National Australia Bank Exchange Rate Forecast Update: "Market’s Volatile Trade Angst Still Cuts Both Ways"

- Written by: James Skinner

Image © Desiree Caplas, Adobe Stock

- U.S. trade war with China cuts both ways for markets say NAB.

- Federal Reserve to continue raising interest rates, supporting USD.

- Pound Sterling to remain under pressure as Brexit day draws near.

Currency markets have been volatile in 2018 but the closing stages of the third-quarter are most likely to herald a continuation of recent trends, with President Donald Trump the only wild card, according to the latest forecasts from National Australia Bank, a division of Bank of New Zealand.

Policies emerging from the U.S., whether monetary or trade related, have been the driving forces behind currency market moves in 2018 and are set to remain so over coming months.

A superior economic performance has enabled the Federal Reserve to go on raising its interest rate at a time when many other central banks are sat on their hands due to economic underperformance or subpar inflation.

The Fed is expected to raise its interest rate again at the end of September, while the Bank of England, European Central Bank, Reserve Bank of Australia and Reserve Bank of New Zealand are all expected to stand pat well into 2019.

This is important because changes in interest rates have an effect on relative interest rates, which impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

Beyond the realm of monetary policy, currency markets have also been tossed and turned by the ebb and flow of developments in President Donald Trump's so-called trade war with China.

This has increasingly driven investors into the arms of the safe-haven U.S. Dollar, to the detriment of emerging markets and other risk-sensitive currencies.

The White House trade offensive is expected to continue for a while yet, so it will remain an influence on markets and continue to support the Dollar in the weeks and months ahead.

But the National Australia Bank team have also highlighted some key threats to recent trends that are lurking in the long grass of the fourth quarter and 2019 year. These could upend the established order.

The Pound-to-Dollar rate was quoted 0.04% higher at 1.3150 Tuesday while the Euro-to-Dollar rate was up 0.28% at 1.1701. The Pound-to-Euro rate was 0.26% lower at 1.1237.

Exchange rate forecasts are included at the bottom of the page.

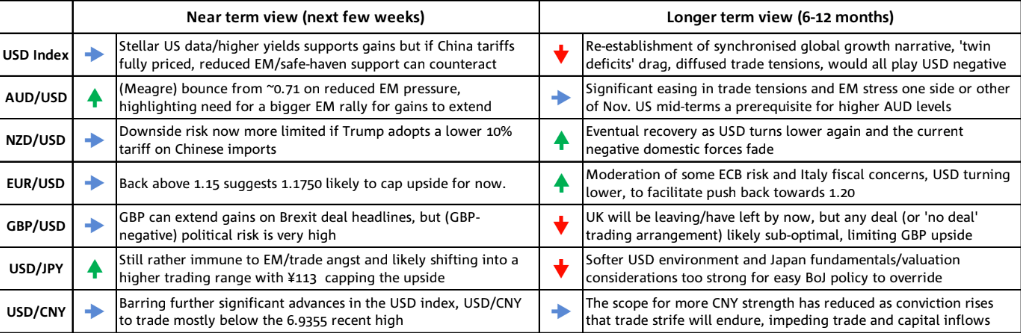

Above: National Australia Bank key currency views.

Pound Sterling

"The news headlines make it clear the UK is moving closer to securing a Brexit deal with the EU. A deal here refers to the ‘Withdrawal Agreement’ that focuses on the UK’s divorce payment of £39bn, citizen’s rights after the UK leaves, the transition period (end Mar 2019-end Dec 2020) and the Irish border."

"While the EU really wants most of the details on this future relationship carved out after the UK has left on 29 Mar 2019, that’s not especially helpful for UK citizens (unless you are a keen leaver) and may prove problematic for Parliament that is to have a ‘meaningful’ vote on whatever deal declaration has been struck. Clearly then, this declaration will have to be sufficiently detailed."

"The most business-friendly (soft) Brexit would be one where the EU accepts May’s Chequers proposal where goods stay close to and mirror EU rules and regulations, whiles services are split off and allowed to form bilateral trade agreements with other countries. Here the EU would be allowing access to its coveted Single Market in goods without the UK being in a Customs Union."

"We think this is extremely unlikely. Our interpretation of the most recent EU commentary on this is that the EU will not be willing to grant the UK this access. Moreover, even if we are wrong and the EU does fold here and the UK Parliament backed such a deal (itself not guaranteed but likely the best the UK could get) GBP’s rally could be cut short fairly quickly."

