Steady Gains in Euro to US Dollar Rate Take Market to Important Resistance Lines

Can EUR/USD break higher through a key trend-line and start to move up towards the 1.17 range highs?

The Euro to Dollar exchange rate is seen trading at 1.1153 at the time of writing having started the week at 1.1128.

Indeed, there has not been much movement in the pair over recent days, however, this does still represent steady progress for the EUR/USD pair which has crept back up to 1.1140s from the 1.09s seen three weeks ago.

The single currency’s steady rally seems to have been driven in the main by the good news that the Eurozone is unlikely to have been impacted by Brexit as much as was feared in the immediate aftermath of the vote result being released.

Indeed, markets have hardly increase rate-rise expectations for the US Fed even after two positive payroll’s results in a row.

This, combined with the Eurozone's solid current account surplus, leaves the Euro resistant to any advances by the US Dollar, even following that strong jobs data report seen seven days ago.

There is also the observation to be made that the European Central Bank no longer has the ability to push Eurozone yields, and by extension the Euro, any lower should they decide to introduce additional stimulus over coming months.

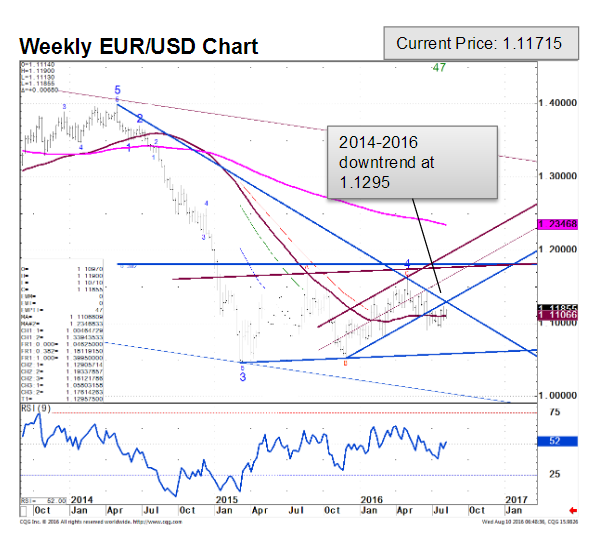

Charting the Outlook

At first glance from a technical, chart perspective, the pair appears to be completely chaotic and directionless, however, Commerzbank’s Karen Jones points out that the pair is close to a major trend-line drawn from 2014-16, which is situated at about 1.1300:

Whilst Jones forecasts this will lead to a rejection and probable move back down within the range to the 1.10s, the trend-line represents a ‘make-or-break’ level where, if the rate was capable of breaking above, confirmed by a move above 1.1350 for example, it would see it take on a much more bullish perspective and see it moving back up towards 1.1700.

Scotiabank’s Market Strategist Shaun Osborne, however, sees more upside for the euro, but USD weakness as being “limited”, which seems to support the view that EUR/USD will rise a little higher to the 2-year old trend-line and then be repulsed back down by it.

We see the pair as difficult to analyse, but a clear break above the trend-line, signalled by a move above 1.1350 for example, would be a sign of bullishness, with a target at the 1.17 range highs, based on the height of the move previous to the break extrapolated at the point of the break higher.