MUFG Exchange Rate Forecast Update: USD to Decline while GBP, EUR and AUD Edge Higher

- Written by: James Skinner

© kasto, Adobe Stock

- USD set to lose strength, offering breathing room to others.

- Trade war developments, midterm election both USD headwinds.

- GBP, EUR and AUD will rise before year-end, NZD is sidelined.

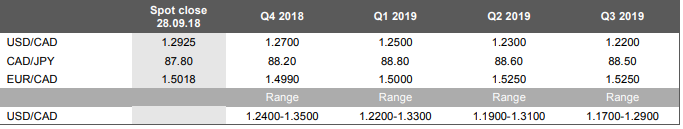

The U.S. Dollar could struggle to extend its gains over the coming months, according to analysts at MUFG, who forecast that the greenback will cede ground to a number of it developed world rivals before year-end.

MUFG's forecast update comes at the tail end of a month where strength in the Dollar index began to wane, with the benchmark sitting largely unchanged at the end of September after rising around 7% during the six preceding months.

The main source of the Dollar's lacklustre return was a market perception that President Donald Trump's "trade war" against China would not, after all, have an immediate destructive impact on international markets.

Chinese Premier Li Keqiang said last month the People's Bank of China would keep the Renmimbi stable, rather than allowing it to depreciate, which had a soothing impact on risk-senstive currencies like the Australian Dollar and those in emerging markets. That helped to take the wind out of the safe-haven Dollar's sails last month.

And then the Federal Reserve appeared to confirm market suspicions that U.S. economic growth will slow from hereon and its interest rate hiking cycle will come to an end over coming years, which will eventually leave investors looking toward other central banks for clues as to where exchange rates might head next.

Now, with the U.S. midterm election approaching on November 06, the outlook for the greenback is deteriorating. This has implications for other currencies the world over. Below is a selection of MUFG' views on what this environment is likely to mean for individual exchange rates.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Pound Sterling

"The pound advanced versus the dollar in September primarily reflecting the broadbased weaker dollar. The change versus the euro was very modest. From the perspective of Brexit, the developments in September would have suggested pound depreciation."

"We appear to have reached an impasse with PM May and her cabinet sticking to the Chequers plan that was flatly rejected by EU leaders at the informal summit in Salzburg. PM May’s view now is that a shift to ‘Canada +++’ is not viable given this would result in a hard border in Northern Ireland or a hard border in the Irish Sea. Hence, the UK stance now is that Chequers or a fresh proposal from the EU are the only ways forward can be found."

"The pound has perhaps derived support from the belief that whatever happens a hard Brexit will be avoided. It is difficult to explain why this view would suddenly take hold now. The Labour Party is moving toward officially supporting a 2nd referendum but whether an option to remain in the EU would be part of that is unclear."

"A more plausible factor behind the resilience of the pound is the positive flow of economic data that highlighted a more resilient economy than expected. While there was some scepticism over the BoE decision to hike in August, wage and inflation data pointed to justification for tightening."

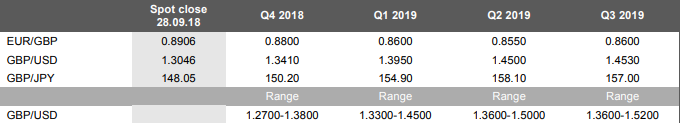

"There is a remarkably high level of uncertainty in relation to the direction of the pound over the final quarter of 2018 and throughout 2019. If we move beyond midNovember without a deal, sharp pound selling is likely as market participants take a firmer view on a ‘no-deal’ outcome. At the 1.3000-level, we are around the mid-point of a wide range for no-deal/deal – 1.1500-1.4500."

"We still maintain our view of a deal and hence our forecast of 1.4500 next year. However, the level of conviction we hold in that call has certainly come down following events in Salzburg."

U.S. Dollar

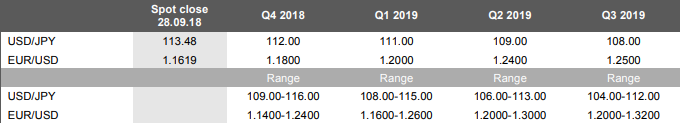

"The dollar was essentially unchanged in September. The price action was in our view indicative of the fact that the US rates market is well priced in reflecting the continued out-performance of the US economy relative to other major economies."

"There are other factors that can prove more important in determining dollar performance. A key development in September was the fact that risk appetite recovered in the EM space and this recovery was not unsettled by the breach of the 3.00% level in 10-year UST bond yields."

"The dollar did advance modestly in the immediate aftermath of the FOMC announcement on 26th September. But we believe our key take-aways from that meeting point to limited sustained traction for the dollar."

"Essentially the FOMC remains comfortable with the extent monetary policy becomes restrictive further out. This is highlighted thirdly by the fact that while the real GDP forecasts were upgraded, the path of GDP is downward, reaching the long-run equilibrium growth rate of 1.8% in 2021."

