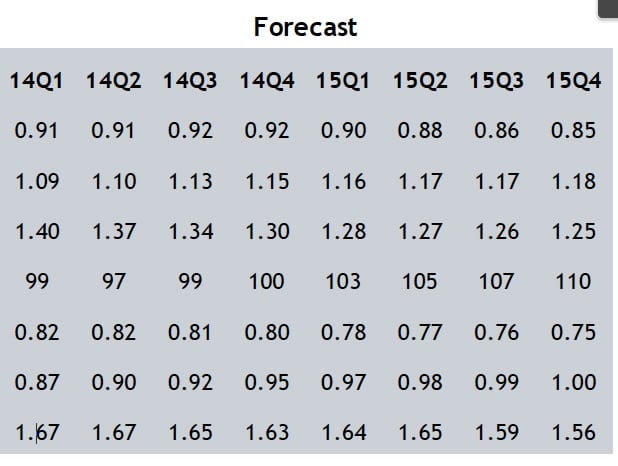

Canadian Dollar Forecast: A Better End to 2014 Predicted, GBP-CAD at 1.56 Year-End

The Canadian Dollar exchange rate complex (Currency:CAD) is forecast to see an easing back of the downward pressures currently being exerted in the latter half of 2014.

According to the latest exchange rate forecasts at RBC Economics 2014 is a year of two halves, a theme that echoes that held in the 2014 forecasts at TD Securities.

Fresh pressure has been exerted on the Canadian, Australian and New Zealand dollars which sold off aggressively on the 19th of March on the back of the FOMC rate decision. "Investors cared little about relative monetary policies they just sold everything in sight. The CAD was the worst performer but AUD and NZD were not far behind," says Kathy Lien at BK Asset Management in response to news that the US Fed has set out clear timelines for rate rises.

(Please note that all FX references here are in relation to the wholesale interbank market. Your bank will affix a spread at their discretion when delivering retail rates for international payments. However, an independent provider will seek to undercut that offer, and can deliver up to 5% more currency in many cases. Find out more here.)

Canadian dollar feels the heat in 2013/H1 2014

It has been a tough period for the CAD as of late, the weakening in Canada’s currency took on speed in late 2013 as markets pushed expectations of interest rate hikes further into the future, commodity prices stalled and foreign purchases of Canadian securities slowed.

After slowly losing ground against the US dollar for most of 2013, the Canadian dollar’s downward momentum increased in late October when the Bank of Canada removed its tightening bias.

Stabilisation Ahead, Any further weakening reflective of US dollar strength

However, the remainder of 2014 should see some stabilisation say the forecasters at RBC:

"In January, the currency lost another 2.9% against the US dollar. The sharp selling pressure stalled in February and although we expect further Canadian dollar weakness ahead, the pace will likely be much slower with the residual weakening more a reflection of US dollar strength than any made-in-Canada factors.

"That said, we expect the Canadian dollar to trade at 87 US cents at the end of 2014 and 85 cents at year-end 2015.

"A weaker Canadian dollar enhances the competitiveness of Canadian goods in the US market with a 10% depreciation historically boosting export volumes by 3.3% in the following two years."

Pound sterling vs CAD to hit 1.56 at year-end 2015

Canadian exporters to benefit from weaker currency

Part of the reason the Canadian dollar will see an improving outlook is thanks to the Canadian export sector.

The export sector has had a tough time in recent years coming under the thumb of a stronger Canadian dollar.

To-date Canada’s export sector has significantly lagged other areas of the economy and underperformed previous recovery cycles.

At the end of 2013, export volumes were still 5% below their pre-recession peak.

This is in contrast to all other sectors of the economy which eclipsed their recent highs.

Consumer spending on goods and services and residential investment stood 10.5% higher while business investment rose 7.6%.

RBC say:

"Part of the export sector’s underperformance is directly attributable to the subpar US recovery though there were also competitiveness issues that weighed on growth.

"In our view, it is the changing fortunes of the both the US economy and the Canadian currency that will act as catalysts for stronger exports in the year ahead."