New Euro Forecast Sees Four Trillion EUR to Flow out of the Eurozone Come 2016 - 2017

- Written by: Gary Howes

Our latest coverage of institutional euro exchange rate forecasts (EUR) sees massive outflows of currency from the Eurozone are needed for the area’s current account to become sustainable.

At present, the euro area owes the world roughly 10% of its GDP. - Robin Winkler, strategist at Deutsche Bank.

Since the launch of the euro, there has not been such a swift and aggressive meltdown in the currency pair like the one happening now, points out Kathy Lien; Managing Director of FX Strategy at BK Asset Management.

The euro to dollar exchange rate has fallen from 1.21 to close on 1.05. The euro to pound exchange rate (EURGBP) meanwhile trades at 0.7066 down from 0.7767. (A recent recovery rally could see us back at 1.11 before the onset of fresh declines).

The prospect of the euro reaching parity with the greenback, a value not seen since 2002, is on the cards. And, the moves could continue for up to 8 years it is argued.

Weighing on the euro area is the flow of money from the Eurozone to alternative global investment markets.

With European portfolio outflows currently running at record highs, Deutsche Bank asks how long can the outflows continue?

“The answer to this question is critical: the greater the European outflows, the more the euro can weaken and the lower global bond yields can stay,” says Robin Winkler, strategist at Deutsche Bank.

Are you looking to move currency internationally? Keep in mind that the levels quoted here are spot market rates; the retail rate offered by your bank will be lower owing to the spread they apply. An independent provider will guarantee to get you closer to the market, in some cases up to 5% more FX can be delivered. Find out more.

4 Trillion Euros Worth of Currency Must Exit the Eurozone

Trying to figure out just how much money will leave the Euro area depends on how much money is owned by external investors - also known as the net international investment position (NIIP).

Research at Deutsche Bank shows Europe is currently a net debtor to the rest of the world, “or in other words foreigners own more European assets than European investors do offshore,” says Winkler.

At present, the euro area owes the world roughly 10% of its GDP.

Due to a structural rise in saving preferences post-crisis, DB argues that Europeans now have to become net creditors to the rest of the world.

“We find that the Eurozone’s NIIP needs to rise from -10% of GDP to at least 30% for Europe’s current account surplus to become sustainable,” says Winkler.

Deutsche Bank analysis suggests the adjustment requires net capital outflows of at least 4 trillion euros,” equivalent to a continuation of the current pace of outflows for the next eight years,” says Winkler.

Once a mature lender, Europe’s assets abroad will yield stable investment income on the current account.

“Interest and dividends will either be reinvested or spent on imports from the borrowing economies, thus being neutral or even bullish for the euro,” says Winkler.

Why the Pound Sterling and US Dollar will Benefit

The massive shift out of Eurozone assets will require the exchange of currency, the net result a fall in the euro rate against key majors.

The two stand-out winners against the shared currency are the British pound and US dollar.

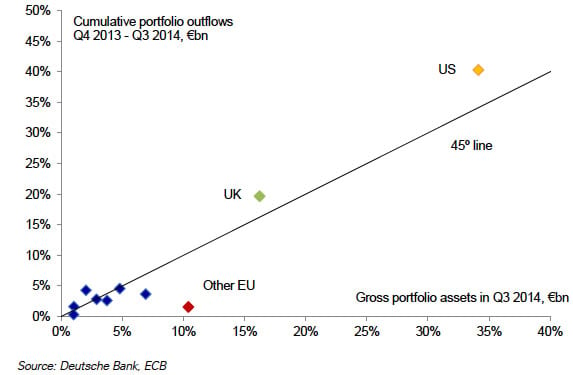

As the below graphic shows, Britain and the United States are by far the most popular destination of Eurozone capital.

“Portfolio outflows from the euro area have been searching for yield overseas. Relative to the allocation of the EMU’s total stock of foreign portfolio assets, recent flows have disproportionately favoured assets in the US, the UK, and Canada,” says Deutsche Bank’s George Saravelos.

Downgraded Euro Dollar Forecasts

As a result of the above-mentioned dynamics Deutsche Bank now forecast the euro to dollar (EUR/USD) will move down to 1.00 by year-end 2015, 90cents by 2016 and down to a trough of 85cents by 2017.

Explaining this longer-term weakness, Saravelos says:

“The current pace of portfolio outflows is double the current account surplus, explaining the recent weakness of the Euro.

“Even if one assumes that the pace of adjustment slows and that it would take a decade for the new NIIP equilibrium to be reached, portfolio outflows would still exceed the current account surplus, maintaining downward pressure on EUR.”