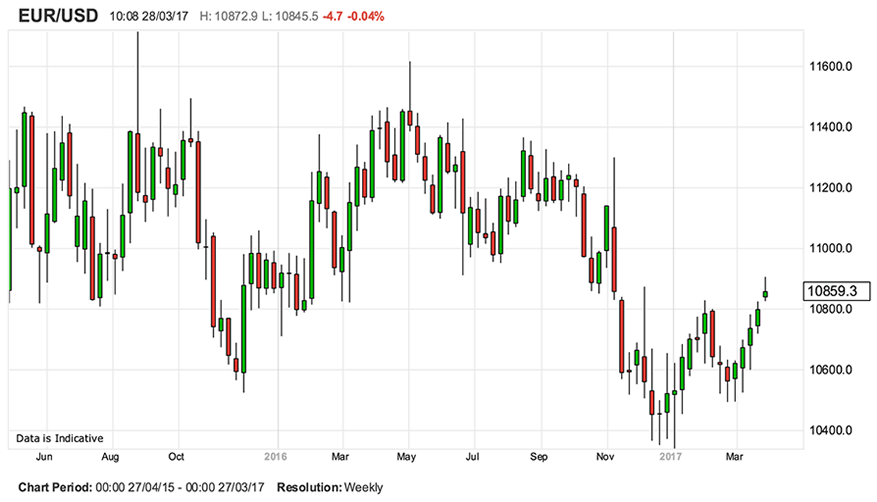

EUR/USD is Finally Drawing a Line Under Long-Term Decline

The EUR/USD pair has broken to the upside and moved up to just shy of 1.09 as markets simultaneously upgrade their assessment of the Euro and downgrade their assessment of the US Dollar.

And, it now seems possible that the EUR/USD pair is forming a bottom, particularly as a result of a souring of the outlook for the US Dollar, according to analysts at two leading European finance houses.

The gains made by the Dollar in the aftermath of Donald Trump’s inauguration were based on expectations that the president would introduce more stimulus via a generous programme of infrastructure spending (the Homeland Investment Act) and tax reform.

However, these stimulus promises now look less likely to materialise in the short-term, and the Dollar has weakened because of that reassessment.

The trigger to this view was Trump's failure to repeal the Affordable Healthcare Act - known as Obamacare - with the bill being withdrawn from Congress on the realisation that there was not enough support from the Republican Party to see it succeed.

Thus, even on the long-term timeframe, the full scope of Trump’s ambitions are brought into question by a Congress that has shown it will reach independent conclusions.

What does this Mean for the EUR/USD Outlook?

“The argument we had for a short-term move lower in EUR/USD driven by more clarity with regard to a possible US border tax adjustment and Homeland Investment Act II is fading. It appears that clarity with regard to US tax reforms has been postponed until later in the year and hence is less of a short-term USD positive,” says Danske Bank’s Senior Analyst Morten Helt in a briefing on the matter to clients.

One major impediment to the stimulus plans is the US debt ceiling which has been reached and cannot legally be breached.

This constrains how liberal the President can be with his spending.

The Dollar was in a longer-term downtrend prior to the Trump rally and analysts at UniCredit Bank in Milan are characterising that rally as merely a temporary cessation and correction against the broader current of selling.

This has led to them making a call to sell the US Dollar versus the Euro.

Their criteria for selecting counterparts to trade against a falling US Dollar are as follows:

a) The currency must already be undervalued.

b) It must be subject to an extremely high number of speculative short bets.

c) It must be exposed to the “global activity upswing currently underway.”

In relation to these criteria:

“EUR-USD ticks all boxes in terms of the first point, JPY shorts remain very stretched at a time when sentiment towards US assets is turning more cautious and the AUD is still the currency with the highest beta to global growth prospects,” said UniCredit’s Senior Analyst Dr. Vasileios Gkionakis.

But EUR/USD Could Still Weaken in Short-Term

The longer-term view is that EUR/USD is basing and preparing to go higher, however, in the short-term the pair may still lose ground, according to Danske’s Helt.

The rate differential between the two as well as recent GDP figures still support a rise in the Dollar against the Euro.

“In our view, relative rates remain EUR/USD bearish as the Fed is slightly under-priced and the ECB is priced too hawkishly,” says Helt.

Above: Danske Bank's forecasts for the Euro-Dollar

The Danske analysts still expects two more rate hikes from the Fed in 2017 – one in July and the other in September, as well as 3-4 in 2018.

Helt, meanwhile, sees the first rate rise from the European Central Bank in March 2018.