Euro to Pound Rate Forecast Cut at Barclays

Analysts at Barclays have told clients that they are forecasting the pound sterling to advance further than they had previously expected against the euro over the next year.

Barclays have upgraded their forecasts for the UK’s sterling against the euro noting, “the associated reduction in UK political risk implies a one-off increase in GBP relative to our forecast path.”

Indeed, the British pound has appreciated in excess of 3.5% against the EUR since the 7 May general election which unexpectedly delivered a Conservative majority government. The GBP strength more than likely reflects the removal of a significant portion of UK political uncertainty and takes us back to where economic fundamentals are happy to price GBP.

A note on the matter, penned by Barclays’ Hamish Pepper, does however warn that the path to a higher pound exchange rate will be more gradual owing to the new Conservative government’s fiscal plans.

“The election result also implies that the pace of GBP appreciation should be more moderate. Tighter fiscal policy is likely to reduce the degree of UK economic outperformance versus the euro area and result in more accommodative monetary policy over the next 1-2 years,” says Pepper.

Indeed, BoE Governor Carney noted recently that the Bank’s forecasts were based on the fiscally austere 2015-16 Budget and fiscal policy is one factor that likely delays the timing of rate rises and results in a more gradual pace of monetary policy normalisation

As such, while Barclays revise their EURGBP forecasts lower they are also reducing the pace of depreciation. “We now forecast EURGBP to hit 0.68 at end-Q1 2016, from 0.70 previously. Although our forecasts are entirely based on fundamentals, the new forecasts are consistent with our technical strategist’s view,” says Pepper.

Turning this around, this equates to a pound to euro forecast of 1.4706 by the end of the first quarter of 2016.

Looking at the longer-term picture it is argued that the UK’s commitment to a continued reduction in the UK’s fiscal deficit likely enhances Sterling’s safe-haven status in the context of continued European political uncertainty and global growth concerns.

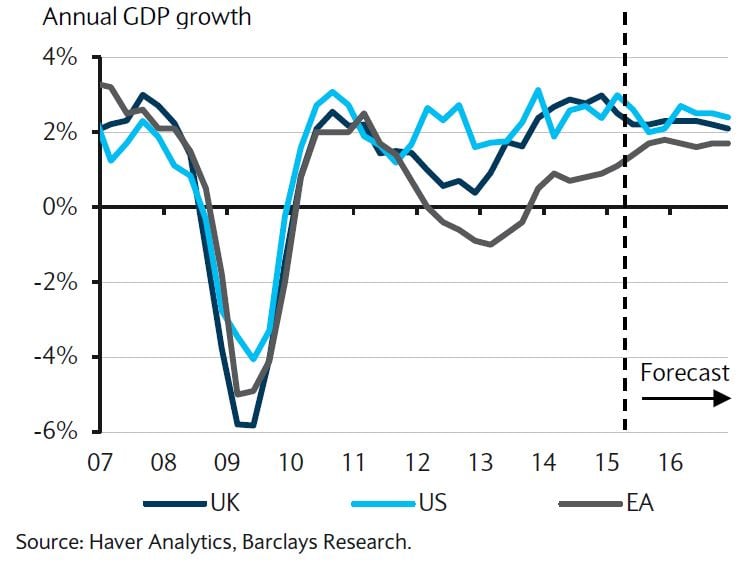

In addition, the UK economy is likely to outperform its Eurozone counterpart:

Barclays believe UK economic growth is likely to be higher than that of the euro area until at least end-2016, something that will keep the euro under pressure against sterling.

“However, longer-term UK political risks of an EU referendum and potential pressure for Scottish independence remain. Overall, we think that the net impact of these factors on Sterling’s real equilibrium value is ambiguous,” says the forecast note.