Barclays 2019 Forecast Update: U.S. Dollar to Remain Dominant as Brexit Weighs on GBP

- Written by: James Skinner

© Pound Sterling Live

- Brexit to weigh on GBP as market lacks confidence in BoE outlook.

- USD to remain overvalued, dominating G10, as Fed climbs higher.

- EUR to see new lows and remain depressed as ECB outlook darkens.

The Dollar will remain the dominant force in the currency market next year and Pound Sterling will succumb to another dose of 'Brexit uncertainty' while the Euro reaches new lows, according to the latest forecasts from Barclays.

America's Dollar is on course this December to record a near-double digit gain for 2018, after having reversed what was once a 4% first-quarter loss to then clock up a 5% gain, while Sterling has suffered another bout of Brexit-related losses and political risks have returned to jilt Europe's single currency.

The greenback emerged resurgent from its first quarter malaise after it became clear the U.S. economy was gathering pace just as growth elsewhere had begun to slow. That enabled the Federal Reserve (Fed) to raise its interest rate repeatedly as other central banks moved only slowly, if at all.

Next year will offer more of the same, Barclays says in its 2019 outlook, as the Fed drives the Dollar to new levels of overvaluation and political factors keep Sterling and the Euro on the proverbial back foot. Barclays says the Fed will go on raising its interest rate in a sustained manner next year, contrary to what other forecasters have begun to anticipate.

Elsewhere in the developed world, the Canadian, New Zealand and Australian Dollars will continue to take their cues from the U.S. greenback and commodity prices. All of those things will in turn, be sensitive to developments in the so-called trade war between the U.S. and China. That trade war is set to rumble on in the New Year too, Barclays says.

Below is a selection of views from the Barclays team outlining what all of this could mean for individual exchange rates next year.

The Dollar index was quoted -0.21% lower at 96.98 Tuesday but is now up 5.1% for the 2018 year overall. It has risen more than 9% since the beginning of April.

The Pound was 44% higher at 1.2613 against the Dollar but is down -6.5% in 2018, while the Pound-to-Euro rate was 0.19% higher at 1.1079.

The EUR/USD rate was up 0.26% at 1.1385 but is down -5.1% this year, and the EUR/GBP rate was 0.16% lower at 0.9026 but has risen 2% in 2018.

Above: Barclays exchange rate forecasts.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

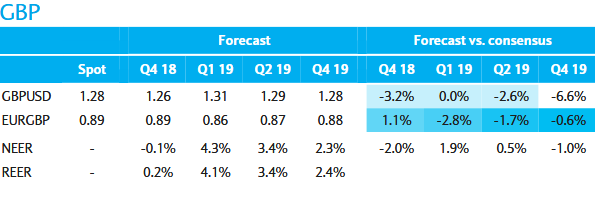

Pound Sterling

"Brexit risk will predominantly drive sterling over the coming quarters, in our view. Under our base case that the Withdrawal Agreement is eventually ratified by the UK Parliament, most likely in Q1 19, we see EURGBP depreciating towards 0.86, reducing part of the negative risk premium embedded in the pound."

"We expect the positive momentum for sterling to persist for a quarter or so, but start modestly reversing, given mixed UK data, uncertainty about the outlook of the UK’s trade relations with the EU and the lack of market confidence in the BoE’s hiking path."

Above: Barclays exchange rate forecasts.

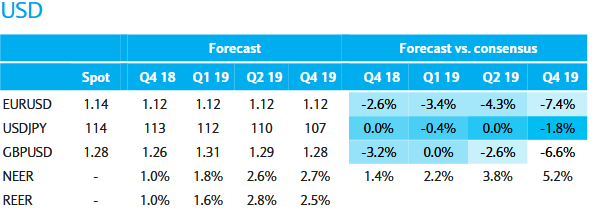

U.S. Dollar

"We expect the USD to sustain its high-level– ie, overvalued –range trade against other G10 FX while continuing to grind higher versus more challenged EM currencies. As in recent months, we expect the USD’s modulation vs. other G10 to reflect the ongoing tension between the high valuation of the greenback and US assets and the growing interest rate advantage of the dollar as US rates further diverge from G10 peers."

"As confidence in the US expansion waxes and wanes, we expect the USD alternately to trade towards range highs and lows. With markets underpricing the Fed, in our view, and overly exuberant on trade tensions, we expect the USD to rebound towards the upper end of its range early in 2019 as the likelihood of sustained Fed hikes becomes more apparent."

Above: Barclays exchange rate forecasts.

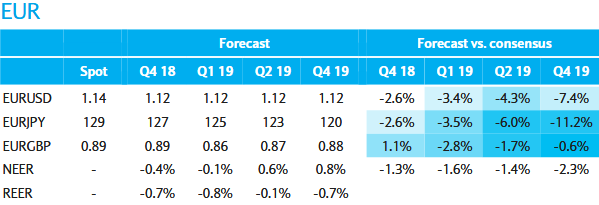

Euro

"We project EURUSD depreciation towards 1.12 into year-end and broad stability thereafter as markets balance the USD’s increasing carry returns with its overvaluation."

