Brexit Will NOT be a 'Black Wednesday' Event for Pound Sterling say Ebury Partners

Ebury Partners - a recognised forecaster for Bloomberg - believe that the pound is unlikely to suffer a shock similar to that seen on Black Wednesday in 1992.

“We do not anticipate a decline in Sterling to the magnitude witnessed in the early 1990’s, let alone the 20% depreciation suggested by Goldman Sachs.”

On 23 June the British public will go the polls and decide on the fate of Britain’s long-term membership with the European Union.

While we expect the ‘in’ vote to prevail, the possibility of a Brexit cannot be ruled out. The most reputable opinion polls have generally shown the ‘in’ campaign to be ahead, albeit by a narrow margin.

This advantage shrunk following the attacks in Brussels last month and, in our opinion, betting odds of around 33% chance of a Brexit seem roughly in line with the polls.

However, it’s become increasingly apparent that investors are genuinely concerned about the chances of a Brexit and its perceived negative effect on the UK economy.

GBP/EUR has traded mostly in tandem with the Standard & Poor’s 500 index over the past six months. However, this has shown a noticeable divergence since mid-February when the market began pricing in the risk of a Brexit (Figure 1).

Figure 1: GBP/EUR vs. S&P 500 Composite Index (Oct ’15 – Apr ’16)

Source: Thomson Reuters Datastream Date: 18/04/2016

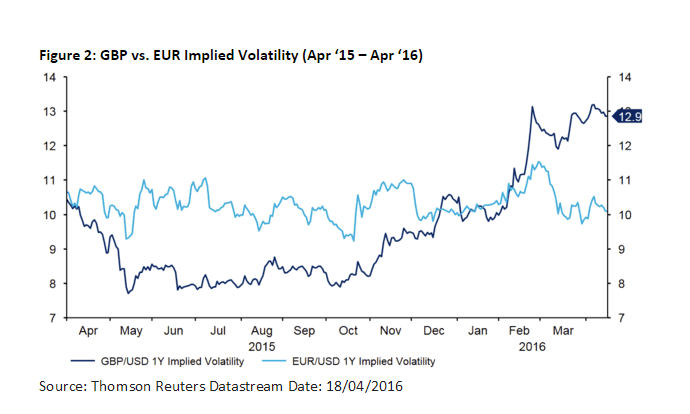

Implied volatility in Sterling, probably the most accurate measure of foreign exchange market fears regarding a Brexit, has also increased drastically since the turn of the year.

Both one year and six month implied volatility in GBP/USD are now higher than the same measures for EUR/USD (Figure 2), having historically been lower ever since the introduction of the single currency in 1999.

Figure 2: GBP vs. EUR Implied Volatility (Apr ‘15 – Apr ‘16) Moreover, expectations for the first post-financial crisis interest rate hike by the Bank of England have been pushed further into the future, due largely to EU referendum jitters.

Moreover, expectations for the first post-financial crisis interest rate hike by the Bank of England have been pushed further into the future, due largely to EU referendum jitters.

Market pricing suggests we won’t see a UK rate increase until 2019, with a non-trivial chance of a rate cut over the next year.

In the event of a Brexit, we'd expect a sell-off in Sterling.

It is, however, extremely hard to predict the extent, given the lack of historical precedent.

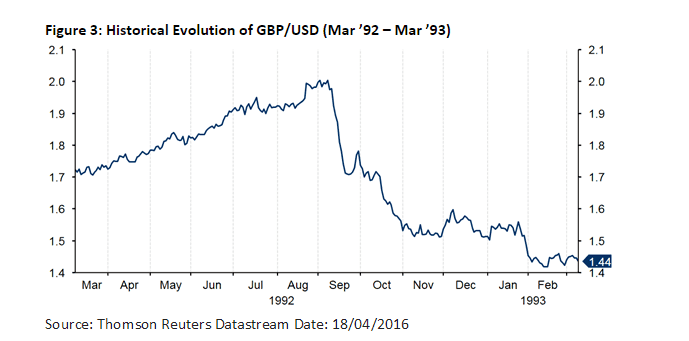

The closest event in recent memory would be when Britain was forced out of the Exchange Rate Mechanism (ERM) during ‘Black Wednesday’ in September 1992.

Following the exit from the ERM, Sterling dropped 15% against the US Dollar and the German Mark in the space of just a week, ending the year 25% lower against the Greenback (Figure 3).

Figure 3: Historical Evolution of GBP/USD (Mar ’92 – Mar ’93)

However, that dramatic decline was from a universally-accepted excessive level, whereas Sterling has already depreciated substantially against the US Dollar and the Euro so far this year.

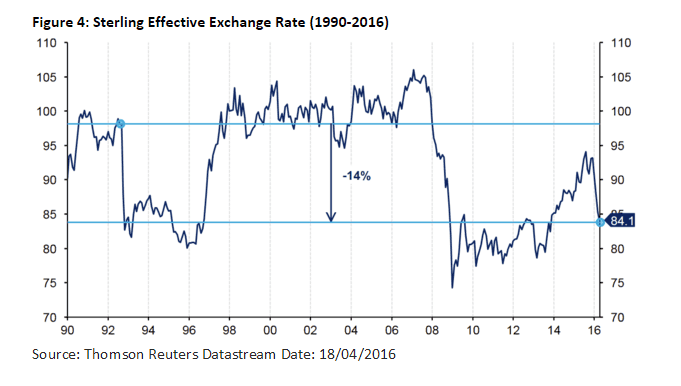

In trade weighted terms, the Pound is currently trading around 14% lower than it did prior to the removal of the ERM in early September 1992 (Figure 4).

Figure 4: Sterling Effective Exchange Rate (1990-2016)

This would suggest that the Pound has less to fall in the event of a Brexit than it did following the withdrawal from the ERM.

We do not anticipate a decline in Sterling to the magnitude witnessed in the early 1990’s, let alone the 20% depreciation suggested by Goldman Sachs.

We would instead expect a depreciation in Sterling of roughly 10% against the US Dollar and 5% against the Euro in the immediate aftermath of a Brexit vote.

Conversely, and given the odds being priced in, an ‘in’ vote and the resulting clearing of uncertainty would bring about a Sterling rally of roughly half that amount, 5% against the US Dollar and 2.5% against the Euro.

It could be very interesting to see how the Bank of England would react in the event of a Brexit. We would expect the monetary policy committee to issue an emergency interest rate cut and flood the markets with liquidity in order to maintain monetary stability.

By contrast, an ‘in’ vote would lead markets to quickly remove expectations for a rate cut and start pricing in the chance of a hike at some point in the following twelve months.

We therefore still forecast the Bank of England to hike rates in the final quarter of 2016, provided the UK remains a member of the European Union following this summer’s referendum.