MUFG Exchange Rate Forecasts: GBP, EUR and AUD to Rise as USD Falls

- Written by: James Skinner

© kasto, Adobe Stock

- USD to decline as Federal Reserve hikes at slower pace in 2019.

- Enabling GBP, EUR, AUD and NZD to recover ground lost in 2018.

- But other risks mean 2019 will not be entirely a one-way street.

The U.S. Dollar is in retreat from its 2018 highs and will remain so throughout this year, according to the latest forecasts from MUFG, enabling currencies like the Pound, Euro and Australian Dollar to recover from earlier losses.

Federal Reserve (Fed) policymakers revealed a change of heart on the outlook for U.S. interest rates in December when they used a Federal Open Market Committee dot-plot and that month's policy statement to signal that they will be slower raising interest rates this year.

This was widely perceived as a death knell for the days of U.S. economic exceptionalism, which had enabled the Fed to raise rates four times last year as economies elsewhere slowed and the respective central banks stood pat.

Since then markets have begun speculating that rather than raising interest rates again this year, the Fed could actually begin to cut them before the curtain closes on 2019. That speculation was further encouraged by FOMC member Raphael Bostic Wednesday, prompting a sell-off in Dollar exchange rates.

Markets care about monetary policy because of the push and pull influence that changes in rates can have on international capital flows, as well as their allure for short-term speculators.

Decisions of the Federal Reserve are important for all global markets given the Dollar's status as the global reserve currency. Like with all central banks, those decisions are normally only taken in response to movements in inflation.

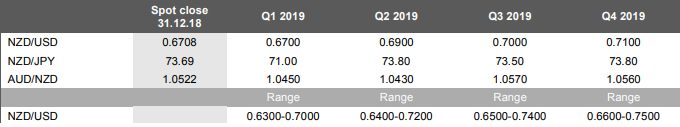

It is this new global interest rate dynamic that is behind all of MUFG's forecasts for the 2019 year. Below is a selection of tables and quotes detailing what the current environment will mean for individual exchange rates.

The U.S. Dollar index was quoted -0.56% lower at 95.37 Wednesday, with losses broad-based across currency pairs. The Pound-to-Dollar rate was 0.14% higher at 1.2759 while the Euro-to-Dollar rate was up 0.59% at 1.1524.

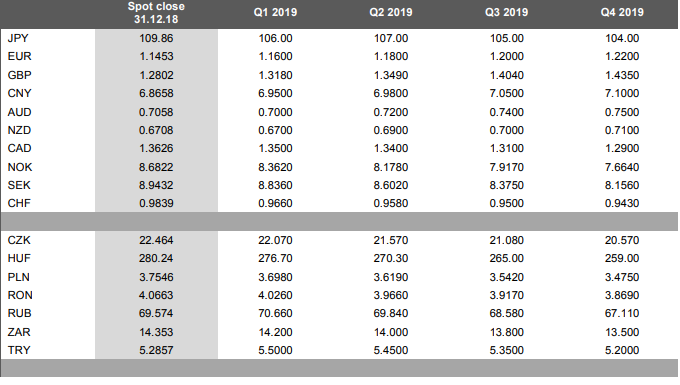

Above: Table of MUFG exchange rate forecasts.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Pound Sterling

"We now assume PM May’s deal is rejected, followed by an extension to Article 50, followed by either a shift to a Norway-type trading deal or a 2nd referendum. Whatever the outcome, the avoidance of a ‘no-deal’ Brexit on 29th March will prompt GBP appreciation this year."

"Abandoning Brexit would fuel greater appreciation than we assume while a ‘no-deal’ Brexit would see much weaker levels – a scenario we attach a 10% probability to."

"A collapse of the government and fresh elections we also assume will be avoided. That too would prompt a period of much weaker GBP given investor fears of a Labour-led coalition would more than offset any positive GBP impact from Brexit being halted."

"Because our scenario now assumes Brexit uncertainty is likely to continue beyond 29th March (albeit more of hope of a softer Brexit) we have taken out one of the rate hikes we assumed for 2019 – a May rate hike now seems too close to a period of pronounced uncertainty that has likely done near-term damage to the real economy."

"We assume enough clarity on a softer version of Brexit will exist by summer time thus prompting the BoE to hike by 25bps in August."

"Ultimately, we assume the removal of the current Brexit uncertainty, which will prompt a period of pound appreciation as the year unfolds."

ff

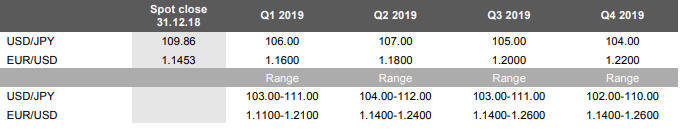

U.S. Dollar

"On a DXY basis, the dollar advanced by 4.4% in 2018, partially reversing the 9.9% drop recorded in 2017...Concerns over the sustainability of growth in the US limited the scale of dollar strength as well."

