Six Reasons to Sell EUR/USD at these Levels

For a whole three years now the EUR/USD exchange rate has been stuck in a range between 1.05 - 1.15, torturing traders and investors alike with its random walk.

Now as the pair approaches the top of the range once again analyst George Saravelos of Deutsche Bank sees 1.15 holding and the pair declining back down.

He gives six reasons, “why we think the top end of the multi-year 1.05-1.15 EUR/ USD range will hold,” and says, “we would fade euro strength as the top end of the range approaches,” in a recent note to clients.

So, what are these six reasons Saravelos gives for expecting a reversal of EUR/USD?

We list them below:

1. Data Surprises in Europe are Too Good to Be True

Data has been strong in the Eurozone but these things are cyclical and it won’t last.

Saravelos thinks the upcycle in European data results is coming to an end and the number of surprises – which is when the ‘real’ data result outperforms the estimate – will decline.

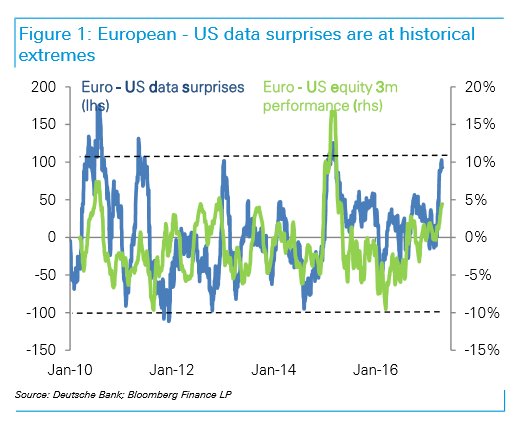

“European data has been impressive but data surprises are now approaching extremes relative to the US,” notes the strategist.

“From current levels the risk is that US data improves over Europe,” he adds.

The comparison of data surprises mirrors the performance of EU and US stock exchanges, which indicates the stronger European indices may be approaching peaks and the US indices could be about to catch up.

Given a major part of currency demand is driven by equity investors this could reverse the flows from US to EU back to the US again, favouring the Dollar.

2. Money Printing Will Soon Come to an End in the Eurozone – and Everyone Knows it

The European Central Bank (ECB) implemented extraordinary monetary policy measures – QE, bond buying or money printing in common parlance - to combat the threat of deflation and moribund growth, however, since then the Eurozone has made substantial progress and its ‘ultra-loose’ monetary policy stance is now no longer appropriate.

Despite the President of the ECB Mario Draghi saying only this week that Europe still needs monetary stimulus, most believe he and his officials are on the cusp of unwinding their programme.

This will be positive for the Euro as the programme keeps interest rates at rock bottom so when it is removed they will lift, attracting more capital from international investors.

The problem is that the secret is now out, and Saravelos reckons, probably rightly, that it is already baked into the price of the Euro – indeed it arguably drove the most recent rally above 1.10.

He also notes that the slow unwinding of stimulus - called ‘tapering’ in central bank jargon - does not tend to be very bullish for a currency, at least, based on the example of the US.

“Recent ECB commentary has confirmed “American-style” sequencing with tapering coming first. The Fed experience showed us that this is not particularly bullish for a currency. The euro has already appreciated by a similar size to the dollar around Fed taper in 2013. After the initial dollar rally the greenback weakened over most of that year,” said the Deutsche analyst.

3. Short-term Interest Rates are Pointing Down Are Being Ignored

As we mentioned above, interest rates are a big driver of currency markets and the higher the better for a currency, however, short-term lending (interest) rates in the EU are falling, and so should the Euro. Except it isn’t. Yet.

“The euro is completely mispriced to short-end rates. The correlation between front-end rates and the euro has broken down but this has historically been a powerful driver and is pointing lower. Historical experience suggests that as the dollar climbs it should find increasing support as a high-yielder according to global yield rankings too,” says Deutsche. Eventually the Euro will fall more into

Eventually, the Euro is expected to fall in sync with rates and therefore weaken.

4. Traders are Over-Confident the Euro will Go Higher

There is nothing like irrational exuberance to warn of an impending top.

According to data drawn from the options markets which is said to be a gauge investor enthusiasm, confidence is dangerously high in the Euro.

“The risk reversal, a measure of market demand for EUR/USD calls over puts has turned to the highest level since 2009 pricing out all downside risks to the euro,” says Saravelos.

5. Equity Inflows are Peaking

Demand for European Stocks and shares is peaking and vulnerable to a reversal.

“Unhedged foreign equity inflows have been a key support for the euro in recent weeks but the gap to previous peaks is quickly closing,” said Deutsche.

6. US Interest Rates Will go up Faster Than Anyone Thinks

The value of the Dollar is only currently reflecting one rate hike from the Federal Reserve in 2018, whereas the members of the Federal

Reserve committee who are the ones responsible for putting up rates actually expect three rises.

Whilst they are not always right the disparity between what the market thinks and what the Fed estimates warns that the someone is extremely wrong.

Higher interest rates mean a strong currency.

Assuming Fed officials are right and the market is wrong the Dollar should appreciate.

“The market is only pricing one rate hike from the Fed next year compared to a 75bps Fed baseline and at a time when financial conditions are exceptionally easy,” says Saravelos.

Disclaimers

“Where could we be wrong?” Asks the analyst about his forecast.

One thing which would keep EUR/USD rising would be a surprise increase in inflation in the Euro-area.

The Dollar could fall if Donald Trump is impeached.

A new Fed Chairperson could slow the pace of interest rate increases.

Save

Save

Save

Save