Maybank Exchange Rate Forecast Update: GBP, AUD and NZD Downgraded

- Written by: James Skinner

-GBP, AUD and NZD forecasts downgraded at Maybank.

-USD forecasts upgraded but greenback still set to decline.

-Dissipation of USD strength to offer respite to other currencies.

© Chris Titze Imaging, Adobe Stock

Exchange rate forecasts for Pound Sterling as well as the Australian and New Zealand Dollars have been downgraded at Malayan lender Maybank, while projections for the US Dollar have been upgraded ahead of an regime change in the currency markets for 2019.

Maybank's latest forecasts come toward the tail end of the third-quarter that has seen the US Dollar continue to reign supreme over currency markets, pushing each of its rivals progressively lower for almost six consectutive months.

Superior US economic growth supporting continued Federal Reserve rate hikes, and underperformance from economies elsewhere in the world, has been a significant driver of recent price action. So too has President Donald Trump's "trade war" with China, both of which have made the Dollar a more attractive proposition for investors than many of its rivals.

Currency crises in Turkey and Argentina, as well as pressure on other emerging market currencies, have contributed to a growing tendency toward risk aversion in financial markets during recent months. This has further supported the US Dollar to the detriment of other developed world currencies.

However, for the quarters ahead, the Maybank team forecast a gradual decline for the greenback, which should relieve some of the pressure on other currencies. Albeit that this downtrend will begin from upwardly-revised levels.

Below is a selection of commentaries from the bank's latest monthly foreign exchange forecast update, with projections for all G10 currencies relative to the US Dollar.

The Pound-to-Dollar rate was quoted 0.14% higher at 1.2932 Thursday but has fallen 4.17% this year, while the Euro-to-Dollar rate was down 0.11% at 1.1612 and has declined 3.1% in 2018. The Pound-to-Euro rate was 0.25% higher at 1.1127 and is down 1.1% for the year-to-date.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

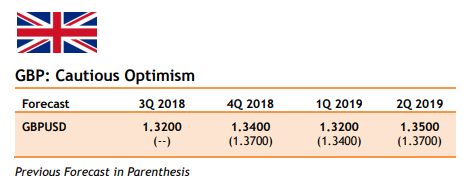

Pound Sterling

"We maintain our cautious optimism on the outlook of GBP on the basis that UK will manage an orderly brexit (i.e. to strike a deal with EU while PM May remains in power, cabinet divide narrows). While brexit and PM May’s leadership are undoubtedly the key sources of volatility (uncertainty) for GBP, we believe pessimism on no-deal may have been front-loaded onto GBP."

"We argue that any positive progress towards an agreement on Brexit could build on recent momentum and result in further GBP shorts rushing for the exit. This could force an abrupt move higher in GBP and the market bias may even be shifted to rebuild GBP long, from sell GBP-on-rallies. The recovery may even be amplified in the environment of renewed USD weakness."

"However we acknowledge the risks of no-deal brexit as details on EU’s offer for customized union remain scanty at this stage. Play-up of brexit fear (no deal or PM May’s leadership being challenged) especially when deadline is approaching is a potent source of volatility for GBP. As such we calibrate our forecast lower to partially take into consideration those risk factors but maintain the forecast trajectory."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

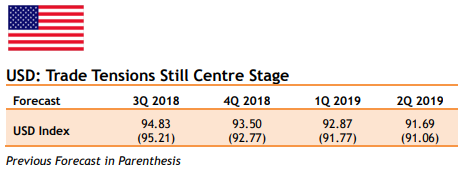

US Dollar

"The USD index fell slightly in our month ahead forecast horizon due to downward revisions as we recalibrate JPY to reflect some of the safe haven plays from the recent Turkish crisis concerns. The end year USD index rose because of revisions lower to euro (due to risk of German state elections in Oct and Turkish risk) and lower GBP (due to risk of no deal has escalated)."

"USD likely to remain mixed for the remainder of 2018. Against the majors we expect to see a milder downtrend likely to remain in place for second half of 2018 but we do not rule out bouts of USD strength like what we had witnessed in the past few months. Against the emerging market and regional currencies we expect the dollar to remain strong as concerns that the ongoing trade tensions are starting to affect growth in China."

"However, if activity slows or labor market conditions weaken, we believe the Fed would be more likely to delay its normalization plans even if higher import prices boost short-term inflation outcomes. A more serious escalation that threatens the US recovery could lead to a pause in balance sheet normalization, though it is far too early to draw any such conclusion."

