Lloyds Bank.

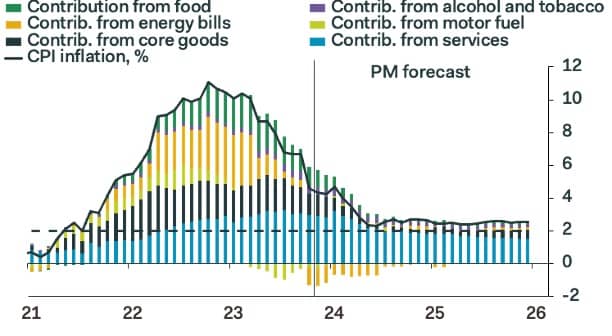

A fall in household energy bills in October and the mechanical drop out of the previous October's massive energy spike from the annual figure drove the sizeable fall in headline inflation, meaning the large decline was well anticipated by investors.

However, from a monetary policy point of view, the fall in core CPI inflation to 5.7% y/y in October (consensus: 5.8%) from 6.1% will be welcomed by the Bank of England. Core CPI rose just 0.3% in the month, which was below expectations for 0.4% and September's 0.5%.

Services CPI inflation - a key consideration for the Bank - fell to 6.6%, from 6.9%, below the consensus expectation for 6.7% and the Bank's own forecast for 6.9%.

Above: CPI inflation breakdown, image courtesy of Pantheon Macroeconomics.

But the Bank of England will feel the job is still not done as these numbers are not yet consistent with inflation falling back to the 2.0% target. Pockets of demand-side concerns also remain, with the ONS saying recreation and culture provided the only large positive contribution to this month's figures, rising from 6.0% y/y to 6.4%.

"We’ve likely reached the peak of rising interest rates, and many are expecting the Bank of England to cut rates at some point next year. But with inflation set to fall slowly and the Bank of England being clear in their 'higher for longer' message, businesses and consumers shouldn’t expect a significant reduction in rates anytime soon," says Alpesh Paleja, Lead Economist at the CBI.

The developments have been welcomed by the Government, which at the start of January committed to halving inflation by year-end. It also relieves pressures on household and business budgets, which materially improves the UK's economic outlook.

For the Pound, this can only be supportive and helps explain why the decline in the UK currency is relatively limited. The below chart shows the sizeable reaction that followed a softer-than-expected U.S. inflation reading the day prior and how limited the market reaction to the UK undershoot has been:

Above: GBPUSD at 15-minute intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Analysis from HSBC finds underlying momentum in core inflation remains "a tad above average".

"With annual wage growth still running at close to 8%, the path towards 2% inflation is likely to be a long and difficult one," says Chris Hare, Senior Economist at HSBC.

HSBC says labour market dynamics (resulting in high wages) means the Bank of England won't be in a position to cut interest rates until 2025, a view that suggests a massive mispricing by markets which see the first cut coming in mid-2024.

The Pound has fallen over recent weeks as markets moved to 'price out' the prospect of rate hikes beyond 5.25% and raise odds for rate cuts.

Clearly, how these expectations evolve from here will depend on upcoming inflation prints.

Should inflation come in above expectation over the coming months, the market could push back rate-cut pricing, offering mechanical support to the Pound.

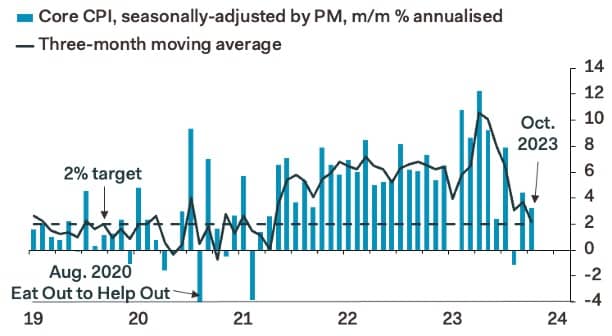

Above image is courtesy of Pantheon Macroeconomics.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says the Bank will be in a position to cut interest rates as soon as May as he believes inflation is set towards the 2.0% target.

"October’s consumer prices report should entrench expectations that the MPC will be able to start to reduce Bank Rate in about six months’ time," he says.

Pantheon Macroeconomics notes that the run-rate of core price rises has also slowed and estimates that the 0.3%m/m increase in the core CPI is equivalent to a seasonally-adjusted annualised increase of 3.2%, well below the current year-over-year rate at 5.7%.

"With food, core goods and energy prices set to rise only slowly next year, the headline rate should still be below 3% for most of next year," says Tombs.