"This deal would pretty much guarantee the Tory Brexiteers would mount a leadership challenge to May as they want a clean, hard exit and an FTA deal. They have the required 48 signatures to challenge May’s leadership but not the 157 votes required to defeat her."

US Dollar

"Fed officials have of late all been singing from the same song-sheet, namely that it needs to push on with its ‘gradual’ tightening at least until policy gets to what is considered neutral (and with a growing Fed chorus suggesting policy will need to become restrictive)."

"Market pricing often sits a bit below the median Fed ‘dots’ and market economists’ expectations, to account for the risk of negative shocks. But even allowing for this, the market appears to significantly underprice risks of what the Fed will most likely deliver in the next 18 months. Repricing, if and when it comes, can provide some support to the USD."

"After the mid-terms, Trump could become less bombastic - or more so. Assuming the Democrats take control of the House, trade and foreign policy will be two areas where Trump can still have serious impact. Bear in mind too the Sino-US trade stoush is, in the FT’s words “at its heart an attack on Chinese “state capitalism”, there is a non-trivial risk of permanent tariffs and no trade resolution."

"Our forecasts assume as a base case that it isn’t going to come to this and that together with an approach of a peak in the Fed tightening cycle in 2019 – which typically presages a change in the USD trend - this will ultimately bring the USD significantly lower."

Euro

"The EUR has been in an effective 1.15-1.1875 range since mid-May with only brief excursions out of the range. Two factors have contributed to the stickiness of the range: (1) the USD has maintained its strength, though now appears to have topped out against the majors at around 95 in the DXY; and (2) the ECB’s caution since April, along with their dovish forward guidance in June."

"Although downside risks have been more prominent over recent months, in many areas these are now starting to recede. Italy has ‘committed’ to EZ fiscal targets – namely sticking to a 3% of GDP deficit. While squabbles within the governing Italian coalition continue, yield spreads have started to narrow given reduced fiscal uncertainty."

"Even with a more balanced set of risks, it is unlikely the EUR will have much support for a move higher outside of its range. European export orders have been weak, largely due to EM weakness and for now the USD remains supported from the Fed’s hiking cycle and ongoing trade tensions. While an intensification of the US-China trade war is likely to be EUR neutral, any impact on export orders will be closely scrutinised."

Australian Dollar

"AUD volatility has continued to be driven for the most part by price action in Emerging Markets (EM). The recovery from sub-071 to (briefly) above 0.72 in the past week has therefore come in conjunction with the small-scale recovery in EM markets, initially on the back of news of the US invitation for fresh Sino-US trade talks and subsequently the likes of Turkey’s out-sized policy rate rise"

"Domestic news hasn't been a strong influence of late, though the better than expected Q2 GDP outcome (0.9% q/q) and August employment numbers (+44k) certainly haven't done any harm. Intra-day at least, these data points saw gains of about 40 and 20 points respectively."

"Support from external sources and related USD slippage couldn’t have been timelier, coming not long after AUD/USD had broken clean below the 0.7140-60 lows from May and December 2016 and which appeared to open up serious risk of an early test of the August 2015 and January 2016 lows below 0.69. In the absence of an immediate fresh lurch lower in EM risk markets, we see scope for a larger short covering correction higher in AUD/USD, although AUD is likely to remain a ‘sell on rallies’ currency."

"While our end-2018 pick of 0.7500 looks ambitious, we are not rushing to revise it lower. Four months is after all a very long time in FX markets! The same goes for our longer term forecasts. Our 0.75 ‘flat-line’ profile for 2019 disguises expectations for a fair amount of volatility. In truth, we’re more comfortable in thinking of the currency as now more firmly ensconced inside a 0.70-0.75 range."

New Zealand Dollar

"The NZD trend still looks fairly ominous, with fresh lows made in May, July, August and September, and down to 0.6501 just last week. The market remains on tenterhooks awaiting Trump’s next move on Chinese import tariffs."

"Our short-term fair value model estimate sits just below 0.70, suggesting that the current “discount” for the NZD is around 6%. A discount of 5-6% has been in play for the past couple of months, reflecting negative sentiment for the NZD as the US-China trade war has been simmering and emerging market currencies have come under pressure."

"Q2 GDP data are released on Thursday. The market thinks that there is more chance of the figure coming in stronger than the RBNZ’s estimate of 0.5% q/q and we concur. Those expecting a high chance of a rate cut over the next six months will need to see a significant miss to the downside, followed by further weak data ahead, but we suspect Q3 growth will be even stronger."

Above: National Australia Bank foreign exchange forecasts.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here