EUR/USD: 1.08 and then Parity Predicted for EUR/USD

After a torrid start to 2015 currency traders will be wary of rebounds in the shared currency but any ticks higher should be seen as an opportunity to sell.

Attention has switched back to the Euro with a sharp sell-off forcing EUR/USD prices nearer targeted support at 1.1000.

"An increasingly oversold near to medium term environment will probably enable the market to re-stabilise temporarily thereabouts but broader technicals are likely to remain negative regardless," note Barclays in a weekly currency forecast note.

At the time of writing we are seeing a hint of the corrective potential in the technically over-sold shared currency playing out with the euro to dollar rate (EUR/USD) rallying off its recent lows and being quoted at 1.1253.

The euro pound exchange rate (EUR/GBP) is meanwhile seen at 0.7449.

A Mere Pause in the Longer-Term Selloff

"Prices are still under significant pressure with no evidence of anything more than an interim floor being put in place despite immediate oversold readings," says Lucy Lillicrap, FX risk management, at AFEX.

The market is within sight of projected 1.1000 area support and this could allow at least some near term stability to return but without evidence of base forming. Re-emergent EUR strength would be viewed as corrective only suggests Lillicrap.

Commenting further, the AFEX analyst tells us:

"Recovery attempts have little obvious resistance until 1.1350 then 1.1500 areas and it is conceivable a range thus forms in coming sessions to allow the extended sell-off from above 1.2500 (prior notable rally peak from mid-December) to be digested.

"However market attention is expected to remain on the downside throughout 2015 and on this basis 1.0500 then 1.0000 areas are likely to attract before any major floor can be put in place again."

Bill McNamara at Charles Stanley is equally negative on the euro / dollar's outlook:

"Although market participants have been anticipating QE from the ECB for some time now the magnitude of the central bank’s asset purchase program managed to achieve an upside surprise and, unsurprisingly, this led to a downside shock for the single currency (which slid to eleven-year lows).

"The Greek election result is likely to destabilize the euro even further in the near term and although it now looks relatively oversold the broader technical picture is pointing towards further weakness, with 1.08 or so as the next downside target."

Tactical Projection: Stay Short on EUR/USD

Barclays, in a weekly FX forecast note tell us they will maintain a tactical short trade on EURUSD:

"We expect the Fed to make few changes to the policy statement on Wednesday and maintain their baseline case of gradual policy normalization starting around mid-2015. This will highlight the contrast with ECB’s dovish policy stance and likely provide additional boost for the USD against EUR. Our technical strategy team also remains bearish on the prospects of EURUSD."

Watch the Yen

An interesting point is made by Barclays in that the Yen will be of importance to future movements in EUR/USD:

"EUR crosses have also weakened significantly with even EUR/JPY breaking a long term ascending series in the past few days.

"This influential cross pair prompted an intermediate reversal higher for EUR/USD in October 2000 and July 2012, both of the previous notable occasions that the single currency was under substantial pressure. Having turned negative again EUR/JPY is expected to constrict any Euro gains elsewhere for several months at least (if not the balance of 2015)."

Elsewhere crucial support for EUR/GBP has now given way with the penetration of circa 0.7700/50 support (1.3000 resistance in GBP/EUR terms) signaling a multi-year top formation.

Thus far the Euro still remains within an overall positive configuration versus SEK but elsewhere the technical picture remains one of at least implied or otherwise outright bearishness. On this basis it is difficult to imagine a sustained EUR bounce being mounted from this projected 1.1000 objective.

"At best an interim low might form but parity appears increasingly to be within reach and may not even hold going forwards either," say Barclays.

