Euro-to-Dollar en Route to 1.30: Société Générale

© Mohamed Yahya, Reproduced under CC licensing

- Time to reload on Euro longs says French investment bank

- Bund yields are highly correlated to EUR/USD

- An anticipated rise in yield to 50 bps is likely to coincide with EUR/USD at 1.20

The EUR/USD rate is forecast to rise over the next year as the European Central Bank (ECB) steadily unwinds monetary stimulus and prepares to raise interest rates, according to the strategy desk at Société Générale.

Monetary stimulus, or quantitative easing (QE), has a depressive effect on the Euro, therefore the ECB's plans to dismantle it are likely to do the opposite and help the currency to strengthen.

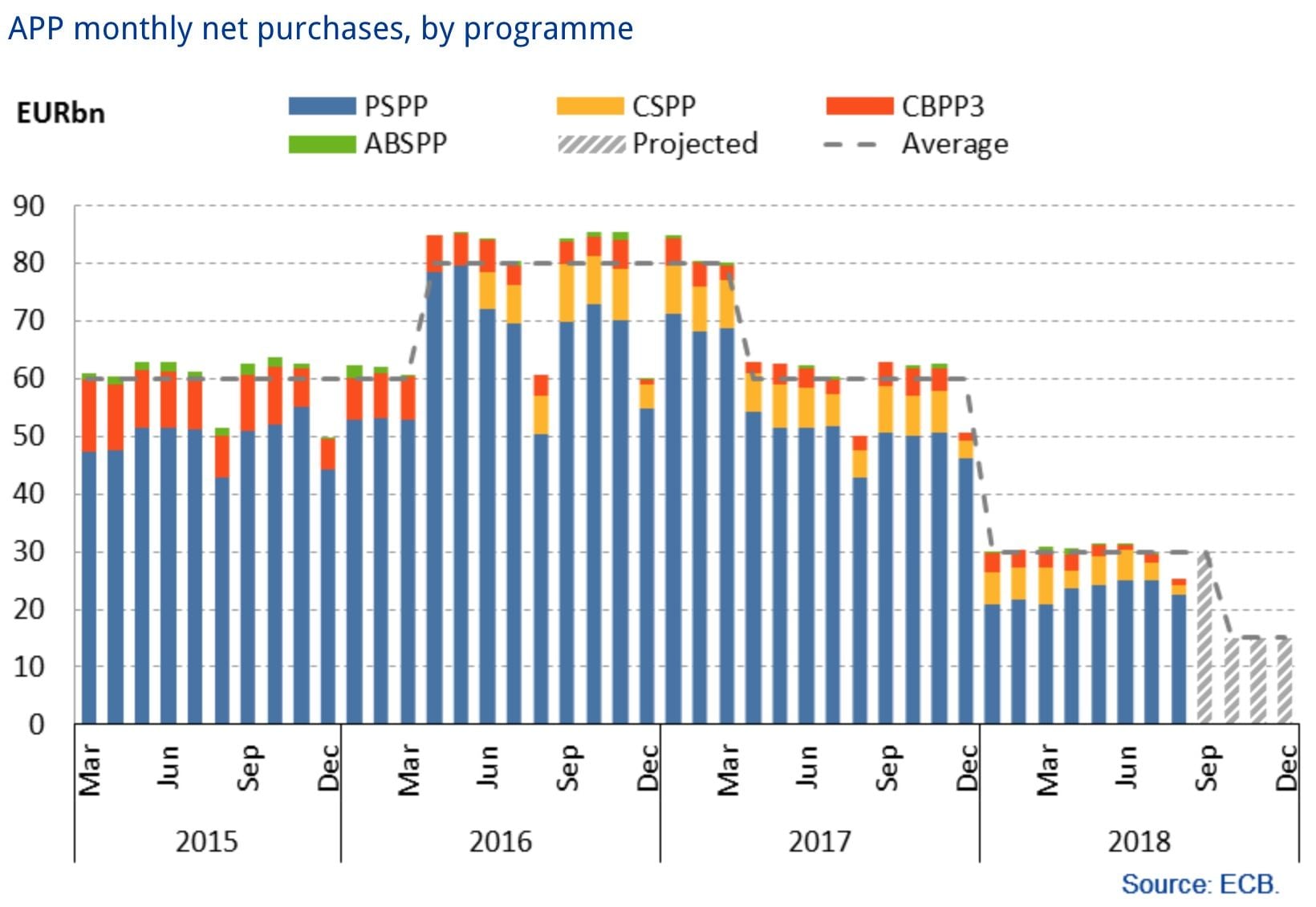

The strategy call comes a day before the Frankfurt-based ECB addresses the media following their September policy meeting and markets are expecting confirmation that QE is still due to be wound up by year-end.

One way of quantifying the effect of the QE is by looking at the German sovereign bond - or 'bund' - because QE involves the purchase of large amounts of bunds and so tends to keep their price artificially elevated.

This has the effect of dampening bund yields which are inversely related to prices.

The bund's yield is a measure of investor compensation for inflation expectations and risk. That it is the inverse of price, therefore, should not come as a surprise for when bund prices fall it is usually because of higher inflation expectations or other risk factors so yields should rise to provide investors with higher compensation.

In the case of bunds, however, yields have been artificially suppressed by QE rather than other factors, so if they rebounded it would simply indicate that the ECB was removing QE.

Société Générale show that the German bund yield is highly correlated with the EUR/USD exchange rate and that higher yields equate with a higher EUR/USD spot price.

Using Société Générale's regression analysis model above a German bund yield of 50 basis points (a basis point is a 10,000th of a percent) corresponds with EUR/USD at 1.20 - the current yield is nearer 40.

"For the past year, EUR/USD has essentially been driven by German yields, which integrate both the direction of EUR rates and a sovereign risk premium. Italian jitters are making the latter a volatile component, which is therefore factored into FX. A simple regression indicates that Bund at 50bp would imply EUR/USD back at 1.20 (Graph 2)," says Olivier Korber, quantitative analyst at Société Générale in Paris.

The September 13 ECB policy meeting should see the confirmation of a reduction in QE from 30bn asset purchases per month to 15bn which should support the argument for a firming of bund yields.

Korber does not expect the ECB to make any policy changes at the meeting - probably not even to reduce QE - however, he does expect them to eventually and over time, steadily tighten monetary policy.

This should have the effect of gradually raising bund yields (rates) and the EUR/USD at the same time.

"While nothing new is expected from the ECB this week, our rates strategists think that the market preserves ample repricing potential, with EUR rates set to grind higher over the medium term," says Korber.

The Euro should be further helped by a mixture of better European economic data in H2 and diminishing Italian political/economic risk.

The time to buy the Euro may be close at hand since it is "now revisiting the lows of its range ahead of tomorrow's ECB meeting, suggesting an entry point to reload EUR longs," says Korber.

Korber recommends using a complex options strategy called a 'seagull' to trade the rise in EUR/USD, which involves "selling volatility" and at the same time capitalising on the "gradual rise in the spot price".

"We expect EUR/USD to neither durably revisit sub-1.15 lows nor to appreciate quickly: a seagull structure would maximise investors' leverage in a context of gradual EUR/USD appreciation within a range," says Korber.

Longer-term Société Générale expects the EUR/USD spot price to rise to 1.30 in a year's time.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here