"For now, the committee sees fiscal stimulus as providing solid momentum in domestic activity, as well as a significant buffer against external shocks; we retain our view that the Fed will hike its policy rate one to two more times this year and three times next year. Although, for this year we now have built in a higher probability of just one more hike by the Fed."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Euro

"We are slightly cautious in the near term (4 – 6 weeks) on Italy budget concerns and potential political risks in the lead up to German Bavarian State election (14 Oct) amid negative carry environment and still-cautious market sentiment as trade war (EU to retaliate if US impose auto tariffs) and geopolitical concerns (in Turkey) remain."

"Dips towards 1.14 – 1.15 should not be ruled out especially in the event Italy and EU clash over 2019 budget plans but that does not alter our view or signal a change in our bias to accumulate on dips. We calibrate our forecast levels modestly lower to reflect above-mentioned risks but maintain the bullish bias trajectory across the forecast horizon."

"We continue to retain a constructive bias in the medium term on a combination of factors that should take time to develop: (1) monetary policy convergence at some stage possibly towards the turn of the year (ECB-Fed policy divergence likely to slow as Fed normalisation likely to have been priced in while ECB normalisation remains underpriced by markets); (2) inflation already overshooting ECB’s sub2% target; sustained price pressures above target may result in ECB needing to normalize policies ahead of schedule; (3) improved economic backdrop on sustained signs of activity momentum in Europe, looking past transitory factors in 1Q though trade war tensions still warrant caution; (4) political concerns in Germany play out after Bavaria State election (14 Oct)."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Australian Dollar

"We had indicated in our recent note that domestic politics could present opportunities to buy the AUD as trade war risks remain mostly frontloaded and there is still much more fear than optimism in the price. The trade war presents a more fundamental threat to the Australian economy rather than politics and thus a stronger and more lasting driver of AUD. Should trade tension ease in the next few weeks, AUDUSD could head higher and break out of the downward sloping trend channel that started early this year."

"China has matched the past two tranches of tariffs, dollar for dollar. The US has to decide on the tariff by the end of Aug and the tariff could be imposed as early as Sep. The value of Chinese imports targeted this time is four times as much as what has been slapped on so far (U$50bn) and could have more significant impact on inflation and growth. That translates to further downside risks to the AUD. However, should there be any signs of delay or postponement on the decision; we anticipate a short squeeze to the AUD."

"We are less sanguine on the prospect of a rate hike now given the impact of the drought in the Eastern part of Australia. To put things into perspective, the value of the agricultural output is around the same as the value of iron ore and a quarter of it comes from the New South Wales that is now entirely in drought as confirmed by the officials. Rural goods make up around 15% of total exports of goods for Australia. The deterioration in current account is unlikely to show up in 2Q though as net exports of goods for Apr-Jun have been positive and they are likely to be a contributor to the headline GDP as well. Expect the fall in metal prices, impact of trade war and this drought to show up in 3Q numbers."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

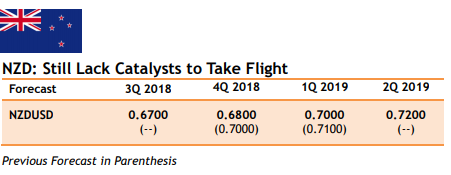

New Zealand Dollar

"We still hold to our view that NZD lacks fundamental catalysts to drive it meaningfully higher as monetary policy divergence between Fed and RBNZ persists, dairy prices remain soft (Fonterra cuts milk payout by 0.25 to $6.75/kg amid rising production in North America, Europe while demand in Asia and Middle-East slows) while external environment remains unfavorable (trade war tensions between US-China remain and NZD is highly sensitivity to movements in CNH and risk sentiment)."

"That said we believe the downside for the NZD may be limited towards 0.66, as implied by our fair value model projection and CFTC short positioning at historical levels. We do not rule out NZD forming at interimbottom around 0.6600 levels and we look for opportunity to buy on dips, looking for short term rebound towards 0.6850 levels (next 2 – 4 weeks). Current spot at 0.6660."

"Our fair value model shows that NZD spot is close to testing our model’s lower bound of 0.66 levels (1 standard deviation of fair value estimate of 0.73 levels). Historically NZD spot has hardly trade outside of our model’s lower bound and this implies that downside could be limited, barring external shocks (i.e. full -blown trade war, re -escalation of geopolitical tensions, etc.). In addition NZD net short position is near historical records. This adds to our bias that NZD downside may be limited from current levels."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here