J.P. Morgan Exchange Rate Forecast Update: April 2018

- Written by: James Skinner

- Litany of global risks sees US Dollar outlook turn more neutral.

- Scope for USD strength given growth, trade and geopolitcal outlook.

- Some commodity currencies to bask in glow of rising commodity prices.

The Chase Tower, New York © Kristen Cavanaugh, Flickr

Currency markets have reached an inflection point at which key trends of the last year or more will either be dashed upon the rocks of a global economic slowdown or continue unabated following a period of consolidation, according to the latest forecasts from J.P. Morgan.

The forecast update comes hard on the heels of a quarter that saw the US Dollar call a halt to a 12 month decline while the Euro ceded its crown as the currency market's darling and Pound Sterling was annointed the developed world's best performing unit for the year to date.

A slowdown in growth momentum across the developed world during the three months to the end of March is the most significant curve ball to have been the way of traders, positing questions about market expectations for growth and monetary policies over the rest of the year.

Elevated risk around geopolitics and international trade are other factors to have led strategists at large to take a second look at their forecasts for the quarters ahead.

All of these factors have augured a sense of risk and uncertainty across markets, which explains the relative improved performance of the US Dollar during the recent quarter, but what matters now is how much longer these issues remain a concern for markets.

J.P. Morgan economists have stuck to their forecast that the Federal Reserve will raise interest rates three more times in 2018 but revised their global growh projections downward at their quickest pace for more than 2 decades during the recent quarter. This will have implications for price action in currency markets if the downgrades prove warranted.

However, on a more positive note, they have given short shrift to the idea that the so called "trade war" between the US and China that began in March is severe enough in its current form to have any meaningful impact on global growth.

The net effect of all of this has been to push the J.P Morgan foreign exchange team onto a neutral footing as far as their US Dollar view goes, although they have also warned there is scope for the Dollar to "strengthen" if their global growth forecasts prove correct or if the outlook for the global economy deteriorates further.

This would be bad for the likes of the Pound-to-Dollar rate and the Euro-to-Dollar rate. However, countries like Canada and Norway may escape the full force of a resurgent Dollar given their commodity linkeages and the fact that oil prices are expected to continue the strong run seen during the recent quarter.

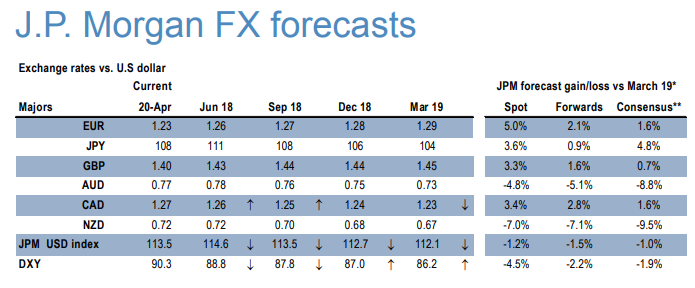

Above: Table of J.P.Morgan and consensus forecasts for major currencies relative to the US Dollar.

Pound Sterling

"GBP has been a notable outperformer since the last Key Currency Views, albeit correcting lower in recent days as a May rate hike is called into question."

"Despite the bullish price action we remain circumspect about GBP’s prospects in view of a less than convincing macro backdrop characterised by underperformance in growth and outperformance in inflation (the forecasts are unchanged and envisage a broad consolidation in the GBP TWI over the coming year)."

"Policy risks to GBP have increased but subjective Brexit risk continues to subside as B-day looms on March 29th 2019."

US Dollar

"With a lot of noise and uncertainty, but little shift in baseline macro expectations, forecasts revisions are limited to a few notable idiosyncratic adjustments and smaller tweaks elsewhere; the USD index is still expected to grind lower in the coming quarters."

"The dollar has failed to rally in the past month, despite several potential triggers, including a relative outperformance in surprise indices, and a sharp drop in equity markets."

"Unfortunately, the high level of uncertainty over a multitude of very important global and US idiosyncratic tail risks will likely persist for some time, which will constrain risk-taking by FX market participants."

"Beneath all the uncertainty and noise, the baseline assumptions about the global macro backdrop have not changed much in the past couple of months, and so we continue to expect the broad dollar to eventually resume a broad if modest grind lower in the medium-term."

Euro

"There are no changes this month to our moderately constructive EUR forecast following yet another turgid month in which EUR/USD has continued to respect the pitiful three cent range that has endured for over three months now."

"The insensitivity of FX to rate differentials remains the single most important issue in FX. Investors are wary about ignoring interest rate spreads, hence there is a reluctance to sell USD when it is so undervalued vs rate differentials, but at the same time there is little conviction to position long USD for a convergence to interest rates as the two have been decoupling for over a a year now."

"For EUR/USD specifically, the current mispricing vs simple interest rate models is of the order of 4-5% (chart 2). This overshoot is clearly material, albeit it is by no means unprecedented (the average absolute mispricing from this rate model over the past 20Y is 6%) and is in fact quite modest when compared with the 18% undershoot in EUR when QE was introduced in 2015."

"Balance of payments remains supportive for EUR on a trend basis, we believe. Nevertheless, flow demand has stalled in recent months due to net outflow of equity and FDI capital. The current account remains close to a record (€36bn per month) but equity and FDI has flipped from a inflow of €249bn in 2017 to an outflow of €62bn in January-February. This highlights the vulnerability of EUR/USD to a deeper setback in equities globally and bears close monitoring."

Australian Dollar

"Our forecast track expects AUD/USD to hold around the USD0.77-78 level in 2Q18, before declining towards USD0.75c by year end. We expect both monetary policy divergence and modestly weaker commodity prices to push the currency lower. We are also expecting the pace of domestic growth momentum to decline in 2H18, after a boost from net exports in the first half of the year."

"In 2018, the main bearish risk to AUD comes from a lift in market volatility...we view the Antipodean currencies as quite vulnerable in a less carry friendly and more volatile world, especially given the lack of support from local monetary policy – for the first time since 2Q01, 1-month carry in AUD/USD longs is now negative."

"Still solid Chinese growth and little change in the terms of trade profile in the next few quarters provide some fundamental support to AUD. This should allow a gradual decline in AUD in 2018."

"RBA commentary this year has reinforced Australia’s policy divergence with the G10. Indeed, in the March RBA Statement, the RBA softened its tone on the domestic growth outlook, simply noting that “... The Bank's central forecast is for the Australian economy to grow faster in 2018 than it did in 2017”."

"From a valuation perspective, AUD/USD looks close to fair value at present (Chart 3). Our model takes into account the terms of trade, real short rate differentials between Australia and the US and the CRB index (to account for USD weakness). This probably helps to understand why the RBA exhibited little anxiety around the currency in its most recent Statement, simply noting that the AUD TWI was still within ranges that had held for the past two years."

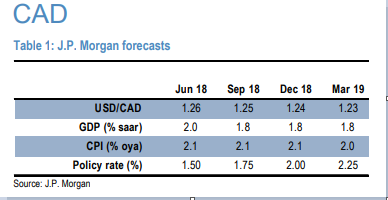

Canadian Dollar

"Swings around perceived US trade policy risks have driven large swings in CAD’s risk premium so far this year. The 4.5% peak-to-trough decline in USD/CAD in the past month, follows a 7% rally the prior month and a half, which itself followed a 5% decline from late December. These oscillations within a wide range is, to a large extent, driven by swings in CAD risk premium."

"We are near-term bullish CAD, having recommended longs vs JPY and USD earlier this month as a fade of excessive risk premium in CAD against the potential for a near-term NAFTA breakthrough. The recovery of CAD in the past two weeks have largely unwound what had earlier been a large discount, but we have held onto our long CAD recommendation as a near-term NAFTA catalyst is still looking likely."

"This tactical bullish view is in spite of BoC’s dovish policy outcome earlier this week...In other words, despite CAD’s material rebound in recent weeks, there is not a lot of monetary policy to “unwind” from the USD/CAD highs in late March."

"Ongoing strength in oil prices, and in particular local heavy crude prices is also supporting further nearterm CAD strength, even if it proves to be temporary. While WTI crude prices have risen 12% in the past two months (from $61 to $68/bbl), local West Canada Select prices have risen a much larger 52% (from $33 to $52/bbl), due to a sharp narrowing of the WTI-WCS discount as earlier transportation bottlenecks have eased somewhat."

"But beyond the near-term, our economists revised policy expectations now expecting BoC hikes to lag the pace of the Fed, which leads us to marginally trim expectations of CAD strength further out in the forecasts."

New Zealand Dollar

"NZD faces headwinds, even in a clearly weak USD environment...Domestic growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government."

"Over 2018, we see scope for underperformance from NZD, though this is now more contingent on ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3, and perhaps on evidence that real assets (equities, housing) are threatened by late cycle growth dynamics and government intervention. We expect NZD/USD to depreciate to USD0.67 by 1Q19."

"The last round of inflation and growth data were important in this regard. Annual inflation has fallen back to just a little above 1%, the bottom of the target band. The return to 2% is now more reliant on an acceleration in growth. On recent momentum of construction and exports, it is difficult to see how growth will reaccelerate back to the high 3s, per the RBNZ’s forecasts."

"We have expected the RBNZ to initially interpret their new employment mandate as a natural extension of the old, price stability mandate. Recent commentary from the Governor and Assistant Governor have confirmed this. With that hawkish knee-jerk reaction to the mandate change now seemingly out of the way, the focus will return to the - justifiably - easy policy settings required to achieve the staff’s growth and inflation forecasts."

"The winding back of LVR restrictions in New Zealand, apparent stabilization of NZ house prices (Chart 3) and likelihood of more bad news on housing/macroprudential tightening in Australia, make the outlook for AUD/NZD more range-bound than before. We now expect the cross to be anchored around 1.10, where it finished 2017."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.