Commerzbank Exchange Rate Forecast Update: Dollar Upgraded amid Sweeping Downgrades of Other Majors

- Written by: James Skinner

Commerzbank HQ dominates the Frakfurt skyline. Image © Andre Douque, reproduced under CC licensing conditions

- USD decline delayed by global weakness in new forecasts.

- EUR outlook weaker on combination of ECB and Fed policy.

- GBP forecasts cut radically as 'no deal' Brexit threat grows.

- AUD forecasts cut after RBA hits Aussie yields, AUD appeal.

- Best in class CAD continues to stand apart from G10 crowd.

Commerzbank has downgraded many of its exchange rate forecasts after most major currencies defied earlier projections as well as the market consensus during the first half of the year, leading the German lender to push back a still-anticipated trend change for the big Dollar.

Europe's single currency is still expected to recover from the trough recently carved out back in July, although the upturn is now expected to be even slower in the making than earlier forecasts had suggested. And the script for Pound Sterling's Christmas time recovery of post-referendum losses has been all-but torn up, with the British currency now seen clinging to recent lows into year-end as fears of a 'no deal' Brexit roil markets.

Meanwhile the Australian Dollar recovery from a punishing 18-month period of losses, which has seen it fall by a double-digit percentage relative to the U.S. greenback, is no longer expected to happen. Instead, the Antipodean unit is forecast to plumb new lows next year as Reserve Bank of Australia (RBA) interest rate cuts drive the bond yield differential even further into negative territory and as the damaging U.S.-China trade war rolls on.

All of these downgrades for individual G10 currencies explain why the long anticipated, but ever-elusive, decline of the big Dollar from muli-year highs has been pushed back again. In short, the greenback will be unable to fall so long as there's a shortage of other worthwhile things for investors and traders to buy elsewhere in the world.

The Dollar is now seen remaining stronger for longer, which is another blow for a market consensus that once strongly envisaged a capitulation quite some time before now. Below is a selection of Commerzbank's views on what this environment is likely to mean for selected individual exchange rates. Details of earlier forecasts from the first quarter of 2019 can found on the linked webpage.

The Dollar index was up 0.03% at 98.37 Tuesday and by 2.45% for 2019, while Sterling was 0.48% lower at 1.2070 against the Dollar and has fallen 5.26% this year. The Euro was down 0.02% at 1.1079 and has fallen 3.36% in 2019.

Above: Commerzbank G10 exchange rate forecasts.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

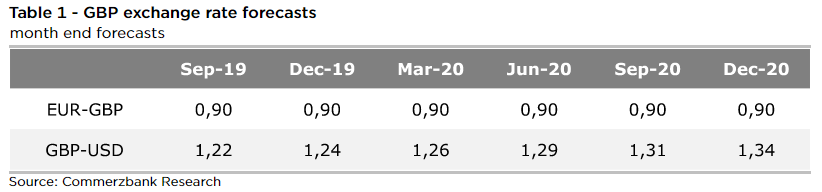

Pound Sterling

"The market is increasingly concerned that Prime Minister Boris Johnson might force through a no deal Brexit on 31st October which is putting pressure on Sterling."

"There is the possibility that Johnson is only bluffing in the hope that (a) the EU will cave in at the eleventh hour, that (b) the House of Commons will only reach an agreement in the face of a no deal threat and / or (c) he will be able to attract votes from Brexit Party voters in possible early elections as a proven (albeit failed) Brexiteer. However, this bluff theory is questionable...it remains quite possible that Parliament will prevent a no deal even against a Prime Minister who is serious about it."

"It is impossible to provide a reliable forecast as to how things will develop politically over the coming two months. The current GBP levels reflect a higher likelihood of a no deal scenario, but are not likely to have fully priced in this scenario yet. If we really do see a no deal Brexit at the end of October we might well see a further 10% GBP depreciation."

Above: Commerzbank exchange rate forecasts.

AA

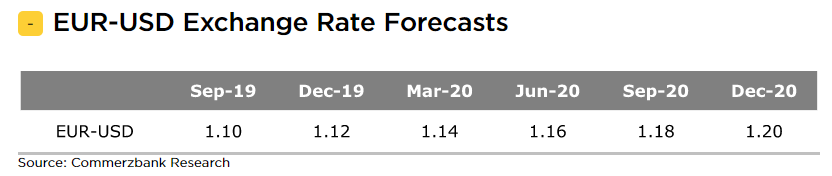

Euro and U.S. Dollar

"The Fed has already cut its key rate once, despite a still sound economy, and a further 50bp are likely to follow this year. At the same time the ECB has announced new expansionary steps. We expect the following for September. (1.) a 20bp rate cut, (2.) the introduction of tiered interest rates and (3.) the resumption of the ECB QE program."

"A choice between a rock and a hard place. But what will have the more pronounced effect? In my view there are three reasons why the dollar will end up coming under more pressure in the end...Even if the ECB has a stronger reason to become expansionary it will not manage to keep up with the Fed. It will be unable to implement economically relevant rate cuts."

