Barclays Exchange Rate Forecast Update: GBP, EUR, NZD, AUD and CAD to Remain Under Pressure

- Written by: James Skinner

© Pound Sterling Live

The U.S. Dollar is set to continue its undisputed reign of dominance over currency markets during the quarters ahead according to the latest forecasts from Barclays, while the Pound, Euro and other currencies are likely to remain on the back foot as economic underperformance ties the hands of their respective central banks.

Faltering economic growth outside of the U.S. and its implications for monetary policies the world over is at the heart of Barclays' updated outlook for currency markets, as President Donald Trump's America is set to continue outpacing rivals during the years ahead.

Much of this U.S. economic performance is the result of January's sweeping cuts to corporate and personal tax rates which, handing an estimated $1,200 of annual income back to the average household, were implemented just as the current economic upturn began to tire in other parts of the world.

While the boost from those tax cuts will eventually fade, slower than anticipated "spillover" of this stimulus to the rest of the world means other economies are likely to trail their North American rival for a while yet. With this economic underperformance is likely to come disappointment as far as inflation pressures are concerned.

The European Central Bank's fight against below-target inflation is well known and, according to Barclays, likely to persist for a while yet. Traders are also in for a disappointment as far as U.K. economic growth, inflation and Bank of England policy are concerned too.

This downbeat outlook for interest rates outside the U.S. leaves the Federal Reserve as the only game in town for traders of developed market currencies. Below is a selection of Barclays' views on what this environment is likely to mean for individual exchange rates.

The Pound-to-Dollar rate was quoted 0.31% higher at 1.3157 Tuesday while the Euro-to-Dollar rate was up 0.20% at 1.1775. The Pound-to-Euro rate was 0.11% higher at 1.1172.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

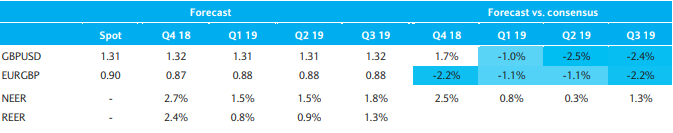

Pound Sterling

"Brexit risk has returned as a driver of GBP volatility. While we remain confident in a withdrawal agreement being reached – even if it requires a short extension of the Article 50 (A50) two-year negotiation window – both sides have raised the stakes to attract concessions and in doing so have heightened “no deal” fears."

"Dueling headlines are likely to keep GBP volatile. However, we expect its trend to be governed mainly by the outlook for the UK economy and Bank of England policy. Despite some surprises in recent surveys and an unexpected pop in August inflation, our reading of the economy is that it continues to slow and is unlikely to support further rate hikes."

"As a result, we now expect a small bump in GBP following an agreement on exit, but for it to be unwound once disappointment over the path of the BoE materializes."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

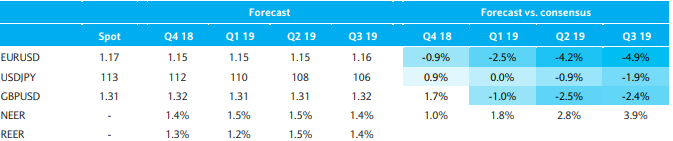

U.S. Dollar

"Relative to our June forecasts, we have revised higher, across the board, our USD forecasts. We have pushed USD depreciation to the end of our forecast horizon, as the convergence of the rest of the world appears further away."

"Our prior forecasts assumed a greater degree of convergence between the US, economically and in carry, in 2019, leading us to expect the USD to resume the downtrend that started in 2017. But, while our US growth and interest rate forecasts remain unchanged, and strong underlying momentum lends them upside risks, we have had to moderate our forecasts for most of the rest of the world. There appears to be less autonomous growth in other economies and less spill-over from the US fiscal expansion than we expected."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

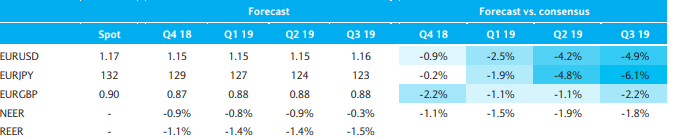

Euro

"We project modest EURUSD depreciation towards 1.15 by year-end and broad stability in the pair thereafter, as markets balance the USD’s increasing carry returns with its overvaluation. Risks largely skew to the downside for the EUR."