"We view those concerns as understandable and likely to persist. After raising rates on four occasions last year, we expect the FOMC to act much more cautiously this year and expect a 6-month pause now until June before the fed funds rate is raised again and then a further 6-month pause until December."

"We see the risks to the Fed raising rates less than twice as much greater than the Fed raising rates more than twice."

"Political uncertainty is of course part and parcel of the Trump presidency but nonetheless, these uncertainties could be much higher this year than last year. A Democrat controlled House could fuel partisan politics especially if the Mueller investigation findings (expected in February) are damning."

"We see a less favourable backdrop for the dollar this year and are forecasting a reversal of the 2018 gain and some more. Our current DXY-related currency forecasts imply a 6.3% dollar depreciation this year."

f

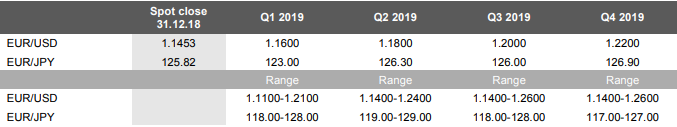

Euro

"While the euro weakened in 2018, the performance relative to other G10 currencies was still impressive. After being the top G10 performer in 2017, the euro was the third best performing G10 currency versus the US dollar last year – the yen and Swiss franc were first and second."

"We expect the weak phase of economic activity to prove temporary and hence expect economic growth to rebound. The European Commission estimates that fiscal stimulus this year will be the largest since the Great Financial Crisis with Germany, France, the Netherlands and Italy providing much of the stimulus. In addition, the strongest nominal wage growth since 2008 will help support household spending."

"Secondly, the resolution to the budget quarrel between Rome and Brussels should help to create some rebound in activity. Thirdly, we do not expect a ‘no-deal’ Brexit and a shift to a softer Brexit will also help to create some additional positive momentum for the euro-zone economy."

"With economic growth set to rebound we continue to expect the ECB to hike at the final meeting of the year in December. While rate spreads will remain substantially in favour of the US, the prospect of the first ECB rate hike coupled with the euro-zone’s substantial current account surplus will help provide EUR/USD with support. We doubt the EU elections, scheduled for May will have any lasting influence on the direction of EUR/USD this year."

f

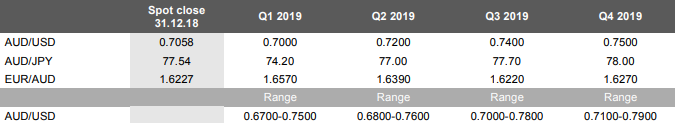

Australian Dollar

"The Australian dollar spent much of 2018 being influenced as much by global growth expectations as it did by expectations on the outlook for the domestic economy. Domestic economic conditions were broadly stable but AUD/USD trended lower through much of the year, which we believe reflected the worsening outlook for the global economy and particularly concerns over slower economic growth in China."

"Domestically, the economy continued to remove spare capacity in the labour market with the unemployment rate drifting down from 5.6% at the end of 2017 to 5.0% in November – the pace of employment growth slowed from 379k in the year 2017 to November to 252k this year. This will add to RBA confidence that wage growth will strengthen and back up the view of the RBA that the next rate move is “more likely” to be a hike."

"However, global conditions may well mean the RBA remains on hold for all of 2019. Real GDP data for Q3, released in December, slowed more than expected from 0.9% Q/Q in Q2 to 0.3%. China data in December also point to downside risks in the Asian region which adds to the prospect of the RBA remaining on hold."

"Still, we assume some modest appreciation this year given our assumption of no major escalation in trade conflict between the US and China and given the more cautious policy outlook in the US. That should allow for some AUD strength, albeit, very modest."

f

New Zealand Dollar

"Like the Australian dollar, the New Zealand dollar trended weaker through much of last year before rebounding toward year-end, in part on increased optimism over a resolution to the trade policy conflict between the US and China."

"While rate spreads have not been a consistent driver of NZD/USD, the steady widening of the 2-year swap spread in favour of the US clearly acted to drag NZD/USD gradually lower. That spread turned higher in November and December which helped drive NZD/USD recovery."

"Our view of a more cautious Fed in 2019 implies less cyclical support for the dollar generally, which reinforces our view of further modest NZD appreciation this year. Appreciation is likely to be modest given the RBNZ could well remain on hold throughout all of this year – but this view is already consistent with market pricing."

"In December, the RBNZ announced plans to require NZ based banks to almost double the minimum amount of capital required to hold in order to protect against future risks of turmoil. Such an aggressive step, albeit over a probable 5yr period, could raise the cost of borrowing and encourage RBNZ monetary caution. This will limit the scale of NZD appreciation."

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here