Bank of America Downgrade EUR/USD Forecasts

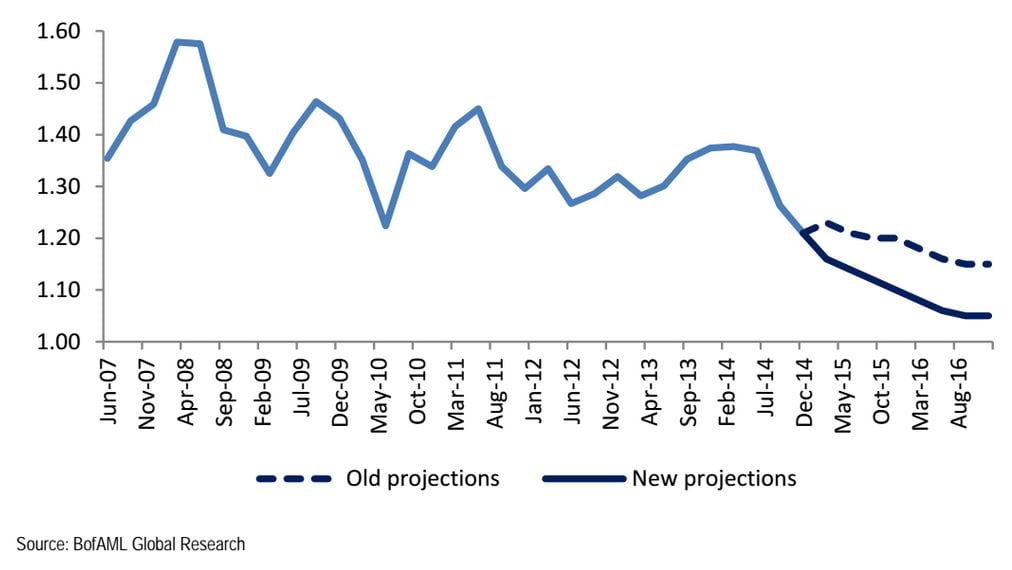

Analysts at Bank of America Merrill Lynch have meanwhile downgraded their predictions for the EUR/USD in light of recent events in the Eurozone:

"A steady-state FOMC statement that maintains a “patient” stance of policy and does not add any dovish language should be supportive for the bullish USD trend seen since the last FOMC meeting.

"The relative strength of the US economy and the policy divergence it fosters is a key reason we have a bullish USD stance in 2015. Inflation remains weak, and market-based measures of inflation expectations have continued to decline (alongside developed market peers). But, importantly, our expectation for healthy 3.5% growth for 2015, the unemployment rate dropping to the low 5% range, and some pickup in wages, all point to rate hikes sometime in 2015, and potentially by June if "activity surprises to the upside and core inflation does not fall further.

"There are clearly risks around this call, but for FX, a shift in the first hike by a meeting or two will not change the trajectory of policy divergence we expect to be a key USD support."

BUT - The Shared Currency is Now TOO Weak

While BofA say they have downgraded their view for the euro, it may have overshot the mark and parity in EUR/USD should not occur:

"The Euro has weakened in response to the ECB and could have weakened more if it were not for the already very short market position.

"We have been bearish EUR/USD, but the Euro has now weakened beyond our expectations. In early 2014, we had expected the Euro to weaken, as the deterioration of the Eurozone outlook would force the ECB into unconventional policies.

"The ECB was already late, being the only major central bank to avoid QE during the global crisis. The ECB ignored the negative signs in the first half of 2014, leading EUR/USD to 1.40.

"Since May, the ECB started addressing deflation risks, but remained behind the curve. As the market started pricing in the inevitability of QE, EUR/USD finally started to weaken.

"We are now projecting EUR/USD at 1.10 by the end of 2015 and 1.05 by the end of 2016, a change from 1.20 and 1.15, respectively, before. We still see a gradual weakening of the Euro, as Fed and ECB monetary policies diverge. After this week’s ECB policy announcements, we do not expect any aggressive further steps for the rest of the year.

"Data and inflation expectations, as well as short-term and long-term rate differentials suggest that EUR/USD is too weak.

Eurozone data could improve as the weak Euro, low oil prices, and positive spillovers from fast growth in the US start to positively affect the Eurozone economy.