This Dollar Forecast Sees Next USD Surge in September

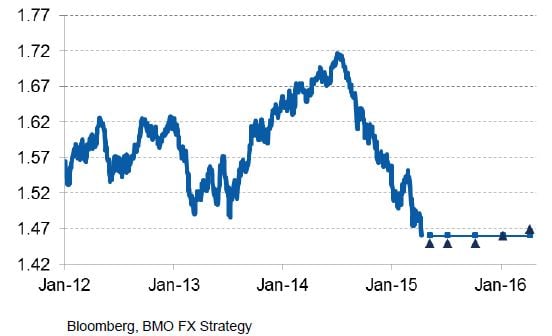

Above: The forecasted trajectory for the pound v dollar pair suggests the worst may be over for sterling and dollar gains will have to be found elsewhere.

Dollar exchange rate forecasts from BMO Capital see more gains for the Greenback commencing in the latter part of 2015.

USD has had about 2¾ cycles in 43 years of floating rates; USD rallies have lasted 6-7 years.

"We expect only about 5% of USD appreciation for the remainder of 2015" - Greg Anderson @ BMO Capital.

The USD complex is on the back-foot at the time of writing allowing the likes of the pound, euro and pretty much everything else out there to catch a much-needed break higher.

The declines come after it was revealed that US retail sales rose by 0.9% m/m in March, below forecasts for an increase of 1.1% m/m.

The March retail sales report also contained significant downward revisions to core retail sales in January and February confirming a soft start to the year for the world's largest economy.

The current USD weakness should however be viewed within the context of a blip in a broader cyclical period of strengthening says a new report that has landed on my desk.

Note that all FX quotes in this piece reference the wholesale markets rates - your bank will affix a discretionary spread to this wholesale rate to derive their profit. However, an independent FX provider will undercut your bank's offer, this can deliver up to 5% more currency in some instances, learn more here.

The Almighty Dollar

The pound to dollar exchange rate conversion (GBP-USD) is seen at 1.4777 in mid-April, this is down from 1.5587 at the open of 2015. The maximum in 2014 was up at 1.7179.

The euro to dollar exchange rate (EUR-USD) is at 1.0565, down from 1.2102 at the start of 2015 and a peak of 1.3947 in 2014.

“We begin Q2 on the heels of another ferocious USD rally in Q1. The USD rallied 4% in Q1 of 2015 after rising 10% in H2 of 2014. Very few currencies are keeping pace with the USD. Its movements have dominated the FX landscape, overshadowing other fundamental developments across the globe,” says Greg Anderson, Global Head of FX Strategy at BMO Capital.

BMO Capital have just updated clients with their latest exchange rate forecasts and more gains in the USD are expected.

A Fresh Wave of USD Strength is Forecast

Anderson and his team are pricing in another wave of USD strength in 2015 and, perhaps unsurprisingly, expect the surge to arrive with the first US Federal Reserve rate hike of the upcoming tightening cycle.

As we can see in the below graphic, while recent dollar gains have been impressive, there remains plenty of scope for further advances:

The Canadian bank is expecting the first hike to take place in September and it is pointed out that the USD has had about 2¾ cycles in 43 years of floating rates and USD rallies have lasted 6-7 years.

“We would tentatively put the next wave of USD strength in Q3 rather than Q2. We therefore expect somewhat of a pause in the USD trend during Q2. This USD pause should mean that many pairs will settle within the ranges established in March, although we would expect a lot of choppiness within the ranges due to the lack of liquidity,” says Anderson.

The Pound Dollar Could Rally Now

The timing of a pause in the USD period of strengthening should coincide with key support levels being established in the pound dollar exchange rate which should keep GBP supported.

As we note here there are a number of regions from which the GBP-USD could find support and carve out a recovery rally.

The below historical representations show the potential for a sideways consolidation zone could establish with 1.46 at the bottom and 1.50 at the top.

Key Thoughts on the Upcoming USD Rally

When the next leg higher in the dollar commences, here are some interesting pointers from BMO to consider:

- If the USD appreciation were to continue at the same pace, fair value would be reached in early May

- Now that the USD has returned to ‘parity’ we don’t think it can continue to rally at the same pace

- We expect only about 5% of USD appreciation for the remainder of 2015

- That USD appreciation is likely to come in a 1-3 month burst that straddles the first Fed rate hike

- The case for USD appreciation doesn’t depend entirely on the Fed - it is only enhanced by the expectation of rate hikes

- The biggest case for USD appreciation is twin deficit improvements

- There may be periodic positioning squeezes, but it’s hard to see what would cause the USD to reverse lower

BUT – Will the British Pound be Immune to the USD Rally?

While the dollar has higher to run, forecasts suggest the big moves against the pound sterling may have already come to pass and USD strength may have to be found against other currrencies, primarily the euro.

BMO are forecasting GBPUSD to be trading at 1.45 in 3m and 1.45 in 6m, not too far from current levels.

Anderson is predicting demand for sterling to pick up after the May General Election and demand will grow as we head towards a Bank of England interest rate increase.

With the UK economy growing at a healthy pace a rate increase is all but guaranteed within the next 12 months.

So while the USD is looking bullish, profiting on any advantages would be best achieved using a currency other than the pound.