"There is one significant note of caution in our FX forecasts. The mid-term elections take place on 6th November and the results could well be important in the policy path taken by President Trump in 2019. There is a high risk that the Trump administration will move to increase the China tariff from 10% to 25% as indicated."

"That could lift the dollar, in particular versus EM currencies. However, in 2019, we would expect evidence of impact on the US economy to begin to emerge, which could then negatively impact the dollar. General increased political uncertainty after the midterms is also a risk that could also undermine the dollar."

Euro

"The euro spent most of September higher on the month but weakened into monthend triggered by a re-escalation of risks in Italy....However, we remain sceptical of the view that Italy will be a sustained factor going forward in driving EUR direction."

"A budget deficit/GDP estimate of 2.4% was the catalyst for the renewed BTP selling as opposed to expectations of a deficit below 2.0%. We doubt this difference in budget deficit will be either a catalyst for a sustained BTP sell-off or an upturn in conflict between Brussels and Rome."

"EUR support close to current spot levels appears very likely to us given the positioning points to continued extreme negative sentiment. EUR speculative longs amongst leveraged accounts as a percentage of total open interest remains close to a record low and at levels last seen when the ECB was first implementing QE in early 2015."

"We see reasons for EUR/USD to remain well supported going forward given current market pricing and positioning. Rate spreads alone have not been the driver of EUR/USD given the fact that on an annual basis EUR/USD is close to unchanged – a time in which the Fed has hiked rates four times and spreads have widened further."

"The domestic macro picture in the core of Europe was a little less compelling in pushing yields higher with only a very modest pick-up in activity evident. Nonetheless, the “relatively vigorous” pick-up in inflation that President Draghi referred to points to the potential for a continued gradual rise in 10-year yields over the forecast period."

Australian Dollar

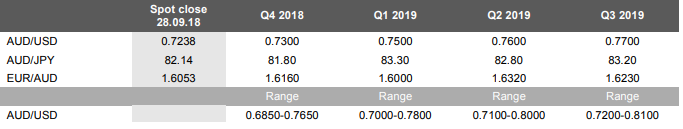

"The Australian dollar advanced initially in September but gave up most of these gains toward month-end caught by some renewed concerns over the direction of the trade conflict between the US and China."

"The data information from Australia was generally positive (jobs increase and Q2 GDP both stronger than expected) and the RBA minutes from its policy meeting in September indicated that the RBA remains very much on the optimistic side and expect the current monetary stance to fuel wage growth and inflation that will require higher rates ahead."

"Until there is a more notable shift to a more explicit reference to possible monetary tightening, AUD is unlikely to gain much traction. For this reason we have again lowered our forecast levels modestly for AUD/USD (each forecast point one to two big figures lower than last month)."

"The comments from President Trump at the UN accusing China of interfering in the mid-term elections suggest relation between China and the US could worsen from here. That suggests near-term downside risks for AUD even though there remains limited evidence on the macro side of trade uncertainty having a negative impact on the economy."

New Zealand Dollar

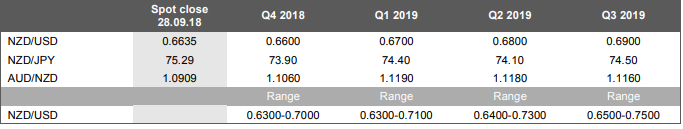

"The New Zealand dollar tracked the broader performance of the US dollar in September with the pick-up in risk appetite through most of the second half of the month helping push NZD/USD higher only for that to fade in the final days after the FOMC raised rates in the US."

"The data for New Zealand was broadly supportive for NZD with real GDP in Q2 coming in stronger than expected (1.0% Q/Q versus expected 0.8%). Card retail spending in August was also stronger than expected suggesting Q3 economic conditions remain positive."

"Still, the NZ-US spread remains at historic levels which will act as a strong anchor against any NZD rally over the short-term. The RBNZ meeting toward month-end did not indicate any change in thinking despite the better data with the forward guidance message the same – rates could either go up or down from here."

"There was however a slightly more upbeat view on the inflation outlook with the RBNZ noting “welcome early signs of core inflation rising” which if sustained may result in some subtle shifts that remove the potential for monetary easing. That is our bias and would provide support for NZD/USD going forward."

Canadian Dollar

"The Canadian dollar strengthened in September with two important factors that may shape direction ahead. Firstly, crude oil prices jumped and although the correlation between oil and CAD is not always reliable, it helped provide support given the 5% gain in NYMEX recorded in September. Secondly, and more importantly, the US and Canada finally reached a deal."

"The deal getting ratified in Congress will only take place in 2019 after the mid-term elections so some uncertainty remains although we expect the deal to be ratified. Our previous forecasts did assume a trade deal would be reached and hence we have only lifted our CAD forecast levels modestly, in part reflecting our higher crude oil forecasts than previously."

"The deal certainly reinforces the prospect of BoC monetary tightening ahead which will likely ensure limited widening of US-CA spreads from here even as the Fed continues to tighten. Inflation risks continue to build."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here