EUR/USD Forecast: Parity by Year-End 2016 say Credit Suisse

- Written by: Gary Howes

Credit Suisse say the move below the 1.0819/09 summer lows in EURUSD are seen as the catalyst for a resumption of the core bear trend.

Swiss investment bank Credit Suisse are so confident of the US dollar's ability to push the euro lower they have made the short EURUSD one of their trades of 2016.

The bank see EURUSD at parity in their 12 month forecast:

"We note that the next three months to January 28 includes two ECB and three FOMC meetings. With our economists still minded to think the Fed can hike in December, we take this opportunity to lower our EURUSD 3m forecast to 1.07, leaving our 12-month 1.00 target unchanged," says Anezka Christovova at Credit Suisse in London.

Credit Suisse are particularly confident in their expectations for a weaker euro based on the assumption that the European Central Bank may be more proactive in stimulating the Eurozone economy than markets are presently expecting.

"We note that the importance of potential divergence between rates in the US if the Fed begins a rate hike cycle and the euro area if the ECB eases again in December cannot be overstated. In the case of the latter, while it is true that the market has already priced in a further 10 bp deposit rate cut, there is room for much more to be priced in for 2016," says a global research note from the Swiss bank.

The contrast with a Fed that is confident enough to hike is pronounced.

Aside from the rate-differential widening that this implies, Credit Suisse say it is worth focusing on the opposite signs of yields too:

"We have long contended that negative yields spur outflows from investors who are not mandated to hold negative-yielding assets ‒ for example, many central banks."

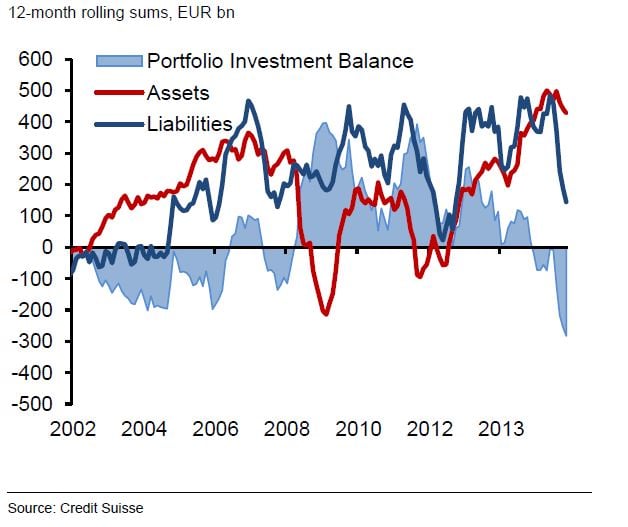

The below graphic shows the euro area's net portfolio balance has been in negative territory and deteriorating, led by foreigners selling euro-area assets rather than Europeans buying foreign ones.

"If there is a tipping point for yields or yield differentials that leads to more aggression on either side, presumably EURUSD

can fall much further. This flow argument has long been a key component of our below consensus EURUSD 1.00 12-month forecast," say Credit Suisse.

USD Strength not Just a Symptom of US Fed Rate Rises

Regarding the dollar's strength, Credit Suisse have long believed that the USD is still engaged in a broader uptrend that will eventually take it to levels widely considered to be overvalued.

From their perspective, the driver for this was more the extreme monetary easing now being seen across the globe outside the US than Fed rate hikes, "although the latter would obviously be the icing on the cake that makes divergence more appetizing from the Fed's perspective."

Analysts do not argue with the notion that this would leave the USD in overvalued territory from a long-term perspective; indeed, "we think that current global conditions exemplified by Chinese and European growth and inflation weakness are exactly those that lead to persistent overvaluation."

From a technical perspective it is argued that the move below the 1.0819/09 summer lows is seen as the catalyst for a resumption of the core bear trend for what is thought to be a quick move back to the 1.0458 low.

Beyond here Credit Suisse target their 1.0109/.9921 long-held target – the long-term uptrend from 1985, as well two key Fibonacci retracement supports.

Nevertheless, reaching parity and beyond remains a hard task.

Reuters report that billions in currency options set between $1.04 and $1.07 stand between the dollar and a push past this year's best exchange rate against the euro.

Data from U.S. securities clearing house DTCC, shows some $12 billion in options with strike prices around $1.05, $1.06 and $1.07 maturing on Dec. 18.

"A lot of people have been putting on downside option structures and the market has been aware of them for a while," said an institutional dealer in London quoted by Reuters.

"That is one of the big reasons why you are seeing a lot of stickiness around these levels and it may be hard to push through."