"If Europe’s recent growth deceleration reflects a lower potential growth rate, convergence will be even slower than our downward revisions imply. ECB policy, too, is unlikely to act as a material impetus for significant EUR gains, in our view."

"Core inflation remains low and will likely be lowered further in the ECB’s projections, implying only very gradual normalization in monetary policy in 2019. At the same time, we continue to project one more Fed rate hike this year and four rate hikes in 2019, more than markets currently price."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

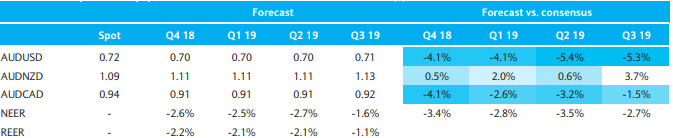

Australian Dollar

"A high-yielding USD is providing increasing competition for global portfolio flows and is likely to keep downward pressure on the AUD, given Australia’s dependence on global savings (via both its structural current account deficit and large net debt to the rest of the world)."

"Escalating US-China trade tensions are also likely to contribute to AUD underperformance versus both G10 and EM currencies, given the country’s large exports to China (around 25% of total goods exports) and the negative effects of slowing Chinese activity on global commodity prices."

"Domestically, GDP growth is relatively strong (and above potential), but consumption remains cautious and inflation low. House price pressures continue to moderate in response to macroprudential measures aimed at curbing investor demand and increased supply, particularly high-density housing in Melbourne and Sydney."

"Given the continued lack of inflation pressure, we do not expect the RBA to hike until H1 20, which implies the US-Australia policy rate differential (currently +50bp) is likely to widen by 100bp over the coming year, given our forecast that the Fed will proceed with another four hikes during that time."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

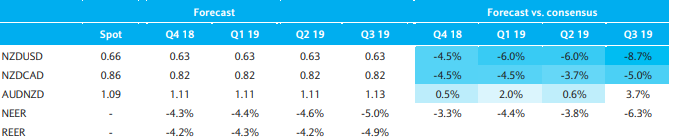

New Zealand Dollar

"We expect the NZD to be a notable underperformer over the coming quarters, as low inflation and sub-potential GDP growth support the prospect of RBNZ rate cuts over the coming year. The RBNZ continues to recognise this through its reference to the next move being up or down, and an alternative scenario added to the August MPS showing 100bp of rate cuts if GDP growth remained below trend."

"Q2 GDP surprised both market and RBNZ expectations to the upside, but importantly remained below the 3% y/y potential GDP growth rate of the economy."

"House prices continue to moderate with the help of recent changes to capital gains rules and the imposition of foreign-buyer restrictions. Wage inflation remains low, but given low levels of unemployment, higher rates of wage inflation represent an upside inflation risk, particularly if immigration falls significantly or planned minimum wage rises cascade into demands for wage increases from higher earners."

"Like Australia, escalating US-China trade tensions should contribute to NZD underperformance versus both G10 and EM currencies given the country’s large exports to China (and Australia) and the negative effects of slowing Chinese activity on global commodity prices."

"US-NZ interest rate differentials are likely to widen materially over the coming year as the RBNZ remains on hold while the Fed tightens 100bp over that time. We also expect the AUD to outperform the NZD on the expectation that the RBA will hike earlier than the RBNZ."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Canadian Dollar

"We forecast CAD stability in the face of USD strength as resilient economic activity, a BoC that continues to gradually normalize monetary policy, and stable oil prices supporting the currency."

"The CAD is now below its long-term fair value, and we expect continued (albeit gradual) rate hikes to support the CAD relative to other G10 commodity currencies. Additionally, we see the loonie as having less direct exposure to China and other likely targets of US trade protectionism. NAFTA risks appear to have diminished as the US and Canada ramp up negotiations, although a complete resolution and a finalized new treaty are likely to be seen only in 2019.!

"There is limited space for CAD appreciation, however, as the market is already pricing in close to three hikes over a one-year horizon and oil prices are unlikely to significantly break higher from current levels."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here