"We think markets have overreacted to the subtle change in recent Fed rhetoric and still envision gradual, quarterly Fed rate hikes. In contrast, we think risks to the EUR are still skewed to the downside, given pronounced weaken ing in data and residual uncertainty surrounding Italian politics. Core EA inflation remains low and will likely be lowered in the ECB’s projections, implying only very gradual normalization in monetary policy in 2019."

"Finally, a potential no-deal Brexit adds further downside risks to our EUR view, given the UK’s deep integration into the EU economy and supply chains. An eventual Brexit agreement would likely lift the EUR somewhat, but we expect any rally to be contained."

Above: Barclays exchange rate forecasts.

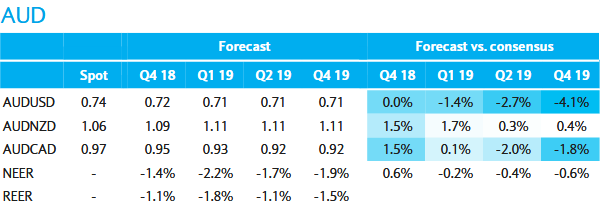

Australian Dollar

"We continue to forecast AUDUSD depreciation over the coming year, but robust economic activity and a positive output gap should limit declines from a point where the currency is inexpensive. The AUD is trading around its long-term average on a real effective exchange rate basis and is close to our short-term fair value estimate. However, an undershoot of fair value is likely, as Australia remains vulnerable to higher US yields, given high household debt and a structural reliance on global savings, along with escalating US-China trade tensions."

"Net AUDUSD positioning for Barclays real money and leveraged clients remains close to its shortest level this year and AUDUSD risk reversals suggest FX options may be being used to hedge these positions with the premium for puts over calls relatively low versus history. We maintain our view that AUDNZD should trade higher towards 1.11 over the coming quarters but that gains may be capped by an intensification in US-China trade tensions, since the AUD is a more popular China proxy (partly because of superior liquidity)."

Above: Barclays exchange rate forecasts.

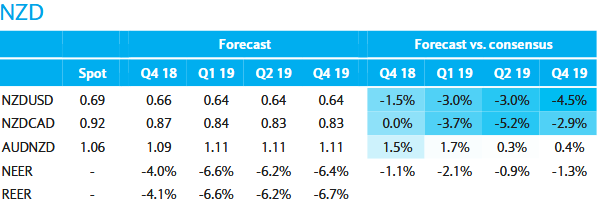

New Zealand Dollar

"A large drop in Q3 unemployment (0.5pp, to 3.9%) and a less dovish RBNZ policy stance have supported recent NZD appreciation, but we expect a reversal in the coming quarters."

"Demand-pull inflation pressure remains non-existent. The output gap is around zero, growth is below potential and wage inflation is subdued, despite ongoing increases in minimum wages. The Labour Cost Index (the best measure of like-for-like wages) increased just 1.8% y/y in the September quarter (average since 2000 is 2.2% y/y)."

"Business confidence is close to post-crisis lows, given uncertainty related to government policy and high production costs. More worryingly, reported activity (which has a strong relationship with GDP) is particularly subdued."

"New Zealand, like Australia, remains vulnerable to higher US yields, given high household debt and a structural reliance on global savings."

Above: Barclays exchange rate forecasts.

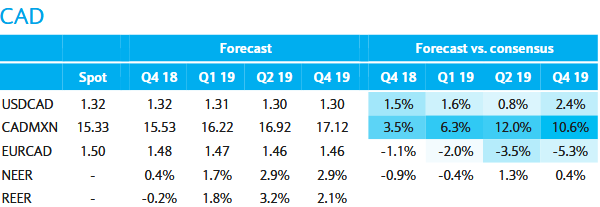

Canadian Dollar

"We expect CAD appreciation in H1 19 as oil prices retrace recent losses and forecast the loonie to remain relatively stable vs. the USD afterwards, as resilient economic activity and the BoC hiking cycle should support the currency. The CAD is now below its long-term REER average, and we expect continued rate hikes to support it relative to other G10 commodity currencies."

"The market has pared down expectations of BoC hikes, following US rates down, and pricing seems more in line with our

expectations of three hikes in 2019, with risks of fewer, reducing the risk of BoC disappointment weighing on CAD. Additionally, we see the loonie as having less direct exposure to China and other likely targets of US trade protectionism."

"There is limited space for CAD appreciation, however, as oil prices are unlikely to return to the high levels during the 2018 peak, while uncertainty surrounding the final ratification of the USMCA in the US Congress remains."

Above: Barclays exchange rate forecasts.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here