Next target for Euro-Dollar seen in the 1.14s says Lloyds Bank

A recent surprise bout of strength for the Euro-to-Dollar exchange rate is not enough to unseat one staunchly negative view.

Holders of Euros looking for an optimum time to buy the Dollar should make their purchase now - or wait for better levels - as another down move for the pair lies on the horizon.

EUR/USD is forecast to decline from its current level of 1.1660 to somewhere between 1.14-1.15 says Lloyds Bank FX Analyst Robin Wilkins - although after that it is set to recover longer-term, so traders missing the boat this time can always purchase Dollars at a later date.

Wilkins clings to his bearish - meaning negative - short-term stance on the pair despite a recent 'surprise' recovery which had led some to revise their views.

"We are still biased for another leg lower to ideal targets between 1.15 and 1.14, which should complete the phase from the 1.2090 highs," says Wilkins.

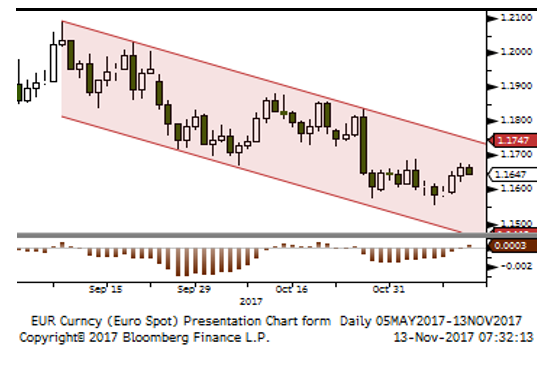

The analyst sees the pair as moving down in a descending channel which has not yet reached a conclusion (see chart below).

Channels are chart patterns which analysts use to help them forecast the direction of financial assets.

If prices fall in a rough channel-like sequence of lower highs and lower lows it suggests a downtrend which increases the chances of an extension.

A successful technical trader called Ed Seykota once famously said, "the trend is your friend," suggesting assets follow extended trends up and down which traders would do well to follow.

Which is what seems to be underpinning Lloyds's bearish view of EUR/USD.

After the move down to the 1.14s, the pair is expected to rebound and then enter a rangebound phase at a higher level in the 1.19s.

There is even a risk of the pair rising up to the level of the recent highs at 1.21-23, which is a "key resistance zone."

Resistance zones are price levels which basically present an obstacle to rising prices - like a cap or ceiling - and analysts highlight them as a warning that the exchange rate might rotate at resistance, or at the very least stall or pull-back.

Longterm Wilkins is bullish - which means he expects prices to rise.

He sees the current move as part of an extended recovery from the 1.0350 January 2017 lows.

"Long term, we believe 1.0350 was a major low, which completed the cycle from the 1.60 2008 highs. This should see an eventual move back towards 1.30-1.35, but for now, we look for medium-term consolidation under 1.21-1.23," says Wilkins.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.