Long-term Uptrend in Euro-Dollar Rate Firmly Intact say Citibank Techs

- Long-term charts reveal startling bullish logic for Euro vs. The Dollar

- Cycle indicates 'curse' of seven years of weakness for the Dollar

- EURUSD needs to break above ceiling in 1.25s to confirm more gains ahead

© BruceG1001, reproduced under CC licensing

One of the most fascinating charts to have crossed this writer's desk in a long time is a yearly chart of EUR/USD from Citibank technician Tom Fitzpatrick who has put together a report with quite compelling arguments for an upside bias to the outlook for EUR/USD, especially in the medium and long-term.

The yearly chart of EUR/USD featured below, with price action represented in Japanese candlesticks (a year per candlestick) along with the analyst's annotations, is striking.

It is rare you get to see price action displayed like this on a yearly timeframe and added to that Fitzpatrick draws some interesting inferences about the probable future direction of the pair based on analysing past examples.

Firstly, to those wondering how a chart of the Euro can stretch back to the 1980s given the currency had not been created yet (the Euro first entered circulation on the 1st of January 1999), Citi used an amalgam of Eurozone member states currencies as a pre-1999 Euro proxy.

The main thing to note on the chart is that EUR/USD yearly keeps forming the same reversal pattern at the lows over and over, and that pattern is what technical analysts call an 'outside bar'.

An outside bar or year occurs when the exchange rate forms a usually short, squat, bar/candle followed by a long filled in bar/candle which entirely engulfs the shorter first one.

EUR/USD formed an outside year at the 2001 lows, the 1985 lows and last year (circled in in green in chart above).

There was also a bearish outside year in 1980, which heralded a downtrend (circled in red) and one more recently in 2014 which signalled a bearish continuation after a pull-back.

But it is the consistent trending after the formation of the outside year which is so interesting.

"The average move in the year following the outside year has been 20% with the smallest (2015) being 13.5%. A similar move (+13.5%) this year would take EURUSD to 1.36," says Fitzpatrick.

Outside years have also consistently showed two consecutive years of follow-through in the direction of the trend suggested by the pattern after it has formed.

Indeed, all bar one of the set-ups in the past have yielded substantial trends well beyond two years, suggesting that a similar extrapolation this time indicates the potential for EUR/USD to rise up to 1.80 by 2024.

