Pound Sterling Rises Against Dollar, Euro Et Al as Borrowing Beats Forecasts

"Our calculations suggest that the OBR likely would revise up its forecast for debt interest payments by around £40B in 2024/25 and by around £20B in five years’ time if it were to produce the equivalent forecasts using today’s market expectations for Bank Rate" - Pantheon Macroeconomics.

Image © Adobe Images

Pound Sterling climbed against the Dollar, Euro and a selection of other currencies on Tuesday after Office for National Statistics (ONS) figures painted a less bleak picture of the public finances for the recent month and in turn led economists to contemplate how the government might respond to any calls for tax cuts in the Autumn budget.

Public borrowing for July and the months leading up to it came in below the forecasts of economists and the Office for Budget Responsibility (OBR) on Tuesday while appearing to hand the Chancellor the luxury of choosing whether to support the economy with added spending in November's budget or to instead put away for a future rainy day.

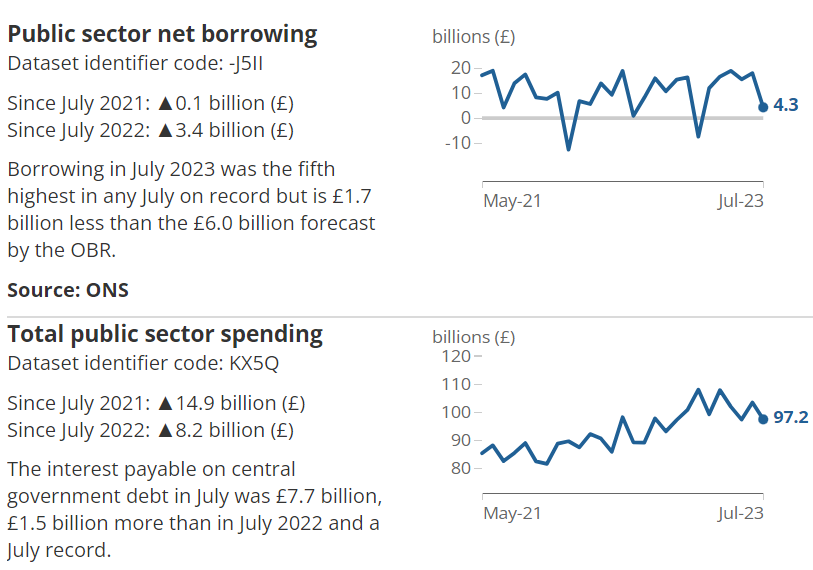

Government borrowing was £4.3 billion in July, some £3.4 billion more than in the same month one ear prior and the fifth-highest since records began in 1993 while borrowing for the first four months of the new financial year was £56.6 billion, some £13.7 billion more than last year but around £11.3 billion below £68.0 billion projected by the OBR.

"Both receipts and expenditure are continuing to come in above expectations, reflecting the impact of higher inflation and higher interest rates," writes Rhys Herbert, an economist at Lloyds Commercial Banking, in response to Tuesday's figures.

"With borrowing still undershooting official forecasts, there seems bound to be continued speculation of tax cuts in next year’s Budget. However, that will also be dependent on the broader economic picture," he adds.

Source: Office for National Statistics.

July's decline in borrowing was aided by lower public spending and higher tax receipts with a £2.5 billion uplift in self-assessment income having played a role but the data comes against the backdrop of an economy mired in high inflation and rising interest rates, both of which are fomenting a widely expected slowdown in the months ahead.

These are all among the reasons why some economists say tax cuts are unlikely in the November budget and that the Chancellor will probably continue prioritising reducing public spending and minimising any further accumulation of government debt.

"Our calculations suggest that the OBR likely would revise up its forecast for debt interest payments by around £40B in 2024/25 and by around £20B in five years’ time if it were to produce the equivalent forecasts using today’s market expectations for Bank Rate," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"The Chancellor could increase borrowing in the near-term and pencil in unspecified spending cuts further down the line to ensure his fiscal rules still were being met. But the turmoil last October suggests markets likely will be less willing to tolerate plans that aren’t credible, particularly given the current economic backdrop of high CPI inflation," he adds.

Market-implied expectations for the Bank of England Bank Rate at the end of this year have risen significantly in the last two months alone and even more so since the March budget with the benchmark for borrowing costs now seen at 6% by new year, up from around 4.75% at the time of the last fiscal statement.

Expectations and forecasts for Bank Rate have been rising since April when ONS measures of inflation and average wage growth in the labour market began to climb afresh, though the drumbeat for higher interest rates has become louder and louder in the more recent months including in the wake of last week's economic data.

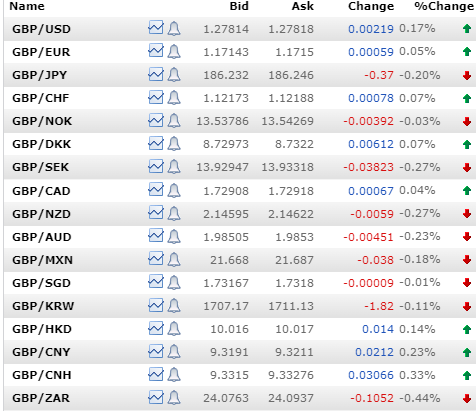

Above: Interbank reference rates for selected Sterling pairs on Tuesday. Source: Netdania Markets.

UK inflation fall back sharply for the month of July last week but by a tick less than had been penciled into the economist consensus while the more important core inflation rate was unchanged at 6.8% but largely due to fluctuations in housing costs as well as prices of hotels and air transport

Meanwhile, the average wage packet was reported to have grown at an accelerated pace of 8.2% in July but mainly due to a one-off pay increase for National Health Service staff and an earlier increase in the national minimum wage, the effects of which are expected to drop out of the numbers over the coming months.

All of this came hard on the heels of much stronger than expected economic growth numbers for the second quarter out in the prior week but owing themselves largely to one-off statistical influences or accounting quirks relating to changes in the scheduling of public holidays this year and last.

"Higher inflation will boost spending on the state pension and benefits, while higher interest rates will increase the cost of servicing debt. This will limit the room for permanent tax cuts, without matching cuts in other spending," says Julian Jessop, economics fellow at the free market think tank, the Institute of Economic Affairs.

"But there will be some other offsets. The higher levels of wages, profits and prices will also boost tax revenues. And the most important component of ‘debt interest payable’ is the RPI uplift on the principal value of index-linked government bonds, which has now peaked," he adds in response to the data.