Goldman Sachs Stick With EUR/USD Parity Forecast

The debate continues to rage amongst institutional analysts as to whether the euro dollar exchange rate conversion will in fact fall to 1:1 and beyond in 2015 and 2016.

A recent forecast update from the currency research team at Goldman Sachs confirms they are expecting declines towards parity in coming months with a Greek debt default being the catalyst.

The call comes following news that a tentative deal is on the cards between Greece and its creditors appears possible. However at this stage we are yet to see any concrete evidence that a default on a host of future repayments has been unequivocally avoided.

“After the initial enthusiasm regarding Greek progress yesterday we are now back to considering the realities of the situation, including the necessity of the any eventual deal being required to go through the Greek Parliament, prior to it being voted upon in other national Parliaments, notably Germany,” notes currency strategist Jeremy Stretch at CIBC in Canada.

Support in the Greek Parliament is far from a foregone conclusion, potentially without opposition support.

Euro to Fall as ECB is Foreced to Fight Contagion

With the prospect of a future default firmly on the cards we consider the potential path of exchange rates.

Goldman Sachs believe that a default will prompt a necessary response from the European Central Bank (ECB) which will look to avoid contagion spreading to other Eurozone economies.

“With respect to EUR/$, we think the Bund sell-off increases EUR/$ downside if tensions over Greece escalate further. This is because the ECB, including via the Bundesbank, would almost surely step up QE to prevent contagion. We estimate that the immediate aftermath of a default could see EUR/$ fall three big figures,” says a FX note penned by Goldman Sachs analysts Robin Brooks, George Cole and Michael Cahill.

The ensuing acceleration in QE would then take EUR/$ down another seven big figures in subsequent weeks.

Goldman Sachs thus see Greece as a catalyst for EUR/$ to go near parity, via stepped up QE that moves rate differentials against the single currency.

But - EZ Data Moves in the Right Direction

The risks to the above forecasts come with Greece continuing to fumble forward – this will allow foreign exchange markets to focus on the improving economic sentiment in the remainder of the Eurozone.

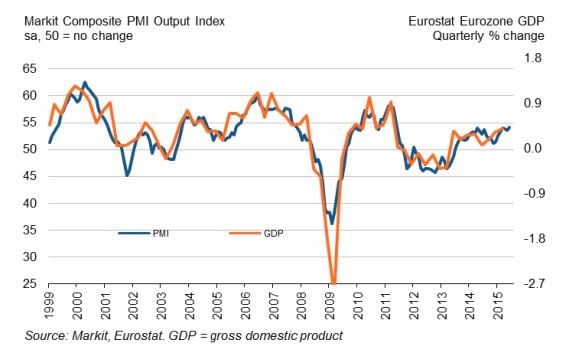

Eurozone economic growth hit a four-year high in June, according to the latest PMI survey data. Markit’s flash Eurozone PMI, based on around 85% of usual monthly survey replies, rose from 53.6 in May to 54.1 in June, its highest since May 2011.

“That we have seen euro area flash PMI rebound (manufacturing reaching the highest level since April ’14 at 52.5 while services sentiment has not been higher since May ’11) suggests that underlying euro fundamentals are looking more encouraging, despite the Greek political malaise. However, that the euro could not maintain a run above 1.14 in the wake of discussion of a deal is instructive,” says CIBC’s Jeremy Stretch.

For now though, despite improving economic fundamentals, the euro exchange rate complex will remain under pressure.

“Despite the PMI uptick, ongoing political uncertainty ahead of the Eurogroup tomorrow and Leader summit on Thursday may keep the EUR ranged, albeit with a modest downside bias towards 1.1205/10. We would also likely keep in mind that any Greek debt resolution (however flawed) could be seen to remove a potential impediment to Fed action prior to the end of Q3,” says Stretch.