Dollar Cycle

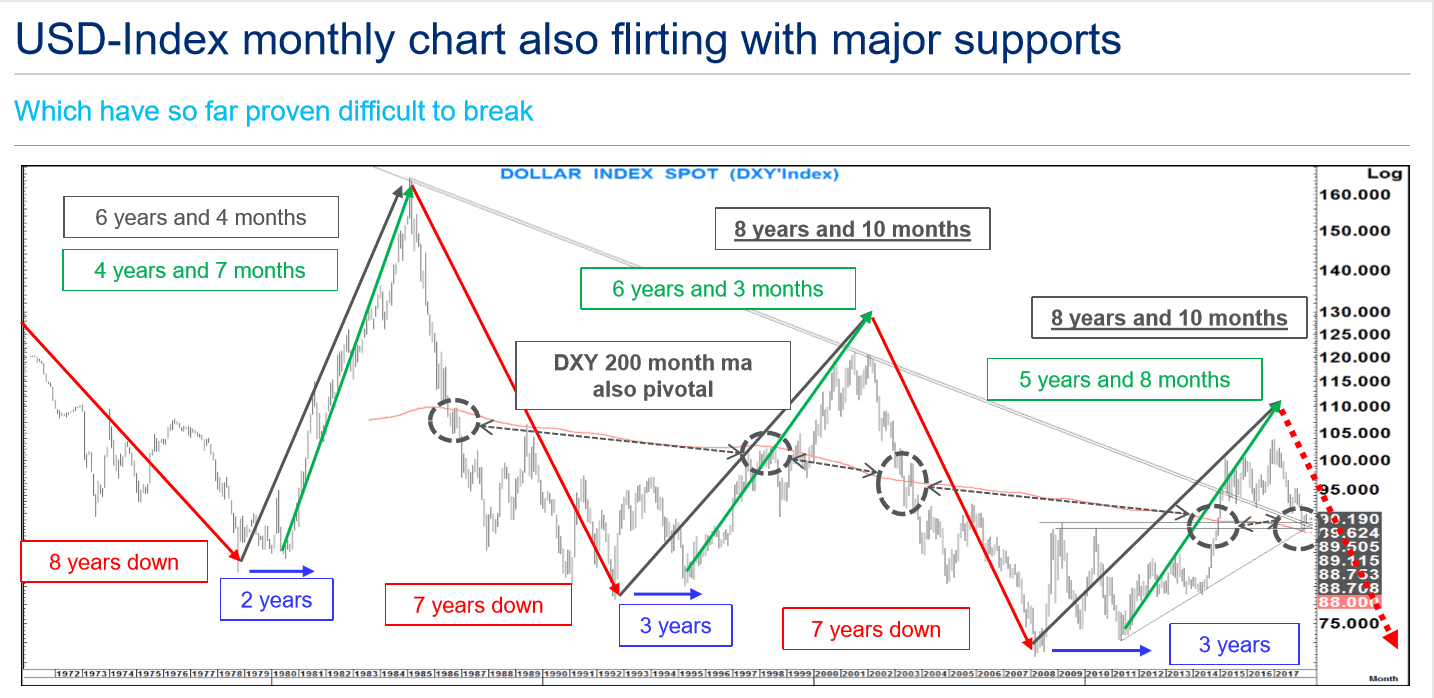

Another indication of impending Dollar weakness and Euro strength comes from the cyclical nature of the Dollar Index (DXY), which is the Dollar versus a basket of trade-weighted currencies, the main contributor of which is the Euro.

The long-term chart of DXY, shown below, seems to keep repeating a regular cycle with left translation, which means the Dollar's 'up' cycle is usually shorter and steeper than its downcycle, so the peak always occurs to the left of the midpoint.

From our current position at the peak of a three-year rally in the Dollar the cycle looks ripe for the next 7-year down phase to begin, and, therefore, a prolonged period of Dollar weakness - and thus upside for EUR/USD.

EUR/USD Monthly Chart Problematic

It would make life wonderfully easy if the monthly chart was also super bullish.

Unfortunately, this is not the case, as the monthly chart of EUR/USD does not fit nicely into the bullish case presented by yearly and DXY monthly.

On the EUR/USD monthly chart, below, the pair is running into tough resistance from a major trendline which is a providing a robust obstacle to further growth (broken blue line circle) and could indicate to some analysts a greater propensity for a reversal back down rather than a breakout higher.

As if that wasn't enough there is also the 200-month moving average (MA) also capping gains at the current monthly highs.

Large MA's are not just equilibrium levels but also dynamic levels of support and resistance which if they are touched can actually present obstacles to strongly trending prices.

When prices touch large MA's they usually recoil due to the heavy selling encountered.

Many technical traders opportunistically try to ride pull-backs from MA's increasing the selling pressure and, in turn, exacerbating the effect.

"There is a strong range of medium-term resistance overhead between 1.2469 and 1.2570. In particular, here our focus is the 200-month moving average which stands at 1.2469," says Fitzpatrick.

So how to square the bullish evidence from the yearly charts with the obstacle-course presented by the monthly?

Fitzpatrick doesn't exactly but rather suggests how to identify a breakout higher and the probable start of the uptrend promise held out by the longer-range charts.

A close above the 200-month at 1.2469 is really important and would 'seal the deal', he says. When this last happened, back in September 2003 (circled in whole blue) the pair entered an extended period of upside.

Another indication would be a strong close this month (March) which means a close above 1.2555, as this would make March an 'outside month' adding further bullish evidence of a probable follow-through higher.

The last two times a monthly chart formed a bullish outside month it followed through higher spectacularly. In November 2017 it led to the 10 big figure move higher to 1.2555 (a similar move would take us into the low 1.30’s) and in September 2003 it rose all the way to 1.25s before pulling-back and higher eventually.

Thus it seems we may be on the verge of great things for EUR/USD if the analysis plays out the way Citi says.

