Exchange Rate Forecasts for Pound Sterling, US Dollar and Euro in 2015 and 2016 from Scotiabank

- Written by: Gary Howes

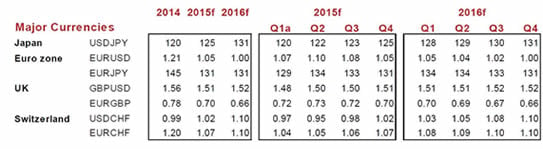

In this report: Euro to Dollar (EUR-USD) seen down to 1.05 and then 1.00.

The pound to euro (GBP-EUR) could hit 1.51.

Full table at end of article.

Scotiabank have told clients they see GBP-USD pair maintaining a stable trend-bound range over coming months despite analysts warning that the dollar is predicted to be the out-performer in global forex markets over the course of the next year.

This confirms sterling will likely join the USD in being one of the leading currencies in the G10 space which should afford GBP the chance to make gains against a host of other currencies.

The euro is meanwhile expected to suffer weakness with the euro to dollar exchange rate (EURUSD) expected to fall lower with parity ultimately being achieved; a viewpoint echoed by a number of other institutional analysts.

Before looking in more detail at the research, for reference the following levels are available:

- At the time of publication the euro to dollar exchange rate conversion (EURUSD) is quoted at 1.1282.

- The pound to dollar exchange rate conversion (GBPUSD) is at 1.5293. See here for graphs and 2015 historical rates.

- The pound to euro exchange rate conversion (GBPEUR) is at 1.3554. See here for graphs and 2015 historical rates.

Take into account that the quotes given here refer to the wholesale markets, your bank or payment provider will alter the exchange rate they offer you at discretion to derive profit. However, an independent FX provider will seek to get you closer to the market. In some cases this can result in up to 5% more currency being delivered. Learn more.

The British Pound Forecast 2015 - 2016

The British pound (GBP) weakened against the dollar in May as the US dollar saw its across-the-board weakness finally come to an end. GBP strengthened against the euro though with the strong performance reflecting the passing of political risk and a stable election outcome providing the basis for a GBPEUR rally.

Looking ahead, “the GBP will maintain a stable trading range versus the USD, with the BoE implementing its own policy normalisation with a modest lag to the Fed,” says Pablo F.G. Bréard at Scotiabank.

Looking ahead, “the GBP will maintain a stable trading range versus the USD, with the BoE implementing its own policy normalisation with a modest lag to the Fed,” says Pablo F.G. Bréard at Scotiabank.

The pound sterling has been unable to gather significant traction against the euro and dollar for much of 2015 owing to a slowdown in economic indicators. However, it is assumed that UK output growth will likely bounce back strongly in the second quarter following the first quarter disappointment - the effects of this will be reflected in third quarter data.

“On a more medium-term horizon, lower energy and food prices and lower inflation represent a significant windfall to household disposable income, which will propel consumer spending growth higher, in tandem with firmer wages and solid employment growth. With the euro zone also showing signs of recovery, UK export growth will likely begin to contribute to growth,” says Scotiabank’s Alan Clarke.

As such, February 2016 is the most likely timing of the first BoE hike in the opinion of Scotiabank. However, if there is a risk to this forecast it is that the first hike arrives sooner rather than later, this could push the British pound higher as markets are forced to readjust their positions.

Scotiabank hold a year-end GBP-USD forecast of 1.51 with a rise to 1.52 being seen at the end of 2016. The euro pound exchange rate is forecast to finish the year at 0.70 (1.4286 GBP-EUR) and end 2016 at 0.66 (1.5151 GBP-EUR).

The Euro Forecast 2015 - 2016

The EUR will meanwhile resume a weakening phase which will pave the way for parity with the USD over the next 18 months.

“Monetary policy divergence will be the primary driver of EUR weakness as ECB policy accommodation is fully implemented. The euro will remain vulnerable to portfolio investment shifts guided by US-Europe interest rate differentials. The European Central Bank’s forceful commitment to a large-scale asset purchase program (i.e. QE) highlights its ongoing divergence with the Fed,” says Bréard.

However, there are some positives that could see the euro outperform as the eurozone’s economic outlook continues to improve.

First quarter real GDP grew by 0.4% q/q, up from 0.3% q/q in the fourth quarter of 2014, outpacing both the US and the UK. The recovery is becoming more broad-based across the region, with France and Spain leading the way. Low oil prices are underpinning households’ purchasing power that in turn is boosting private consumption.

“The lagged impact of the past fall in the euro exchange rate and the improvement in the transmission of loose monetary policy gauged by the latest ECB lending survey points to higher investment in the coming quarters. This would clearly help to make the recovery more sustainable but keeping financial conditions accommodative (low interest rates, low euro exchange rate) remains key at this stage,” says Bréard.

The takeaway from the research, I believe, is that upside risks could well materialise ensuring any weakening is gradual.

Ultimately though, the ECB’s bond-buying programme will ensure any strength in the currency is capped. The euro dollar exchange rate is seen by Scotiabank at 1.05 at the end of the year and at parity at the end of 2016.

The Dollar Forecast for 2015 - 2015

The USD will be the ultimate driver of currency market moves over the course of the next 18 months suggest Scotiabank. Indeed, the United States in the developed world and India in the developing world will likely lead the growth charts in 2015-16, despite signs of activity moderation in the first half of 2015.

“The USD will remain in favour as the Fed initiates a gradual process of monetary policy normalisation. Our medium-term forecast implies broad USD strength, with key policymakers reaffirming their preference for Phase 1 of monetary policy normalisation to begin sometime in late 2015. The underlying fundamentals supporting the US consumer (labour market conditions, lower energy costs and ultra-low interest rates) remain in place,” says Bréard.

There are downside risks to the dollar exchange rate complex though.

“We are dialling back some of our conviction on the September rate hike call as softer-than-expected Q2 economic data create some uncertainty about how temporary the Q1 weakness truly was. A low-growth backdrop could make the FOMC uneasy about further near-term progress on the dual mandate and wary of raising interest rates,” says Scotiabank’s Derek Holt.