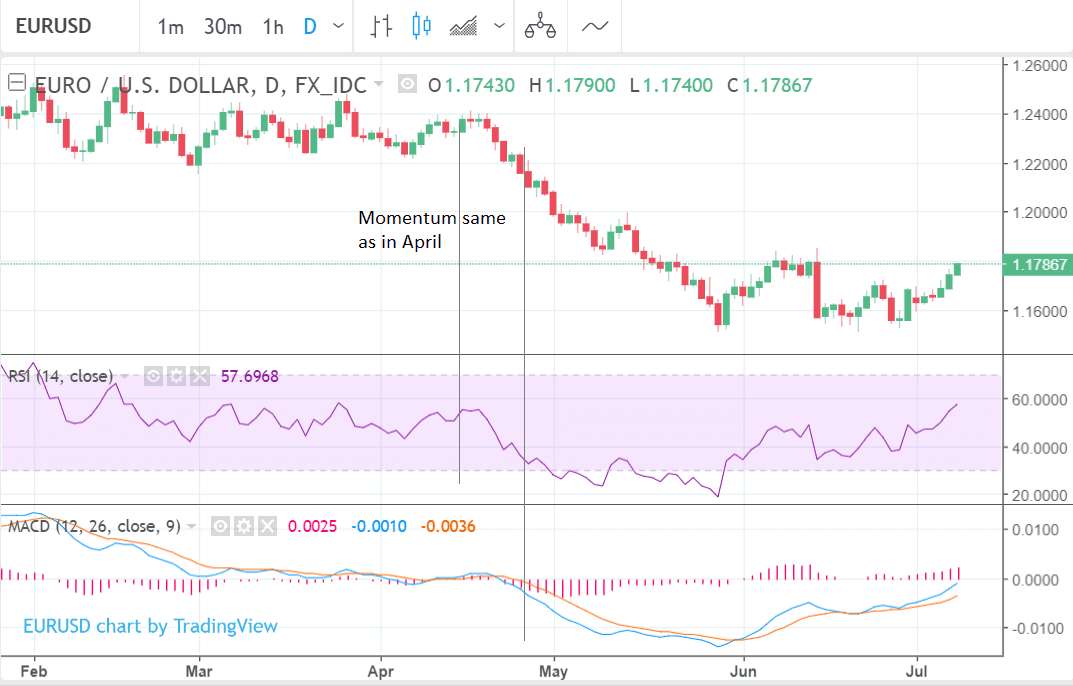

EUR/USD Rate Bullish Due to Stronger Momentum: Hantec Markets

- A rise in momentum to levels not seen since April suggests more upside for EUR/USD

- Euro sellers should consider holding on to get a better rate

- Mario Draghi's speech provides the potential for a further push

Image © European Central Bank

Holders of Euros looking for an optimum price to buy Dollars may wish to consider hanging on a little longer.

Since touching down on June 21 the Euro has risen gently like a 'hot-air balloon' up to the 1.1780s where it currently sits and is set to continue rising, according to chart expert Richard Perry, a market analyst at broker's Hantec Markets, so sellers could profit if they wait for higher prices.

A break above a major level, as well as the elevated momentum studies, underpin Perry's bullish call.

"We had a break out above 1.1720 on Friday, that completed this near-term level of resistance broken," says Hantec's Perry, adding, "Which, sort of, compounds really these improvements in the momentum indicators, with the RSI at 56 - that's the highest since April, and the MACD line rising to the highest since April too, which all points to a test of 1.1850."

Momentum is at the same level as it was back in April when the exchange rate was sitting much higher between 1.22-24 in a phenomenon chartists call 'convergence' which is a bullish indicator.

The move higher appears to have been driven by a combination of uncertainty over growth in the US due to trade fears, moribund US wages and expectations that interest rates will rise more quickly in Europe then is currently being factored in. Higher interest rates generally support currencies by increasing inflows of foreign capital drawn by the promise of higher returns.

The president of the European Central Bank (ECB) Mario Draghi is about to make a speech to the EU parliamentary commission on financial affairs in which he may comment on his view of inflation and the trajectory of interest rates, and if he sees a sharper rise than he did at the June ECB rate meeting when he said a rise in rates was probably not expected before the end of 2019, the Euro could gain a further upside boost.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here