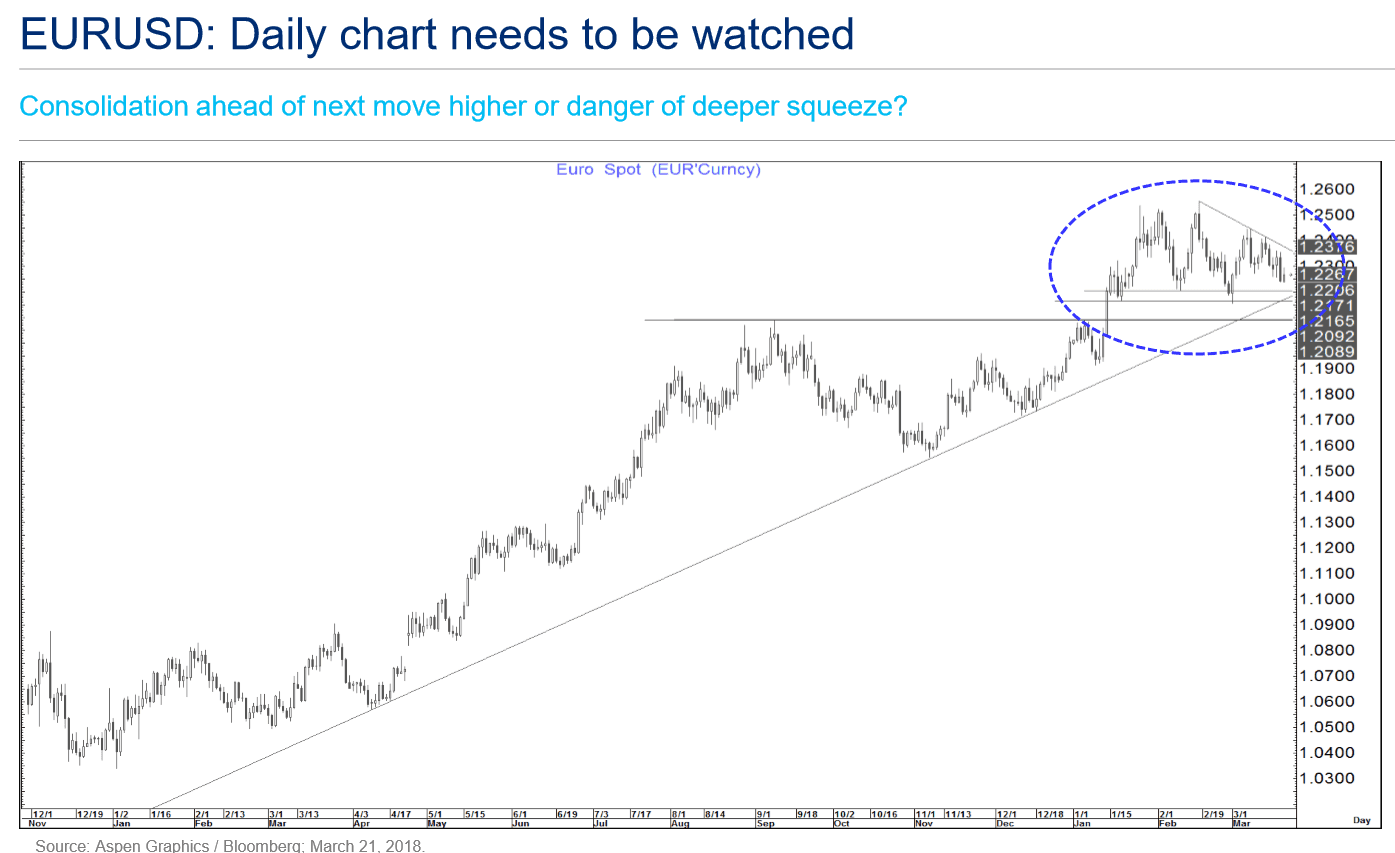

Daily Chart More Bullish

The daily chart below actually offers some sympathy to the bullish cause.

"The present daily pattern continues to look like a pause in the trend rather than a reversal," says Fitzpatrick.

The pair is still above the strong uptrend line at between 1.2090-1.2205 and as long as it remains above this the uptrend is still intact and therefore likely to continue.

"A break above 1.2376 (downward sloping trend line of a possible triangle) if seen with momentum would be constructive," according to Fitzpatrick, and might be the tinder which sets of broader upside alight on the longer-term charts.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.