Australian Dollar: ANZ Forecasts Warn AUD Remains Overvalued

- Written by: Will Peters

An expensive Aus dollar could ultimately fall lower say exchange rate forecasters at ANZ Research who confirm the currency is punching above its weight.

We publish ANZ's latest findings on the AUD as the Deputy Governor of the Reserve Bank of Australia, Philip Lowe, expresses concerns that the overvalued currency is proving counter-productive to efforts to rebalance the Australian economy away from mining.

How Australia copes with this transition remains a key anxiety for policy makers and economists - it is argued that a strong currency will stifle non-mining exports and thus compromise the economy in the long term.

The impact of Lowe's speech proved negative on the currency, at the time of writing we see the effects are still with us:

- The pound to Australian dollar exchange rate (GBP/AUD) is at 1.8358.

- The euro to Aus dollar exchange rate (EUR/AUD) is at 1.4533.

- The Australian to US dollar rate (AUD/USD) is at 0.85839.

- The Australian to New Zealand dollar (AUD/NZD) has fallen to 1.0883.

Note: The above market rates are not available for international payments as your bank will shift the rate in their favour. However, an independent FX specialist will undercut your bank's offer, thereby delivering as much as 5% more currency in some instances. Find out how.

Furthermore, by placing stop-loss and buy orders a specialist will help protect you against the worst-case currency movements ensuring your currency goes further.

Lowe: AUD Exchange Rate Too High

The Deputy Governor of the Reserve Bank of Australia, Philip Lowe, has told markets that the Australian exchange rate regime remains overvalued by historical standards.

The news prompted a sharp bout of weakness that has allowed the British pound to advance through the 1.84 level once more.

"If the exchange rate is to play its important stabilizing role, it needs to go down when the terms of trade and investment are declining, we have seen some adjustment, but if our assessment of the fundamentals is correct we would expect to see more in time,” said the deputy governor.

The rhetoric on the high exchange rate has prompted a fresh bout of AUD selling pressure as traders often take such talk as a warning of possible FX market intervention.

Long-Term, Aussie Dollar is Overvalued

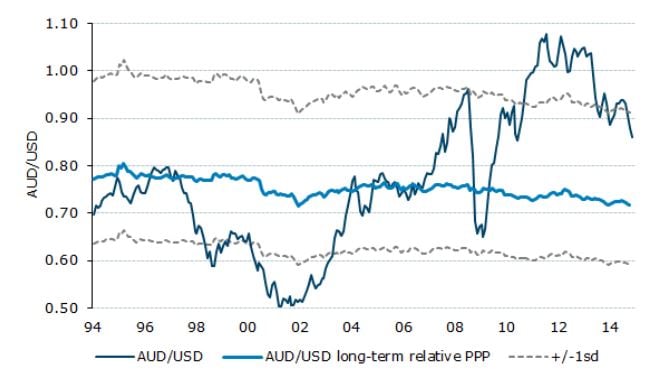

The below graph provided via ANZ Bank shows quite graphically why the Australian to US dollar exchange rate can be considered overvalued in a long-term basis.

The implicit assumption is that the exchange rate should ultimately fall and therefore revert back to longer-term trends.

ANZ Research: Forecasts for Aussie Currency Lowered

Looking at the above image it must be noted that a comparison is made on where the AUD/USD currently lies in terms of historical purchasing parity levels.

Purchasing parity suggests an exchange rate must ultimately ensure the cost of goods in two different countries must ultimately align.

According to ANZ's Daniel Been:

"Parity (PPP) models are suggesting the AUD should be closer to USD0.70. This looks too bearish as it does not wholly account for the structural uplift in the AUD from the shift in global growth towards Asia. But it does set a base for understanding where the distribution of risks lies, should the cyclical slowing in China worsen."

The fact that these long term anchors remain at significantly lower levels, and that ANZ Research does not anticipate marked improvement in key commodity markets in 2015 reinforces a view that the AUD should be trading at lower levels.

