A Softer EUR/USD Exchange Rate Outlook for the Reign of Trump

The EUR/USD spiked higher following news of Donald Trump’s presidential election success but we note the next four years could see the pair struggle to advance beyond recent ranges.

The Euro to Dollar exchange rate rose to a high of 1.1294 after it became clear Donald Trump was going to win the presidential election - it has since fallen back to the 1.08s as markets rushed back into US equities.

The EUR/USD now looking at possibly testing November lows in the 1.0850s as the rapid turnaround gifts the Dollar some positive momentum that we would expect to extend.

The Euro is a major funder of US stock markets and when markets are up Euros are typically transacted into Dollars to meet global investor demand.

“The usual negative correlation of the Euro with US equities is one reason for an EUR/USD rally on the back of a Trump victory near-term. In the medium-run, the effect is ambiguous,” said Deutsche Bank’s Marco Stringa.

Equities came rebounding higher, however, following the President’s calming speech in which he talked of "healing the wounds" and bringing the country back together.

He also stood by a pledge to double GDP while boosting spending on infrastructure projects.

Trump's victory is therefore one that has caused a weakening of the Euro and a strengthening of the Dollar, which could well extend:

Trump Victory to Feed into Increased Political Uncertainty in the Eurozone

The news of Trump’s ascendancy could arguably increase political uncertainty in the EU, slow Eurozone growth and complicate the job of the ECB which could therefore undermine the Euro going forward.

“Following Brexit and a Trump's victory, we expect increasing apprehension about the various political events coming up in Europe over the next twelve months. This uncertainty will constrain the Euroarea recovery, underscore our expectation for a slowdown in euro-area 2017 GDP growth and further complicate the ECB's task,” says Deutsche Bank's Stringa.

These events include a possible General Election in Italy, dependent on the outcome of the referendum on constitutional reform on December 5; a General Election in Netherlands, which has a strong anti-EU following; a Parliamentary election in Germany, and Presidential Elections in France, Germany, Hungary and Slovenia.

Not all analysts are on board with the view that political uncertainty is likely to be a major headwind for the Eurozone economy and its currency though.

Societe Generale’s Kit Juckes, for example, is relaxed about the supposedly negative effects of contagion from Trump to the ballot boxes of Europe:

“The surge in populist voting is perceived, on this side of the Atlantic, as a serious threat to the European project.

“Am I too blasé on this, after years of seeing little political change in the face of economic under-performance as the over-bearing desire to bind Europe closer together conquers all other emotions?”

How will Fiscal Stimulus Impact the EUR/USD?

One major plus for the Eurozone in the future could be Trump’s fiscal stimulus agenda, which seeks to increase government spending by 2-3%, and which, it has been argued, could result in much-increased demand for Eurozone imports.

However, Deutsche Bank do not see this as likely, given the Republican-controlled Senate and House will almost certainly block any executive attempts to increase government spending.

In addition, even if such a stimulus package were to get implemented, it would have only a marginal impact because the plusses would be offset by a shrinking pool of resources, such as labour, for example, because of increased immigration control.

“A fiscal stimulus is most effective when a country has a negative output gap, which is not currently the case for the US,” says the Deutsche analyst.

Indeed, Stringa's colleague at Deutsche Bank, Alan Ruskin, says there could be some similarities with the early stages of the Reagan 1983-84 boom, before the subsequent slowdown showed the limits to a supply side structural uplift in growth.

"The Reagan boom was associated with stronger equities, sharply higher Treasury yields, and a much stronger USD - exactly the opposite of the market response we saw in Tuesday’s trading," says Ruskin.

In plain English, this means fiscal spending works best in countries which have high unemployment and are working at below their maximum productive capacity, which is not the case in the US.

Deutsche’s Stringa also suggests the current account deficit would quickly erode stimulus’s treasure chest too, providing a further negative headwind.

Thus, support to the Eurozone from this source is also unlikely.

The other side of the fiscal stimulus coin are tax cuts.

Trump wants to cut business tax rates from 35% to 15% which would suddenly make the US one of the most tax-competitive nations in the world.

"Trump’s proposed re-write of the US tax code could bring a big shift in USD fundamentals. Reducing US corporate taxes and closing loopholes has the potential to dramatically alter the competitiveness of American business and therefore the long-run equilibrium of the Dollar," says Greg Anderson at BMO Capital who argues a Trump tenancy in the Whitehouse will see a stronger Dollar over the long-term.

Dollar to Rise on Tighter Trade Policies

Despite falling on the news that Trump had won, there is no reason to expect USD losses to escalate unless the President starts enacting maverick policies which destabilise the global economic and political equilibrium.

Judging by his more statesman-like inaugural speech this seems unlikely.

What is more likely is that things will fall back into a familiar ‘status quo’ routine, once the dust has settled, and what the Dollar risks to lose from instability it may gain from certainty.

One such certainty is the President Elect’s pledge to slap tariffs on imports, which will almost certainly lower the volume coming into the US.

This in turn, is likely to support the Dollar.

Assuming a modest 5-10% fall in imports this could translate into a similar rise for the Dollar, all other things being equal.

Any fall in immigration will also impact on remittances abroad, lowering dDollar-selling through that channel, which should also strengthen the dollar.

Balanced against this is the possibility is the argument that the US economy will suffer as a result of Trump's protectionist policies, resulting in an offsetting write-down in the Dollar’s value.

However, judging from the Brexit-effect, which has seen little negative impact on the UK economy, in the short-term at least, the negative implications for the US economy of shutting itself off from the rest of the world are not easily quantifiable and potentially overexaggerated, as was the case with Brexit.

Importance of the Fed

In the short-term, the main factor in Dollar strength is whether Trump’s victory will materially change expectations of a December interest rate hike.

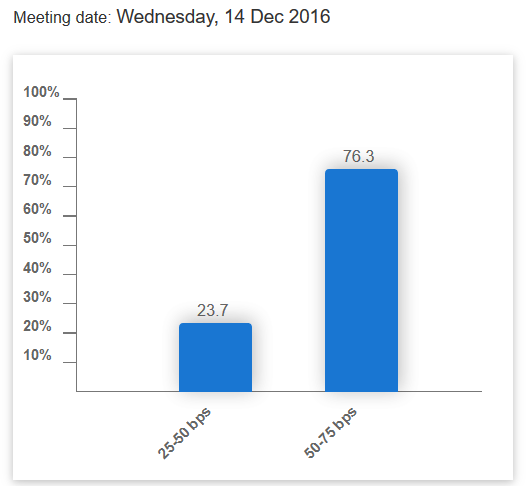

Given he has softened the mood with his opening speech expectations will be slowly building back up for a Christmas hike, and, according to Fed’s Funds Futures, currently stand at a healthy 76% - higher than Tuesday’s 71% when everyone thought Clinton would be the next President!

Therefore, we see more strength as more likely for the Dollar, whilst the outlook for the Euro remains more pressured due to political uncertainty and trade headwinds.

The President nominates appointees to the Fed’s Board of Governors as openings occur. The next President will nominate the successor to Janet Yellen as Fed Chairman when her term expires in January 2018. Trump would appoint mostly Republicans, who tend to be more hawkish than Democrats, although there isn’t a perfect mapping of that issue.

"The Fed’s rate path in 2017 probably wouldn’t be different under Trump, but over the span of several years, a FOMC that is gradually staffed with more hawkish members would likely to result in higher Fed base rates. This would be a USD-positive factor during the period the rates market priced it into forward curves," says Anderson.