Commerzbank Exchange Rate Forecast Update: GBP, EUR, USD, AUD and CAD

- Written by: James Skinner

-GBP seen pressures as Brexit and BoE uncertainty persists.

-USD seen continuing correction higher as Fed marches North.

-EUR seen under pressure as market misinterprets the ECB.

© kasto, Adobe Stock

After a four month period that has seen key currency market trends of the last year go into reverse, calling a halt to the Euro's rally and picking the US Dollar up off the floor it had been pinned to, the latest forecasts from Commerzbank suggest the greenback rally has further to run and yet more weakness is in store for Europe's single currency.

The latest set of projections come as the Euro trades at a year-to-date loss against the US Dollar, after unwinding a 4% gain during the course of April and early May, while the Dollar index has gone on to convert a 4.4% 2018 loss into a 0.58% profit. Commerzbank forecasts point to both these performances continuing for some time yet.

Meanwhile, Pound Sterling has gone from hero to zero in the space of just a few weeks and is now expected to remain under the proverbial cosh for the foreseeable future as a more downbeat outlook for UK interest rates conspires with ongoing "Brexit uncertainty" to thwart any attempts at reassailing its January and April peaks.

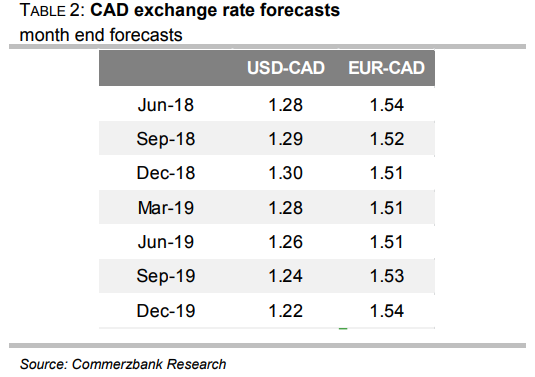

Elsewhere in the world, the Canadian Dollar's fortunes have taken a turn for the worse and the Loonie is now expected remain subordinate to a resurgent "Big Dollar" over coming months as an economic slowdown and fears of a North American Free Trade Agreement implosion darken the Bank of Canada monetary policy outlook.

This anticipated pressure on the Loonie comes against a backdrop of broad weakness for the "small Dollars", including the Australian Dollar, whose fortunes have also dimmed of late as the prospect of a Reserve Bank of Australia interest rate rise grows ever more distant.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Exchange Rate Forecasts:

Pound Sterling

"The uncertainties surrounding the Brexit will continue to cause volatility in the Pound exchange rates. Now doubts about the future monetary policy of the Bank of England (BoE) have arisen. This suggests that downside risks will persist in the pound. However, the market is currently too pessimistic about its interest rate expectations for the BoE."

"The Pound will continue to move in a range of 0.87-0.90 against the Euro, although considerable fluctuations are to be expected in some cases depending on the development of economic data and progress in the Brexit negotiations."

"In GBP-USD, the dollar side will set the pace. As the Fed continues its f interest rate hiking cycle, the Pound will remain under pressure against the USD for the foreseeable future."

Euro

"Since mid-April our optimistic USD-outlook has been confirmed. As a result we consider the sudden USD strength to be justified. We expect only some market technical corrections that are often seen following large moves. Medium term the dollar might even appreciate further. In particular against the euro, as the strength of the single currency is likely to be mainly due to a misinterpretation of ECB policy."

"We expect three further rate hikes for 2018 and we also expect more rate hikes for 2019 than is currently priced in by the market. However, what is even more important regarding the effect on USD exchange rates is: the Fed is currently the only one amongst the major central banks to be returning to active monetary policy."

"As a result we interpret the sudden recovery of USD at the end of April/early May as the bursting of a bubble of unjustified USD scepticism. When will this process have been completed? Not at EUR-USD levels around 1.18/19."

Australian Dollar

"The AUD will begin to appreciate at the end of 2018, as the market will then increasingly speculate that RBA will raise its key interest rate. However, the RBA's concern about an AUD that is too strong should slow the pace of appreciation and allow only a slow upward movement in AUD-USD."

"In the course of 2019, the slowing pace of interest rate hikes by the Fed and a weaker USD as a result of this suggest that the upward trend in the AUDUSD will continue. Since the ECB will not seek to normalise its monetary policy until later in 2019, the AUD will gain against the EUR, especially in 2018. From 2019 onwards, however, the AUD will have to slowly return these gains to the EUR, as the ECB will then go on to raise interest rates."

Canadian Dollar

"The Bank of Canada (BoC) had identified uncertainty about the direction of the NAFTA negotiations as an important factor of uncertainty that had clouded the outlook – and thus also the probability of further interest rate hikes in the near future. Since we believe in an agreement, we also expect the BoC to continue its cycle of interest-rate hikes this year, which should support the CAD."

"Rising US interest rates and the positive effects of the US tax reform on consumption and investment in the US should give the US currency tailwind this year. Therefore, USD-CAD will continue to linger on high levels and even rise somewhat during the course of the year. The CAD is likely to only gain sustainably again against the USD in 2019, when the Fed starts to slow down its rate hike pace, while the economic environment should offer sufficient leeway for continued BoC interest rate hikes."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.