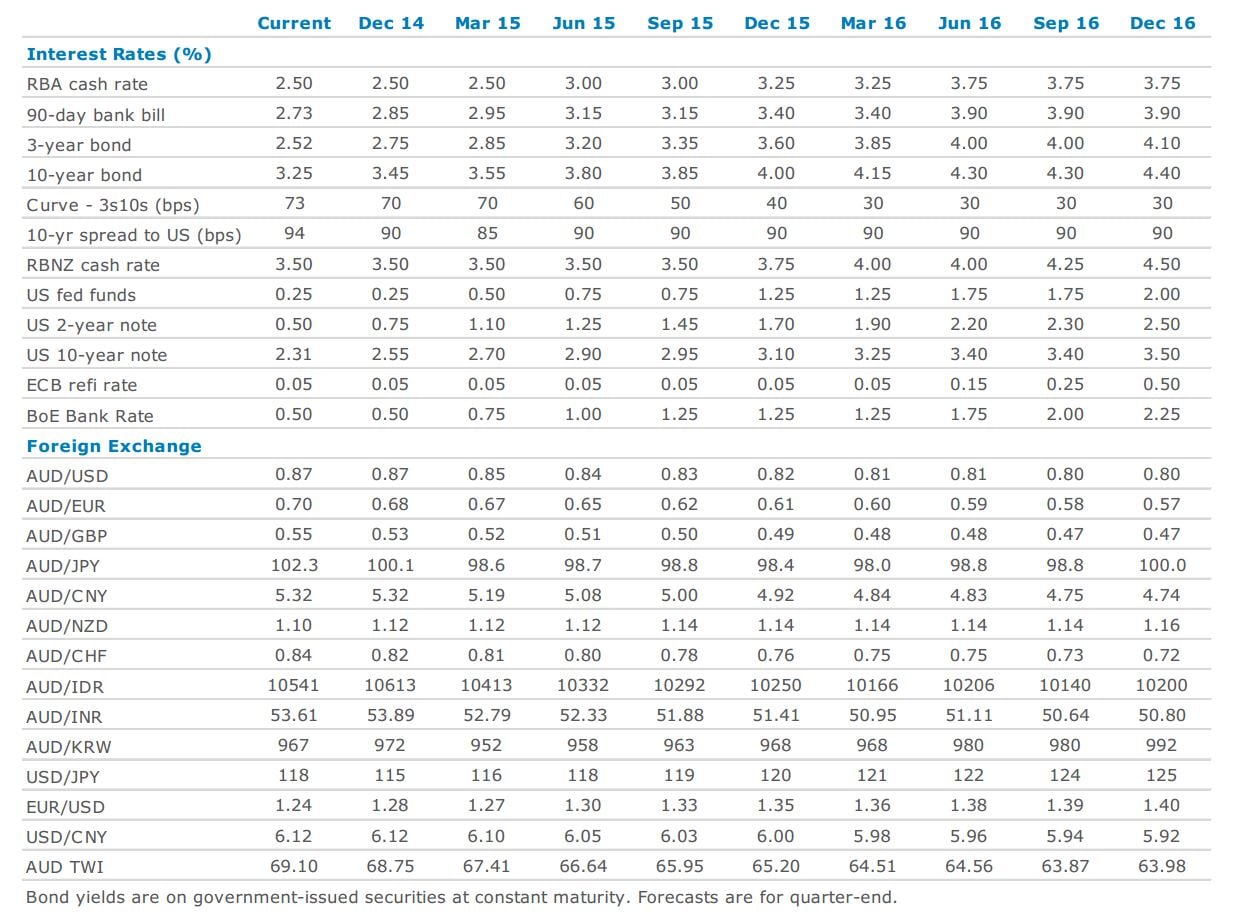

"We revised down our 2015 year-end AUD target from USD0.85 to USD0.82 and December 2016 target to USD0.80," says Been.

British Pound to Aus Dollar Forecast

"As the BoE resolves what to do with rates, the cross will be volatile. Strong fundamentals in the UK will drive GBP outperformance," says Been.

China Interest Rate Cut Won't Save the AUD

Regarding the recent decision by China's central bankers to cut their base rate, we note that there is unlikely to be any major boost for the AUD.

ANZ Research tell us:

"The interest rate cut in China does not materially change the outlook for the AUD. It was a signal that current levels of growth were not sufficient to meet the official target, but the challenging leverage dynamics in the economy mean that it is not a lever that can be pulled for too long - at least not without the market questioning the long term sustainability of China's growth."