US Dollar Forecast 2015 - 2016: Where is the Rally's Limit?

Scotiabank have updated their latest forecasts for the US dollar exchange rate complex – while predictions of further gains should be no surprise the question of how far it will extend remains relevant.

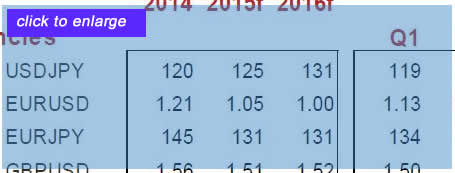

- Forecast table placed at end of article

- You should read this - Morgan Stanley no longer willing to jump on the 'long dollar' trade.

The dollar has seen heightened volatility in mid-March with a rapid decline being seen following the latest update on policy from the US Fed.

However, the impressive recovery that followed in ensuing hours confirms that the markets remain hungry to profit of an extension of the now established uptrend in the dollar family.

Any dips in the USD merely seem to encourage more traders to buy.

Dollar on the Front-Foot

The ascent of the US currency has been impressive with the trade-weighted basket rising from 92 to 99.

Incidentally, the resistance point at 100 appears to be putting up a fight to further gains for the time being. From a technical perspective we should expect the next vigorous leg higher to occur once this point is broken.

The pound to dollar exchange rate commenced the year at 1.5328 and now finds itself at 1.4746.

The euro to dollar exchange rate opened at 1.2002 and has fallen to 1.0689 at the time of publication.

Please note, that all levels mentioned here refer to the wholesale market. Your bank will affix a discretionary spread when transferring money internationally. However, an independent provider will seek to undercut your bank's offer, thereby delivering up to 5% more currency in some instances. Please learn more.

Forecasting Further Gains for the Dollar

The supportive economic conditions for the continuation of the cyclical recovery in the US dollar (USD) remains in place.

On top of this, the USD remains the world’s preferred reserve asset in times of stability and distress.

“We maintain our view that growth and interest rate differentials coupled with systemic liquidity provided by the deep US (debt and equity) securities markets provide a powerful magnet to prolong the US dollarization of investment portfolios in the coming months,” says Neil Tisdall, analyst at Canada’s Scotiabank.

Tisdall and his team at Scotiabank have updated clients with their latest currency forecasts, and the theme of a climbing USD remains central to the outlook.

US Fed Won’t be Stand in the way of a Rising USD

We reported this March that there were concerns that the US Federal Reserve and other policy makers might take fright at the rapid pace of USD appreciation.

Would the Fed then follow the example of the host of other central banks across the world who have taken action on interest rates and other policy levers to depreciate their currencies?

The argument goes that a higher currency depresses the export sector as goods are priced out of the global market.

This dynamic should not hinder the USD advance suggest Socitbank who say the nature of the US economy is such that a strengthening currency is unlikely to impact growth as is the case with the UK:

“The USD has rallied, weighing on the earnings of multinationals and exports; however, the broad US economy is stronger and less reliant on exports than most.

“In addition, the drop in oil prices is stimulative, helping to offset the weight of the USD, leaving the US in a unique position to withstand the impact.”

Meanwhile, the conditions for a pro-USD interest rate rise remain intact as the US economy continues to show healthy growth momentum averaging around 2½% at the turn of the year.

“Consumer confidence and spending are benefitting from sharply lower gasoline prices, rising household net worth, and a significant improvement in labour market conditions,” note Scotiabank.

Forecasts Confirm a Bullish Outlook for USD

The net result of all these underlying dynamics is a continuation of the move higher in the dollar exchange rate complex.

Below is the March FX forecast chart issued by Scotiabank.