Diverging US-EU Yields Tipped to Push EUR/USD X-Rate Yet Lower

Falling demand for global stocks and investor desire for safer assets such as German bunds, has led to even greater widening between rising US bond yields and falling ‘EU’ bond yields, which does not bode well for EUR/USD.

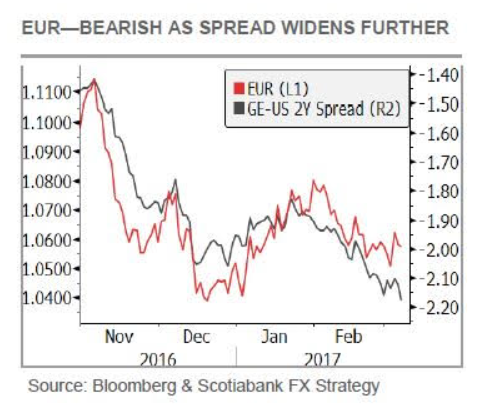

The difference between the US 2-year Treasury bond yield and the Germany 2-year bund yield, (which is used as a proxy for Eurozone bond yields since there is no pan-Eurozone bond), has widened even further says Scotiabank’s Shaun Osborne in a note seen by Pound Sterling Live.

“Global stocks have not shaken off the offered tone that was evident at the start of the week, prompting a bid for fixed income where major European markets are out-performing somewhat; the result is a renewed widening in spreads in the USD’s favour at the short end of the curve, with the USD enjoying a substantially supportive 220bps yield premium over the EUR (top chart) and 124bps over the GBP at the 2-year sector of the curve,” says Osborne.

The gaping jaws between the ratio of yields and the EUR/USD (see below) exchange rate suggests the Euro is over-priced and may fall in value against the Dollar.

What could explain the loss of correlation between yields which are the major factor driving currency appreciation and the exchange rate?

One possible explanation for the divergence may be its source which is souring risk appetite, supposedly triggered by Pyongyang’s aggressive missile tests, but may also be linked to heightened expectations the Fed will increase interest rates at its March 15 meeting.

Higher interest rates in the US could hurt global stocks as many global companies have large amounts of US debt which they have to repay with US interest rates, sometimes also in Dollars.

If the Fed raises rates, that will push up the amount these companies have to repay and if the Dollar appreciates on the rate hike as it almost certainly will, it will also increase the amount these companies have to repay through exchange rate risk.

This is causing the negative outlook and the flight to German bunds.

However, the fall in risk appetite could also be increasing repatriation flows back to the Eurozone at the same time, which could be keeping the Euro artificially bid.

This is due to the extremely low interest rates in the Eurozone, which make the Euro a prime currency for international investors to borrow in, or in financial speak a prime “funding currency”.

The Euro may have been heavily borrowed and used to buy risky emerging market assets which are now being sold off, as a result of the dip in global risk appetite.

This is likely leading to those assets being resold and the borrowed Euro’s being repatriated back to the Eurozone keeping demand for the Euro strong.

Given the ECB is highly unlikely to raise interest rates anytime soon the Euro could remain a favoured funding currency for quite some time yet and benefit from rising global risk aversion as borrowed Euros spent on risky ventures trickle back to Europe.

Nevertheless, regardless of whether these macro arguments offer an adequate explanation for the Euro’s resilience, Scotia’s Osborne sees it fading as the bullish Dollar rises, pointing to key labour market data as the potential catalyst for further gains.

“We remain bullish on the outlook for the USD; a March rate increase in the Fed funds target rate is all but fully factored into the markets at this point but we think that firm US labour market data this week (ADP tomorrow and NFP on Friday especially) will support the USD’s bid tone ahead of the FOMC next week where the Fed will provide an update on the economic outlook and some insight into the expected flight path for rates over the balance of this year and beyond. At the very least, we think the Fed will raise two more time but an earlier than expected move to tighten this year could still well open the door to the Fed doing more,” says Osborne.

We are more sanguine about the Dollar’s scope for gains versus the Euro, however, due to the Euro-supportive, ‘risk-off’ repatriation flow factor.