"We are convinced that the ECB is running out of expansionary measures imminently should not cause any sustainable EUR weakness even if these measures are announced. However, we have to admit that the market sees things differently right now. We cannot assume that it will fundamentally change its view by mid-September. We therefore expect the euro to suffer as a result of ECB policy until the end of September."

Above: Commerzbank exchange rate forecasts.

AA

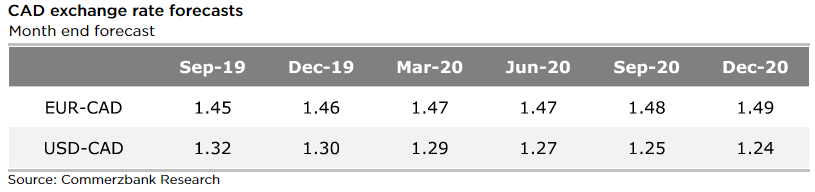

Canadian Dollar

"The Canadian dollar is being supported by the robust economy and positive inflation developments. However, as a result of globally falling interest rates the Bank of Canada will probably be unable to avoid rate cuts - and implement these earlier than previously assumed (forecast change)."

"Even though the BoC maintained its neutral approach at its meeting in July, the trade conflict between the US and China intensified in early August. Canada, as a close trade partner of the US, could potentially be seriously affected by an escalation of the trade conflict. In case of increased risk aversion and fears of a global recession there is also the risk of the oil price remaining under pressure, further dampening growth prospects."

"The BoC is likely to abandon its neutral approach soon and consider a first rate cut. Similar to the Fed’s step it would probably constitute a preemptive measure so as to cushion possible downside risks for the economy resulting from the trade conflict. We now assume that the BoC will implement a first rate cut as early as the autumn."

"The Canadian dollar is nonetheless likely to appreciate against the US dollar, as the Fed is the more “active” central bank that will cut interest rates earlier and more quickly. The BoC is likely to welcome the fact that CAD will appreciate only moderately, as excessive appreciation might put pressure on the export sector."

Above: Commerzbank exchange rate forecasts.

AA

Australian Dollar

"The escalation of the trade conflict between the USA and China changes everything. Also for the AUD. We now expect lower AUD-USD levels for the time being and have revised our forecast accordingly."

"While the RBA saw only a limited need to adjust its outlook in August, we do see substantial downside risks. The reason for this is that the escalation of the trade war between the US and China - the announcement of US punitive tariffs on all imports from China and the clear reaction of the Chinese government and the Renminbi to this - in our view justifies a reassessment of the global environment. China is now openly preparing for a prolonged trade war."

"The clear warning given by RBA Governor Philip Lowe as part of the new monetary policy report in August: the interest rate could fall even further. Without ambitious steps by the government to support productivity, it does not rule out zero interest rates and unconventional monetary policy measures. We do not consider such drastic measures necessary at present. Nevertheless, we also see the risk of further rate cuts in the short term."

"Interest rate cuts by the RBA and a highly uncertain outlook for China will continue to put downward pressure on the AUD. This is particularly true against the euro, as we see only very limited options for further expansionary measures by the ECB, which is unlikely to be sufficient to weaken the euro in the long term. On the other hand, the depreciation against the US dollar should come to an end at some point."

Above: Commerzbank exchange rate forecasts.

AA

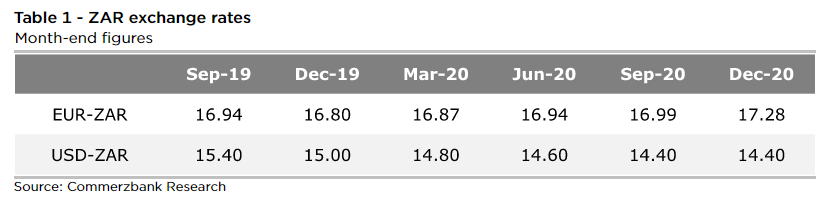

South African Rand

"The rand is amongst the biggest losers of the recent depreciation trend among many EM currencies as a result of falling global risk appetite. In addition to the Fed rate decision in July the recent escalation of the US-Chinese trade conflict was the main cause that spoilt risk appetite amongst investors. Moreover there are considerable domestic risks....We have adjusted our forecast, but remain cautiously optimistic for the ZAR outlook."

"A significant risk for our ZAR exchange forecasts centres on the possibility of South Africa’s sovereign rating being downgraded to junk at a rating review in early November. In that case we might see massive outflow of capital and rand depreciation. Conversely there is considerable potential for a recovery of the rand if risk appetite on the market recovers more significantly and quickly than expected."

"The economic recovery hinges on the restructuring and re-organisation of the debt-ridden national corporates and above all the electricity suppliers. The Ramaphosa government has promised to present detailed plans on this in September. The government is under pressure, and other areas also desperately need reform. In the meantime economic indicators continue to paint the picture of an economy that is lacking investment and that is on the edge of a recession."

Above: Commerzbank exchange rate forecasts.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement