Julius Baer Exchange Rate Forecast Update

- Written by: James Skinner

© IRStone, Adobe Stock

Kicking the “cliff edge” down the road should spell welcome relief for Sterling while strong fundamentals offer respite to the Dollar. However, extreme positioning threatens the Euro with a hangover.

The Pound is expected to gain a moment of respite in 2018 and beyond, according to the latest currency forecasts from Swiss wealth manager Julius Baer, as a Brexit transition agreement effectively kicks the “cliff edge” out into the long grass.

Meanwhile, the downtrodden US Dollar looks set for a period of relief also, as strong economic fundamentals and widening gulf between American interest rates and those elsewhere in the world lends some belated support to the greenback.

However, back over in Europe, extreme levels of optimism around the Eurozone economy in 2017 have seen the number of bullish bets on the currency rise to multi-year highs.

This, particularly in light of the emerging deadlock in Italian politics, means the currency is vulnerable to a sudden deterioration of sentiment that could ultimately leave it with a hangover from hell.

As it stands, the Eurozone unit has risen by 15.9% against the US Dollar over a one year horizon and by 3.16% against Sterling. It is also up by double digit numbers against the Canadian, New Zealand and Australian Dollars over the last 12 months.

British Pound

“A two-year transition period looks increasingly likely, offering continuity until 2021. With the impact of a change in the trade regime now likely to be shifted beyond 2019, we switch to a neutral GBP outlook.”

“Evidence is rising that the EU and the UK can agree on a two-year transition period from April 2019 onwards, with an unchanged trade regime (UK to keep EU single-market passport).”

“A ‘temporary soft Brexit’ until 2021 would push back the impact of a change in the trade regime. Meanwhile, receding inflation reduces the Bank of England's appetite for rate hikes.”

“Our base case remains a loss of the UK's EU single-market passport, weighing on the pound. However, we adopt a neutral GBP stance as this scenario will unfold beyond our 12-month forecast.”

Julius Baer's EUR/GBP forecasts of 0.88 in June 2018 and March 2019 translate into a Pound-to-Euro rate of 1.1360 in three months and 12 months.

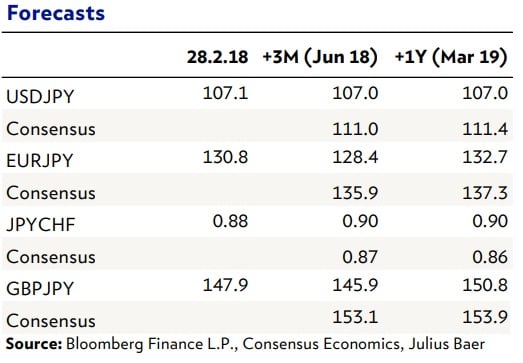

Above: Julius Baer Exchange rate forecasts table.

US Dollar

“Positive economic data and a sizeable interest-rate advantage are competing with gloomy US dollar sentiment. We expect economic fundamentals to win through an result in a short-term bounce.”

“The interest-rate and yield advantage of the US dollar justify a stronger currency, in particular as a solid economic backdrop and signs of higher inflation both support a considerable persistence of this advantage. Extremely depressed sentiment increases the chance of a violent short-term bounce.”

“Ill-timed expansionary fiscal policy is a longer-term headwind for the currency as the global USD supply will rise via a larger budget and external deficit. The US dollar remains fundamentally overvalued, limiting its longer-term upside potential.”

Above: Julius Baer Exchange rate forecasts table.

Euro

“The euro has now fully priced in the end of asset purchases and less divergence in monetary policy. Euphoric positioning remains the major risk for a correction. We remain bearish in contrast to a neutral consensus.”

“The euro has overshot the level implied by the yield differential and other short-term drivers of the currency. At the current level it trades even above the revised ECB monetary policy stance.”

“The strengthened euro is a burden for the eurozone growth outlook and increases the likelihood of negative economic data surprises. With high popularity among speculators this is a major risk.”

“Low inflation means that the euro’s purchasing power remains very solid, which, together with a solid balance-of-payments situation, is the major tailwind for the euro in the longer term.”

Above: Julius Baer Exchange rate forecasts table.

Australian Dollar

“Commodity prices weighed on the AUD's strength last month. We expect them to decline further, which is reflected in our cautious three-month forecast. A return of rate-hike expectations could support AUD in H2.”

“The Reserve Bank of Australia will likely hold interest rates stable until late this year due to slack in the economy. US rates have now caught up with Australian interest rates.”

“Steel prices fell in February and have room to decline further. First signs of a cooling in China suggest that prices should soften, acting as a drag for the currency.”

“A return of rate-hiking expectations in the second half of 2018, together with Australia's solid economic fundamentals, will make the AUD more resilient in the longer term.”

Above: Julius Baer Exchange rate forecasts table.

New Zealand Dollar

“Fading yield advantage and toppish dairy prices will provide no upside to the NZD. Therefore, we expect a mild weakening while US rates continue to rise. A good economic outlook calls for a neutral stance.”

“We believe the Reserve Bank of New Zealand (RBNZ) will keep interest rates stable until Q1 2019 as inflationary pressures remain low.”

“Governor Orr stands for continuity. Dairy prices will likely not move higher and thus provide no additional support to NZD. The declining yield advantage vs the USD could start to weigh on the NZD in the coming months.”

“A steady economic outlook and returning expectation for a rate hike should become more dominant from mid-2018 onwards, supporting NZD in the longer term.”

Above: Julius Baer Exchange rate forecasts table.

Canadian Dollar

“The BoC remains in gradual rate-normalisation mode. A NAFTA break-up remains a risk to sentiment, but would have few negative long-term effects. We maintain a neutral outlook, as upside vs the USD looks limited.”

“Economic data surprises turned negative in February. However, high capacity utilisation will keep the Bank of Canada (BoC) in rate-normalisation mode. More rates hikes are to follow this year.”

“A NAFTA break-up would provoke a sentiment-driven setback, but also offer entry points. The long term impact would limited, as a fallback to the former free-trade agreement CUSFTA would follow.”

“Diminished undervaluation limits the upside vs the US dollar. We maintain a neutral outlook for the Canadian dollar until there is more visibility on interest rates and NAFTA.”

Japanese Yen

“The Japanese economy, the Nikkei and Premier Abe all seem to be less reliant on a weaker yen. The currency is on its way to being released from being weak. We stick to our neutral view in contrast to a bearish consensus.”

“The new mandate of Prime Minister Shinzo Abe makes fiscal spending via, inter alia, rearmament of Japan more likely and takes away pressure from the Bank of Japan (BoJ) to keep the yen weak.”

“The breakdown of the negative correlation between the Nikkei and the yen is an impressive sign that Japan is less dependant on a weaker yen.”

“The BoJ sticks, so far, to its 0% yield target, preventing the yen from rallying. But signs of a shift or at least softening of this policy are accumulating.”

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.